No Data

.TOPIX TOPIX

- 2746.560

- -26.470-0.95%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Profit-taking Sell is prevailing in response to the consecutive rise.

The Nikkei Stock Average fell for the first time in five days, finishing the trade at 39,470.44 yen, down 378.70 yen (estimated Volume 1.9 billion 90 million shares). In the previous day's US market, major stock price indices declined, and after recovering the significant 0.04 million yen mark the day before, profit-taking Sell orders were prioritized due to short-term overheating. Although there were some moments where prices slightly recovered due to Buy orders on dips, the failure to stay above the SQ value (39,434.85 yen) invited selling pressure, and there were instances where it dropped to 39,247.41 yen towards the end of the morning session.

Afternoon session [Active stocks and traded stocks]

*Jelly Beans <3070> 113 +5 announced partial changes (expansion) to the Shareholder benefits program. *Dai Ko Tsusan <7673> 1340 +101 revised the Financial Estimates for the second quarter upward. *INTLOOP <9556> 6200 +790 the operating profit for the first quarter is 2.8 times compared to the same period last year. *Spider Plus <4192> 384 +34 introduced a Shareholder benefits program. *Hatena <3930> 1000 +762 revised the Financial Estimates for the period ending July 2025 upward. *Sakura Saku <7

The Nikkei average fell for the first time in five days, with a slight sense of accomplishment following the previous day's reach into the 40,000 yen range.

On the 12th, the US stock market fell. The Dow Inc average decreased by 234.44 dollars to 43,914.12 dollars, and the Nasdaq ended trading down 132.05 points at 19,902.84. Concerns over an unexpected acceleration in the November Producer Price Index (PPI) led to a decline after the opening. The Dow was pressured by selling due to unexpectedly weak employment-related indicators and the decline of managed healthcare company UnitedHealth, resulting in further declines. The Nasdaq fell amidst concerns over rising long-term interest rates. Towards the end, stocks.

If Construction is updating high prices [New high and new low updated stocks]

The new high stocks on the Main Board include Wakizuka Construction <1888> and Gakujo <2301>, totaling 41 stocks. The new low stocks on the Main Board include Rigaku Holdings <268A> and Tama Home <1419>, also totaling 41 stocks. "Main Board" "Standard Board" "Growth Board" New Highs New Lows New Highs New Lows New Highs New Lows 12/1341412245142312/1277132834102112/113923202792712/1034

Rakusu continues to rank, with a 79% increase in operating profit for the first quarter, and a Share Buyback has also been announced.

Raksul <4384> has made the ranking (as of 14:32). A significant rebound. After the market close the previous day, the company announced its first-quarter financial results. The operating profit is 0.972 billion yen (an increase of 79.7% compared to the same period last year). The operating profit forecast for the fiscal year ending July 2025 is between 3.2 billion and 3.7 billion yen (an increase of 26.8% to 46.6% compared to the previous period). Additionally, the company announced a Share Buyback of 0.7 million shares, equivalent to 0.7 billion yen, which accounts for 1.20% of the total number of outstanding Stocks. The acquisition period is from December 23, 2024, to February 28, 2025.

Stocks that moved or were traded in the first half of the session.

*Raksul <4384> 1310 +204 Significant profit increase in the first quarter and the implementation of a Share Buyback are viewed positively. *Oji Holdings <3861> 614.2 +56.1 The announcement of a large-scale Share Buyback is well received. *Bandai Namco Holdings <7832> 3551 +209 'ELDEN RING NIGHTREIGN' will be released worldwide simultaneously in 2025. *Anycolor <5032> 2546 +142 Positive outlook continues for the first half financial results. *Mitsui High-tec <696

Comments

🚨🚨 ETHENA's #USDe stablecoin has experienced almost $100 million in redemptions since Monday, according to The Block.

🚨🚨 TrumpCoin (DJT), launched by Martin Shkreli, crashes 92% in last four hours.

🇮🇳 India Government sends $87 million GST notice to Binance

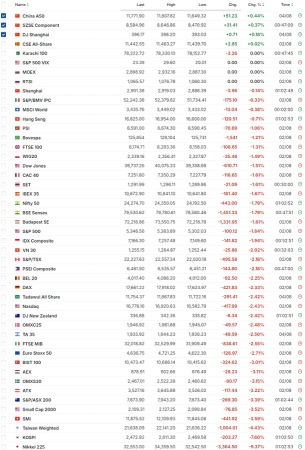

🇯🇵 Japanese stock market rebounds following yesterday’s bloodbath that saw biggest daily losses since 1987.

Key in...

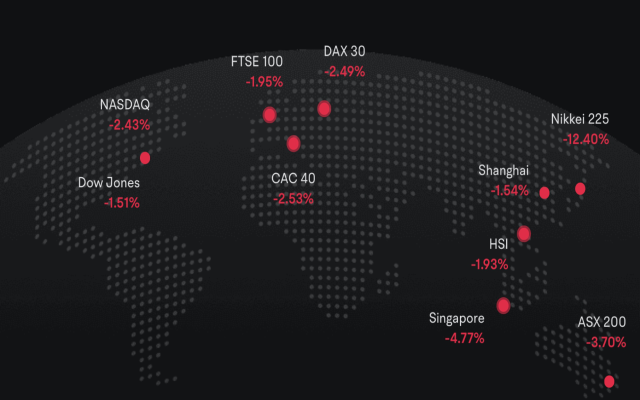

Initial Cracks

Cracks in the markets were already showing 2 weeks back on the week of 23rd July. The catalyst that kicked off this meltdown started with two major stocks, Alphabet ( $Alphabet-A (GOOGL.US)$) and $United Parcel Service (UPS.US)$. Alphabet announced its earnings and even though it beat expectations, the performance was nowhere near stellar compared to the previous quarter. This was taken as a signal that perhaps t...

The Nikkei 225 Index fell below the 33,000 handle, erasing YTD gains.

China:

CIRCUIT BREAKER TRIGGERED FOR TOPIX INDEX UNTIL 9:26:13AM JST, THE INDEX TUMBLED BY ABOUT 20% FROM JULY PEAKS.

NIKKEI 225 FELL BY 7% AT A TIME, ALSO ON TRACK TO BEAR MARKET.

MUFG SHARES FALL AS MUCH AS 21%, RECORD INTRADAY DECLINE.

$FTSE China A50 Index (.FTXIN9.CN)$ $Shenzhen Component Index (399001.SZ)$ $SSE Composite Index (800146.HK)$ $CBOE Volatility S&P 500 Index (.VIX.US)$ $Hang Seng Index (800000.HK)$ $Dow Jones Industrial Average (.DJI.US)$