No Data

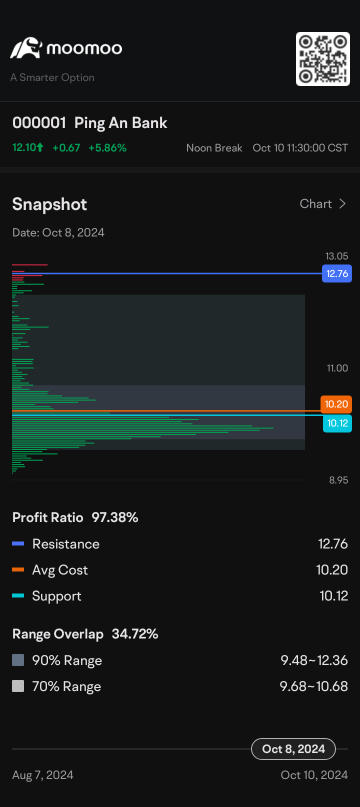

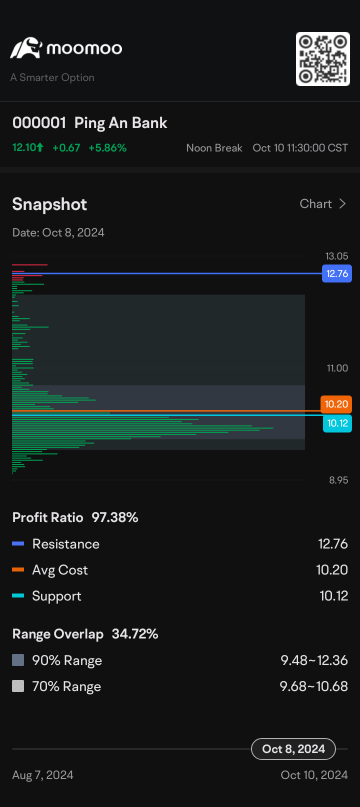

000001 Ping An Bank

- 11.58

- -0.02-0.17%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

No Data

Trade Overview

Capital Trend

No Data

News

Ping An Bank (000001.SZ) completed the issuance of 20 billion yuan perpetual bonds.

Ping An Bank (000001.SZ) announced that, approved by relevant regulatory institutions, the bank recently in the national inter-bank...

Multiple banks disclosed private banking data in the third quarter report, cm bank's number of customers grew by 1147 households, while ping an bank only increased by around a hundred households.

1. Ping An and CM Bank, two joint-stock banks, have detailed disclosures of the latest data, but the former's private banking clients only increased by about a hundred in the third quarter, less than one-tenth of CM Bank. Minsheng Bank only disclosed the balance of private banking assets, without disclosing the number of clients. 2. The five major banks have not updated the data on private banking clients in the third quarter, but the growth rate in the semi-annual report is considerable.

Is the rise in gold prices attracting banks to develop new businesses? Ping An Bank announced new fee-based services three months in advance, and Bank of China previously restarted physical gold RSP.

1. Ping An Bank announced in a notice the addition of fees for the new profit gold business, scheduled to take effect on January 25 next year; 2. This year, the international gold price has already exceeded the $2700 per ounce mark, breaking the historical record of gold prices over 20 times. In addition to Ping An Bank, state-owned major banks have recently resumed gold investment businesses.

Nine joint-stock banks have followed suit today, with seven banks including Everbright and Guangfa announcing a reduction in the deposit benchmark interest rates, with the highest fixed deposit rate cut by 25 basis points.

①The current banks have started a new round of deposit rate cuts, which is of great significance in maintaining interest margins, thereby ensuring the stable operation of commercial banks and increasing the support for financing the real economy continuously. ②This round of bank deposit rate cuts is expected to basically offset the impact of various loan rate cuts on net interest margins.

Ping An Bank's Q3 Profit Down 2.8%, Operating Income Down 12%

Ping An Bank: Third Quarter Report 2024

Comments

All 12 national joint-stock banks completed this round of deposit rate cuts.

The reduction in long-term deposit rates was more substantial, with two-year, three-year, and five-year fixed deposit rates generally cut by 0.2 percentage points. Ping An Bank reduced its two-year fixed deposit rate by 0.3%.

Man...

Analysis

Price Target

No Data

No Data