No Data

002460 Ganfeng Lithium Group

- 41.61

- +3.78+9.99%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

The three major Hong Kong stock indexes continued to show a volatile trend, with the lithium battery and golden industrial concept sectors performing prominently.

① Why have international gold prices strengthened? ② What news has stimulated the strength of consumer electronics stocks? ③ Has the short sell ratio in the Hong Kong stock market shown a decline?

Price fluctuations do not hinder supply clearance, the lithium battery sector welcomes layout opportunities.

Production cuts, maintenance, and spot price increases could not suppress market expectations despite the block orders' aggressive selling. After erasing a week's gains over two trading days, the market rebounded significantly. On November 19th, the lithium sector surged, with ganfenglithium and tianqi lithium corporation both reaching their upper limits on A-shares, while Hong Kong stocks rose by over 10%, with funds pouring in aggressively.

Hong Kong stocks fluctuated | Lithium stocks quickly surged in the afternoon, with ganfenglithium (01772) rising over 13% and tianqi lithium corporation (09696) currently up nearly 10%.

Lithium stocks surged rapidly in the afternoon, with ganfenglithium and tianqi lithium corporation A shares both hitting the daily limit. As of publication, ganfenglithium (01772) rose by 11.99%, trading at 26.15 HKD; tianqi lithium corporation (09696) increased by 9.43%, trading at 29.6 HKD.

Hong Kong stocks unusual | Lithium stocks rose in early trading, with some improvement in supply and demand in the lithium carbonate market. Solid state batteries continue to receive sustained catalyst.

Lithium stocks rose in the early trading session. As of the time of writing, ganfenglithium (01772) is up 3.85%, priced at 24.25 HKD; tianqi lithium corporation (09696) is up 3.33%, priced at 27.95 HKD.

Hong Kong stock concept tracking | Global demand for lithium batteries continues to grow in 2025, Australia's lithium mine production halt promotes lithium price rebound (including concept stocks)

Lithium mining in australia has ceased production, indicating that a reversal in the lithium industry is on the way.

Lithium battery elimination match exam question: Will solid state batteries be cheaper than liquid ones? Will sodium batteries account for half of the market? | Direct hit at the "Battery Davos".

①After the expansion of power batteries, the industry elimination has also entered a deep water area; ②Although the industry generally expects full solid state batteries to become the "next generation battery", experts point out that the bottleneck of conductivity, production equipment and cost still needs to be addressed; ③Affected by the sharp drop in lithium prices, the industrialization speed of sodium batteries has slowed down, and sodium batteries will still need time to reduce costs and increase efficiency in order to win market share in the new round of energy storage competition.

Comments

Fueled by aggressive economic stimulus package, an amazing run-up occurred in China equities ahead of PRC National Day. The streak continued when the market reopened after a one-week break.

On October 8th, 4,976 stocks opened up by 9% or more; only 5 stocks opened down. All in all, benchmark index CSI300 posted a 32% gain in SIX trading DAYs.

The amount of time taken for the US market to rebound 3...

If you are a patient investor and like the idea of being invested in Australia's biggest lithium company who continues...

For resource stocks, $CHALCO (02600.HK)$ declined 3.6%, while $GANFENGLITHIUM (01772.HK)$ and $TIANQI LITHIUM (09696.HK)$ crumple...

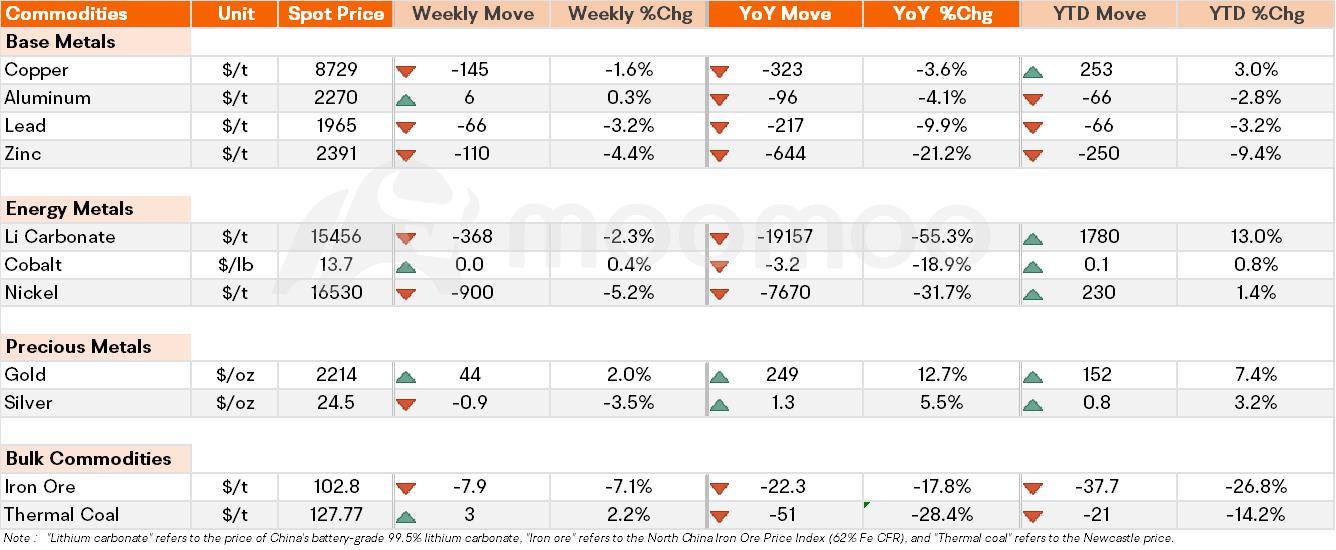

Spot Price Snapshot

Key Price Moves

Gold: On Thursday, the price of gold reached an all-time high and experienced its strongest month in more than three years due to high demand for safe-haven assets and expectati...

Analysis

Price Target

No Data

No Data