No Data

.JPXN400 JPX-Nikkei Index 400 (© JPX Market Innovation & Research, Inc., Nikkei Inc.)

- 24552.620

- +22.070+0.09%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Afternoon session [Active stocks and traded stocks]

*Sec <3741> 4495 +35 Received a contract for the development of the International Space Station's Kibo automated experiment system. Gained popularity temporarily but then lost momentum. *Kyokuto Securities <8706> 1598 +145 Operating profit for the cumulative third quarter increased by 46.4% according to preliminary data. *Shinhua <2437> 282 +14 The operating profit for the first quarter turned to a profit of 0.043 billion yen from a loss of 0.154 billion yen in the same period last year. *Ei Electronics <7567> 463 +55 Introduced a shareholder benefit program.

In the future, attention will turn to the Bank of Japan's monetary policy decision-making meetings.

The Nikkei average continued to rise, closing up 125.48 yen at 39,027.98 yen (Volume estimated at 1.5 billion 30 million shares), recovering the 39,000 yen level for the first time since the 10th. Developments were influenced by reports regarding tariffs from U.S. President Trump. Anticipating that Trump would postpone tariff policies during his inauguration, buying activity led to a rise, reaching 39,238.21 yen shortly after the opening. However, after reports emerged about considering tariffs on Mexico and Canada, it turned negative in the middle of the first half.

The Nikkei average continues to rise, with fluctuations driven by excitement and concern over Trump's tariffs.

On the 20th, the USA market was closed due to the holiday commemorating Martin Luther King Jr.'s birthday. In the highly anticipated inauguration of President Trump, statements regarding tariffs were withheld, leading to a Buy-dominant start for the Tokyo market. There were moments when the Nikkei average rose to 39,238.21 yen, but around 10 o'clock, the report of "imposing a 25% tariff on Mexico and Canada starting February 1" changed the optimistic mood drastically. The Nikkei average experienced fluctuations and declined. After the Sell and Buy transactions settled down, the market was around 39,000 yen.

Japanese Shares Climb on Cautious Optimism After Trump's Inauguration

The most hurt are the allies? On the first day of Trump's presidency: South Korea's Battery manufacturers were stunned.

① On the first day of Trump's presidency, some sectors in the South Korean and Japanese markets seemed to be struggling; ② After the USA President Trump indicated that he might soon impose tariffs on Canada and Mexico and revoke the previous administration's support for Battery electric vehicles, the stock prices of South Korean and Japanese Auto Manufacturers fell from early gains on Tuesday, with many South Korean Battery manufacturers showing an even more pronounced reaction.

API, Ryohin Keikaku ETC (Additional) Rating

Upgrades - Bullish Code Stock Name Securities Company Previous After ---------------------------------------------------------------- <4568> Daiichi Sankyo Mizuho "Hold" "Buy" <6768> Tamura Manufacturing Morgan Stanley "Equal Weight" "Overweight" Downgrades - Bearish Code Stock Name Securities Company Previous After --------------------------------------------

Comments

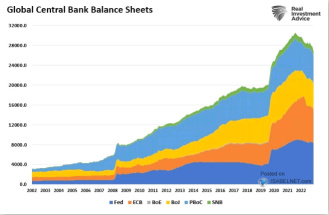

Liquidity is What Moves Markets

Investors worldwide pay very close attention to the Fed whenever they speak. They are searching for any inkling of a clue into future policy decisions. Ultimately, they are looking for the one thing that moves markets, and that would be liquidity.

Will they decrease interest rates? Will they add assets to their balance sheet? Will the Federal Reserve pump liquidity into the ...

if people believe the fed, then I have a 2008 story for you.

if people believe the fed, then I have a 2008 story for you.