No Data

002142 Bank Of Ningbo

- 24.67

- +0.28+1.15%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Bank of Ningbo (SZSE:002142) Investors Are Sitting on a Loss of 30% If They Invested Three Years Ago

Zhongtai Securities: The monetary policy orientation in the third quarter of 2024 is positive, leaning towards smoothing the interest rate transmission mechanism and stabilizing the interest rate spread.

The central bank has explicitly stated that financial institutions should enhance their autonomous "rational" pricing capabilities in the next step to more reasonably respond to market demand and risk. In addition, the central bank pointed out that further regulation and interest rate cuts are subject to the dual constraints of net interest margins and exchange rates, especially the limitations of internal and external pressures.

China Securities Co.,Ltd.: Banks' third-quarter performance improved month-on-month, continue to focus on the trend of asset quality.

Listed banks' third quarter 24 revenue improved quarter-on-quarter, with the spread narrowing, stable expansion in scale, and other non-interest support.

Research reports | swhy: bank of ningbo's third quarter performance growth accelerates better than expected, maintaining a "buy" rating

swhy research reports pointed out that the acceleration of net interest income is driving outstanding revenue performance, and bank of ningbo (002142.SZ) third-quarter performance growth is better than expected. Actively acquiring assets, flexibly structuring underpin the stability of revenue growth in bank of ningbo, expecting bank of ningbo to pass through this economic cycle earlier and demonstrate upward alpha growth attributes in performance. Maintaining profit growth rate forecast, it is expected that the year-on-year growth rates of net income attributable to shareholders in 2024-2026 will be 5.3%, 6.6%, and 9.3% respectively, with the current stock price corresponding to a PB of 0.86 times in 2024, maintaining a “buy” rating.

Huachuang Securities: In the third quarter, the proportion of bank stocks in fund holdings slightly increased from a low level, bullish on the sector's value in the upturn cycle.

In the third quarter of 2024, the proportion of actively held positions in bank stocks in public offering funds bottomed out slightly, with the position ratio still at a low level. However, with the rebound of stock prices, the degree of underweighting has narrowed, and market risk appetite has increased slightly.

Bank of Ningbo: Report for the third quarter of 2024

Comments

$Luxshare Precision Industry (002475.SZ)$

$Hangzhou Hikvision Digital Technology (002415.SZ)$

$Muyuan Foods (002714.SZ)$

$NAURA Technology Group (002371.SZ)$

$CGN Power Co.,Ltd. (003816.SZ)$

$S.F. Holding (002352.SZ)$

$Bank Of Ningbo (002142.SZ)$

$Jiangsu Yanghe Distillery (002304.SZ)$

$Guosen (002736.SZ)$

$Iflytek Co.,ltd. (002230.SZ)$

$Focus Media Information Technology (002027.SZ)$

$Rongsheng Petro Chemical (002493.SZ)$

$Zhejiang Sanhua Intelligent Controls (002050.SZ)$

���������...

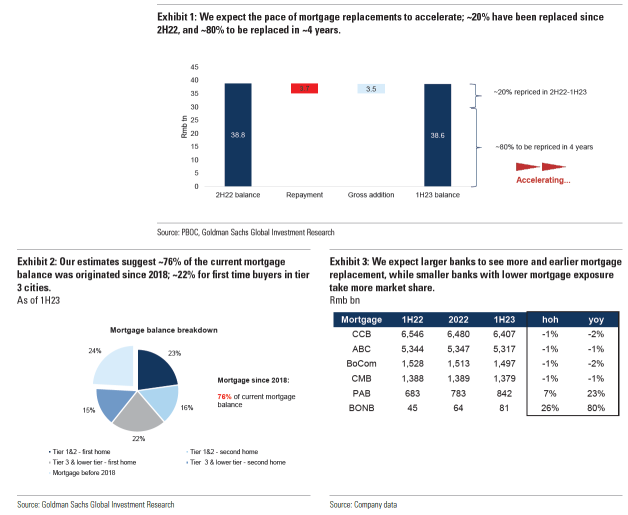

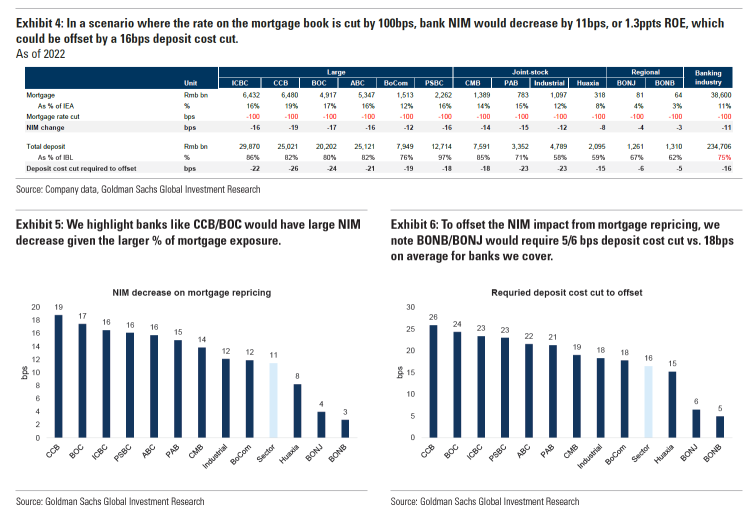

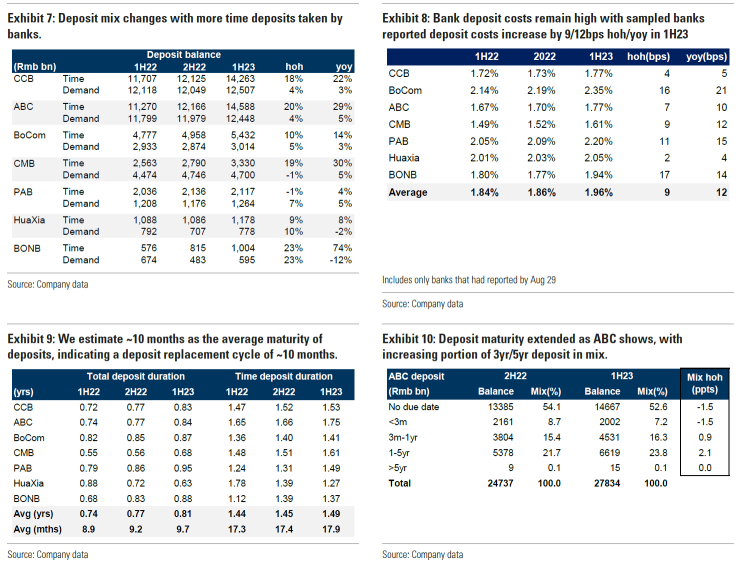

We expect 1) the pace of mortgage replacements to accelerate on a one-off rate cut on existing mortgages. Previously, we estimated ~4 more years to complete the mortgage replacement, assuming ~10% replacement completes in a half year and that the replacement cycle started in 2H22, and that ~20% of the mortgage book had been remortgaged by end-1H23.(...

Analysis

Price Target

No Data

No Data