No Data

.N225 Nikkei 225

- 39381.410

- -99.260-0.25%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

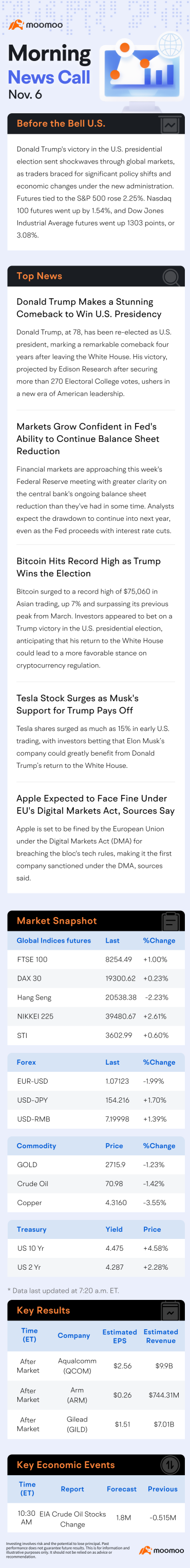

Profit-taking dominant near 0.04 million yen, but Trump trade continues.

The Nikkei Average fell. It ended trading at 39,381.41 yen, down 99.26 yen (with an estimated volume of 2.750 billion shares). In the U.S. market on the 6th, former President Trump, the Republican candidate, won the presidential election held on the 5th and the Republican Party secured a majority in the Senate in the federal congressional elections. Expectations are rising for Trump to push ahead with tax cuts and deregulation promised, leading to major stock indexes hitting record highs across the board. Following this trend, the Tokyo market opened with buying ahead, and the Nikkei Average stock price reached the opening price.

Active and newly established stocks in the afternoon session.

*Da Cheng Construction <1801> 7350 +8652 Announced upward revision of operating profit and net profit forecast for the fiscal year ending March 2025. Announcement of share buyback of 16.41% of issued shares. *Nisshinbo HD <3105> 929.3 -40.32 Revised downward the earnings forecast for the fiscal year ending December 2024. *Toray Inds Inc <3402> 951.4 +105.92 Revised upward the profit forecast for the fiscal year ending March 2025. Also announced share buyback up to 9.67% of issued shares. *Shinko Shoko <8075> 6440 +250 Raised the operating profit forecast for the fiscal year ending March 2025.

The Nikkei average fell for the first time in 3 days, with a backlash from the sharp rise the previous day taking precedence.

On the 6th, the US stock market saw a significant rise. The Dow Inc rose by $1508.05 to $43729.93, while the Nasdaq rose by 544.29 points to 18983.46 at the close of trading. Boosted by optimism following the presidential election clearance, there was strong buying interest post-opening leading to a significant increase. Expectations for pro-business policies of the second Trump administration, such as deregulation leading to increased corporate earnings, accelerated the buying interest and the market remained firm throughout the day. Positive views on the economy and the Federal Reserve Board's Federal Open Market Committee (FRB) led to optimistic sentiment.

Nikkei Falls 0.25% on Likely Position Adjustments Before FOMC Decision -- Market Talk

Stocks hitting the upper or lower price limit in the afternoon session.

■Stem inc. <1801> Dai construction <265A> Hmcomm <269A> Sapeet <3077> Hori Food Service <3106> Kurabou <3985> Temona <5025> Mercury <6180> GMO broadcasting <6622> Daihen <6787> Maikoh <7518> Net One Systems <9127> Tamai Shipping <9685> KYCOM Holdings ■Stem inc. <6026> GMO Tech <7063> Birdman <9

Miraito One reaches a new high [stocks with new high and new low prices]

The stocks that hit new highs on the Tokyo Stock Exchange prime board are Miraito One <1417>, Taisei Construction <1801>, and a total of 64 stocks. The stocks that hit new lows on the Tokyo Stock Exchange prime board are Yokorei <2874>, and Colopl <3668> with 8 stocks. New highs and new lows for "Tokyo Stock Exchange Prime", "Tokyo Stock Exchange Standard", and "Tokyo Stock Exchange Growth": New Highs, New Lows, New Highs, New Lows, New Highs, New Lows on 11/07 - 6482, 7910, 211/06 - 4342, 2106, 411/05 - 2713, 1411, 4211/01 - 4971, 1521, 0210/31

Comments

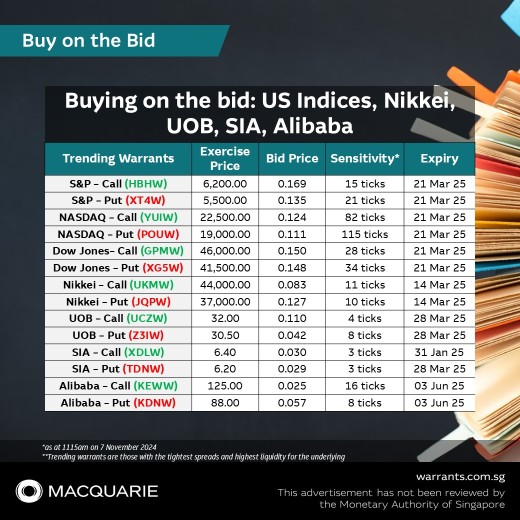

📌 S&P Call, HBHW

$S&P 6200MBeCW250321 (HBHW.SG)$

📌 S&P Put, XT4W

$S&P 5500MBePW250321 (XT4W.SG)$

📌 NASDAQ Call, YUIW

$NASDAQ 22500MBeCW250321 (YUIW.SG)$

📌 NASDAQ Put, POUW

$NASDAQ 19000MBePW250321 (POUW.SG)$

📌 Dow Jones Call, GPMW

$DJIA 46000MBeCW250321 (GPMW.SG)$

📌 Dow Jones Put, XG5W

$DJIA 41500MBePW250321 (XG5W.SG)$

📌 Nikkei Call, UKMW

$NKY 44000MBeCW250314 (UKMW.SG)$

���������...

$E-mini S&P 500 Futures(DEC4) (ESmain.US)$ (4 Hour Chart) -[BULLISH↗ **]We maintain bullish as price has pushed above 5920 resistance-turn-support level. As long as price holds above 5920 support level, we expect price to push towards 6035 resistance level. Technical indicators are leaning towards a bullish scenario as well.

Alternatively: A 4 hour candlestick closing below ...

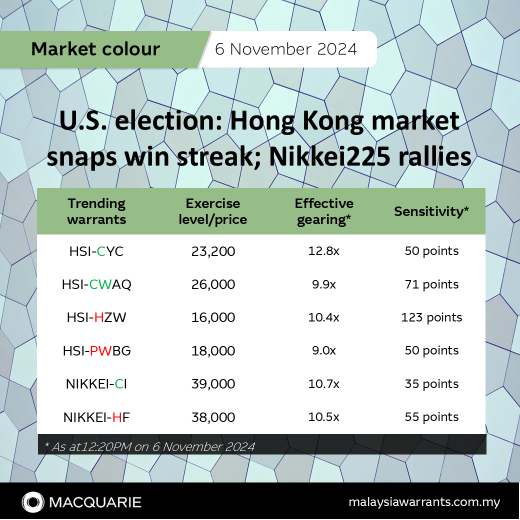

▪️ As Donald Trump takes the lead in the U.S. presidential race as of the time of writing, investors turn risk adverse amid concerns of potential tariffs on Chinese exports and its impact on global financial markets (South China Morning Post, 6 Nov).

▪️ At the lunch break, the Hang Seng Index (HSI) futures have fallen 2.6% to trade at the 20,453. With th...

•As Donald Trump takes the lead in the U.S. presidential race as of the time of writing, investors turn risk adverse amid concerns of potential tariffs on Chinese exports and its impact on global financial markets (South China Morning Post, 6 Nov).

•At the lunch break, the Hang Seng Index (HSI) futures have fallen 2.6% to trade at the 20,453. With the moves in...