No Data

00285 BYD ELECTRONIC

- 41.200

- -1.250-2.94%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Citigroup: Lowers BYD Electronic's (00285) Target Price to HKD 45 and downgrades the rating to "Neutral".

The bank stated that the current stock price has fully reflected the company's growth this year, and short-term stock price catalysts may include the shipment of "H20 NVL16" and the launch of "Pura 80".

CITIC International: Raised the Target Price for BYD Electronics to HKD 53.2, with a rating of "Buy".

CICC released a Research Report stating that BYD Electronics (00285) performed below expectations in the second half of last year, and management expects future profits to improve due to various catalysts. Additionally, domestic demand for AI Servers continues to be released, and BYD Electronics' businesses such as liquid cooling, power supply, and server enclosures also have significant elasticity. The bank maintains a "Buy" rating for the group, raising the Target Price from HK$39.4 to HK$53.2.

[Brokerage Focus] Guolian Minsheng Securities maintains a "Buy" rating on BYD Electronics (00285), noting that it will take advantage of the Auto Parts Business to enter a period of rapid growth.

Jinwu Finance News | Guolian Minsheng Securities reported that in 2024, BYD Electronics (00285) is expected to achieve revenue of 177.306 billion yuan, a year-on-year increase of 36.43%; it is expected to realize a net income attributable to shareholders of 4.266 billion yuan, a year-on-year increase of 5.55%. The firm indicates that in 2024, the company's revenue from Consumer Electronics assembly / Consumer Electronics components / new Asia Vets Business / Autos Business will account for 59.54% / 20.11% / 8.78% / 11.57% respectively, showing year-on-year changes of -4.93 pct / +9.62 pct / -5.41 pct / +0.72 pct.

Choosing between A-shares or Hong Kong stocks, Technology or non-Technology? Goldman Sachs' Research Reports respond to two major hot topics in investing in China.

① Currently, should investors continue investing in Hong Kong Stocks or shift to the A-share market? Should the focus be on the Technology Sector or shift to Consumer, Real Estate, and other non-Technology sectors? ② On Wednesday, Goldman Sachs' chief China Stocks strategist, Liu Jinjing, provided an analysis in his report.

Northbound capital trends | Northbound capital net buying of 13.896 billion. After a large placement of Xiaomi (01810), the stock price is under pressure. Northbound capital is buying on dips, nearly 8.5 billion Hong Kong dollars.

On March 25th, in the Hong Kong stock market, northbound capital had a net buying transaction of 13.896 billion HKD, of which the SH->HK Connect recorded a net buy of 8.479 billion HKD, and the SZ->HK Connect recorded a net buy of 5.416 billion HKD.

BYD Electronic (International) Reports 5.6% Increase in 2024 Profit; Shares Drop 10%

Comments

my view, it is about outlook.. yesterday slide 10%..today din manage to bounce up..overall market is weak. not an inducement to buy or sell. I will choose to sit on the bench learn, observe how media release news n how prices are affected

why going down, anyone know?

Could be a potential bullish flag pattern here and if able to hold as a higher low around its HKD 48 regions, could breakout from its HKD 55+ main downtrend resistance until we see a further breakout.

Support: HKD 48.70 area

Resistance: HKD 50, HKD 54, HKD 56 areas

![BYD ELECTRONICS [Titan Weekend Chart Reviews]](https://sgsnsimg.moomoo.com/sns_client_feed/103290357/20250310/8279e7369b50aa6922d53c0b46f53167.jpg/thumb?area=104&is_public=true)

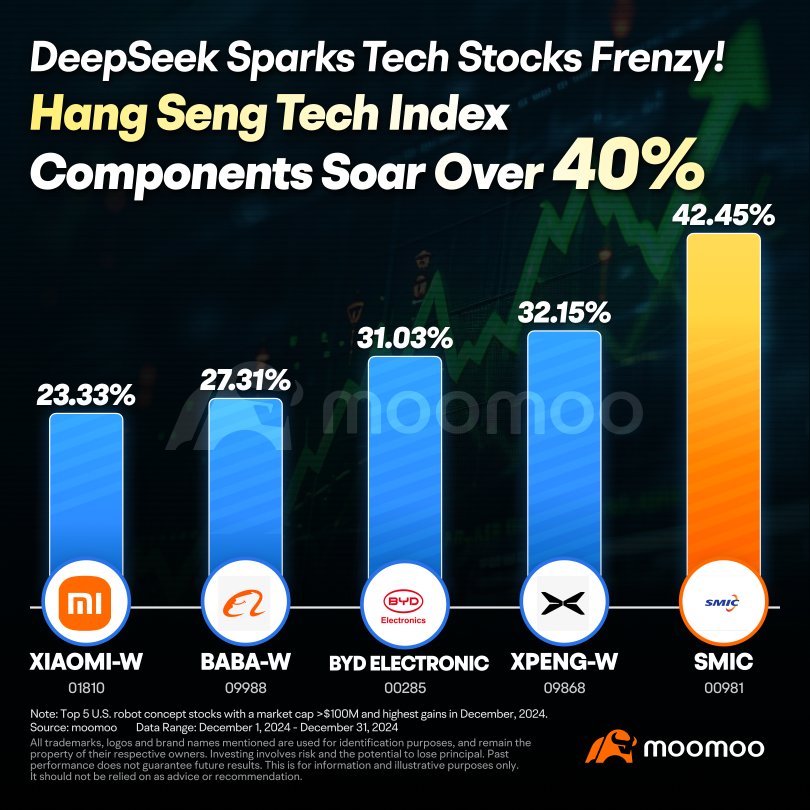

Among its components, $SMIC (00981.HK)$ gained 42...