No Data

.JPXN400 JPX-Nikkei Index 400 (© JPX Market Innovation & Research, Inc., Nikkei Inc.)

- 24892.800

- -126.580-0.51%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

SoftBank Group 13F Update: New 14.67M Share Stake In Recursion Pharmaceuticals, 20.45M Shares In Pacific Biosciences, 628.55K Shares In Better Home & Finance; Dissolved 5.68M Shares Stake In Exscientia, 1.59M Shares In IonQ, 23.38K Shares In DoorDash;...

Japan Tobacco Inc. (JAPAY) Full Year 2024 Earnings Call Transcript Summary

Honda Motor Shares Are Trading Higher on Possible Continued Strength After Reporting Better-than-expected Q3 Financial Results Yesterday. Additionally, the Stock May Be Moving Higher After Announcing It Called off Its Merger Talks With Nissan.

Relog Group---In the third quarter, there was a double-digit increase in revenue and a double-digit increase in profit, announcing an upward revision of the full-year Financial Estimates.

Relogroup <8876> announced on the 13th its consolidated financial results for the third quarter of the fiscal year ending March 2025 (April-December 2025). Sales revenue increased by 11.0% year-on-year to 104.819 billion yen, operating profit rose by 20.7% to 21.714 billion yen, pre-tax profit surged by 137.1% to 43.992 billion yen, and quarterly profit attributable to owners of the parent company increased by 195.0% to 37.279 billion yen. The relocation business generated sales revenue of 72.3 billion yen (year-on-year.

Relog Group - Revised financial estimates for the fiscal year ending March 2025.

Relogroup <8876> announced on the 13th that it has revised its consolidated earnings forecast for the fiscal year ending March 2025, which was announced on May 9, 2024. The number of managed units in the company housing management business and rental management business, as well as the memberships in the welfare business, have been steadily increasing, expanding stock revenues. Additionally, flow revenues such as hotel operations are also growing, and each business is progressing smoothly. Furthermore, due to the impact of the "Waiver of Preferred Shares and Debts to Equity Method Affiliated Companies," announced on August 21, 2024, holdings

The weekend's adjustments in positions have also resulted in active selection based on earnings reports.

The Nikkei average fell for the first time in four trading days. It closed at 39,149.43 yen, down 312.04 yen (with an estimated Volume of 2 billion 30 million shares). Profit-taking Sell orders were prioritized due to the backlash from consecutive days of rising stock prices. Although there were moments when it briefly turned positive at 39,543.93 yen, the yen exchange rate temporarily settled at around 152 yen to the dollar, which also led to profit-taking. Additionally, since the US market will be closed on the 17th, it seems there were movements for adjusting positions as well. The Nikkei average is expected to be followed.

Comments

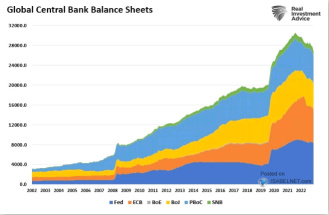

Liquidity is What Moves Markets

Investors worldwide pay very close attention to the Fed whenever they speak. They are searching for any inkling of a clue into future policy decisions. Ultimately, they are looking for the one thing that moves markets, and that would be liquidity.

Will they decrease interest rates? Will they add assets to their balance sheet? Will the Federal Reserve pump liquidity into the ...

if people believe the fed, then I have a 2008 story for you.

if people believe the fed, then I have a 2008 story for you.