US Stock MarketDetailed Quotes

.SPX S&P 500 Index

- 5580.940

- -112.370-1.97%

Close Mar 28 16:00 ET

5685.890High5572.420Low

5679.200Open5693.310Pre Close2.84BVolume6147.43052wk High91Rise1.99%Amplitude4953.56052wk Low412Fall5629.155Avg Price--Flatline

US indices formed Textbook pattern, failing reclaim high ground above 200SMA.

Action Plan:

1. hold cash and wait for base to form.

2. Short indices with options/futures

Things could get more volatile at the bottom.

$E-mini Dow Futures(JUN5) (YMmain.US)$

$E-mini S&P 500 Futures(JUN5) (ESmain.US)$

$E-mini NASDAQ 100 Futures(JUN5) (NQmain.US)$

Action Plan:

1. hold cash and wait for base to form.

2. Short indices with options/futures

Things could get more volatile at the bottom.

$E-mini Dow Futures(JUN5) (YMmain.US)$

$E-mini S&P 500 Futures(JUN5) (ESmain.US)$

$E-mini NASDAQ 100 Futures(JUN5) (NQmain.US)$

1

2

1

1

Columns Wall Street Today: Nasdaq, S&P 500 and DJIA All Lose Nearly 2% or More on Tariff and Inflation Woes

The Nasdaq Composite Index, S&P 500 and Dow-30 all lost close to 2% or more Friday as a worse-than-expected inflation report and Wall Street's continued lack of enthusiasm for President Donald Trump's tariffs sent stocks lower.

The $Nasdaq Composite Index (.IXIC.US)$ led the way downward, sinking 481.04 points (2.7%) to a 17,322.99 finish. The $S&P 500 Index (.SPX.US)$ likewise gave up 112.37 ticks (...

The $Nasdaq Composite Index (.IXIC.US)$ led the way downward, sinking 481.04 points (2.7%) to a 17,322.99 finish. The $S&P 500 Index (.SPX.US)$ likewise gave up 112.37 ticks (...

28

5

11

2

1

$E-mini S&P 500 Futures(JUN5) (ESmain.US)$ Thanks Trump, hope it keep falling-50% 👍

Tech Meltdown & Fear Breakout!

Red everywhere! The market just got hit with a full-blown tech selloff, and fear is spiking fast. The VIX $CBOE Volatility S&P 500 Index (.VIX.US)$ surged +12.79% to 21.08 — its highest in weeks — while SPX $S&P 500 Index (.SPX.US)$ sank -1.79%, breaking below recent support.

Biggest Casualties:

• GOOGL $Alphabet-A (GOOGL.US)$ & AMZN $Amazon (AMZN.US)$: -4.11% — total breakdown

• META $Meta Platforms (META.US)$: -3.42% — flush...

Red everywhere! The market just got hit with a full-blown tech selloff, and fear is spiking fast. The VIX $CBOE Volatility S&P 500 Index (.VIX.US)$ surged +12.79% to 21.08 — its highest in weeks — while SPX $S&P 500 Index (.SPX.US)$ sank -1.79%, breaking below recent support.

Biggest Casualties:

• GOOGL $Alphabet-A (GOOGL.US)$ & AMZN $Amazon (AMZN.US)$: -4.11% — total breakdown

• META $Meta Platforms (META.US)$: -3.42% — flush...

2

2

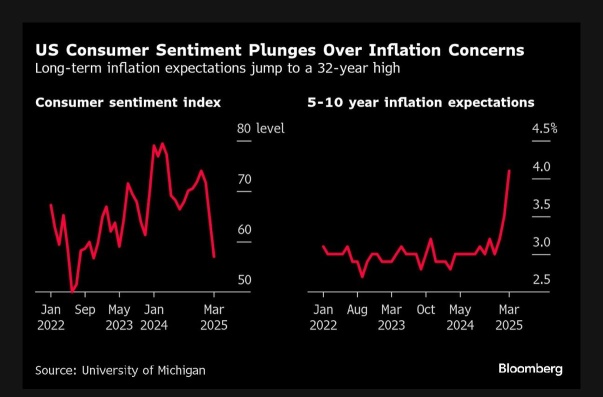

Consumer Sentiment Plunges. Inflation Expectations Surge. Is Stagflation Back on the Table?

The latest data from the University of Michigan just sent shockwaves through the market:

• Consumer sentiment dropped to a 2-year low

• 5–10 year inflation expectations surged to 4.1%—a 32-year high

• Core PCE inflation came in at 0.37% for March, showing price pressures remain sticky

Markets are still pricing in Fed rate cuts—but the battlefield h...

The latest data from the University of Michigan just sent shockwaves through the market:

• Consumer sentiment dropped to a 2-year low

• 5–10 year inflation expectations surged to 4.1%—a 32-year high

• Core PCE inflation came in at 0.37% for March, showing price pressures remain sticky

Markets are still pricing in Fed rate cuts—but the battlefield h...

6

2

No comment yet

He's making sure Republicans never win again.

He's making sure Republicans never win again.

Ever Vasquez : what indicators do you have

Barry K88 OP Ever Vasquez : im keeping things simple i only use simple moving average of 20, 50, 200.