No Data

.TOPIX TOPIX

- 2680.710

- 0.0000.00%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

No Data

News

Keisei, upward revision on 3/25, net profit 66.1 billion yen←47 billion yen

Keisei <9009> announced a revision to its financial estimates for the fiscal year ending March 2025. The net income was revised upwards from 47 billion yen to 66.1 billion yen. The upward revision was made to the net income attributable to the parent company shareholders due to special profits from the sale of Oriental Land Co., Ltd. shares (gain on sale of shares of affiliates) and other factors. [Positive Review] <6675> Saxa Revision | <3267> Fil Company Revision <4378> CINC Revision | <5282> Giostar

The rise is broadening the selection of intermission stocks.

Last week's overview from November 25th to November 29th, the TOPIX Growth Index reached a high of 645.08, a low of 628.97, and a closing price of 643.97, with a weekly increase of 1.44% marking an upward trend. Amid a search for short-term gains, driven by the narrowing yield spread between Japan and the US, the exchange rate market saw the US dollar breaking into the 149 yen level for the first time in about a month. While large cap stocks on the main board struggled due to the strong yen and weak dollar trends, domestic demand-oriented stocks in emerging markets performed well. The reduced participation during the Thanksgiving holiday in the USA also had an impact, leading to profit-taking at the end of the week.

GM, Other US Automakers Face Sharp Profit Squeeze From Trump Tariffs, Analysts Warn

What's Going On With Toyota Motor Stock Today?

This Is When TOPIX and Nikkei 225 Are Expected to Hit New Highs

Reported Wednesday, Eisai and Biogen Introduce LEQEMBI In South Korea To Combat Alzheimer's And Mild Cognitive Impairment

Comments

🚨🚨 ETHENA's #USDe stablecoin has experienced almost $100 million in redemptions since Monday, according to The Block.

🚨🚨 TrumpCoin (DJT), launched by Martin Shkreli, crashes 92% in last four hours.

🇮🇳 India Government sends $87 million GST notice to Binance

🇯🇵 Japanese stock market rebounds following yesterday’s bloodbath that saw biggest daily losses since 1987.

Key in...

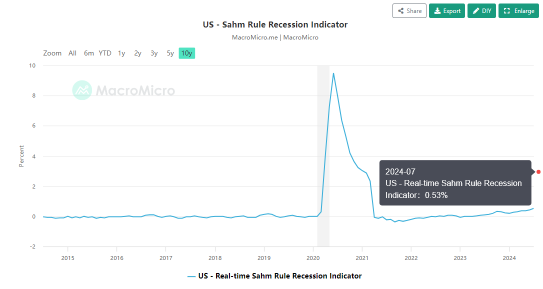

Initial Cracks

Cracks in the markets were already showing 2 weeks back on the week of 23rd July. The catalyst that kicked off this meltdown started with two major stocks, Alphabet ( $Alphabet-A (GOOGL.US)$) and $United Parcel Service (UPS.US)$. Alphabet announced its earnings and even though it beat expectations, the performance was nowhere near stellar compared to the previous quarter. This was taken as a signal that perhaps t...

The Nikkei 225 Index fell below the 33,000 handle, erasing YTD gains.

China:

CIRCUIT BREAKER TRIGGERED FOR TOPIX INDEX UNTIL 9:26:13AM JST, THE INDEX TUMBLED BY ABOUT 20% FROM JULY PEAKS.

NIKKEI 225 FELL BY 7% AT A TIME, ALSO ON TRACK TO BEAR MARKET.

MUFG SHARES FALL AS MUCH AS 21%, RECORD INTRADAY DECLINE.

$FTSE China A50 Index (.FTXIN9.CN)$ $Shenzhen Component Index (399001.SZ)$ $SSE Composite Index (800146.HK)$ $CBOE Volatility S&P 500 Index (.VIX.US)$ $Hang Seng Index (800000.HK)$ $Dow Jones Industrial Average (.DJI.US)$