No Data

00285 BYD ELECTRONIC

- 42.450

- -4.500-9.58%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Northbound capital trends | Northbound capital net buying of 13.896 billion. After a large placement of Xiaomi (01810), the stock price is under pressure. Northbound capital is buying on dips, nearly 8.5 billion Hong Kong dollars.

On March 25th, in the Hong Kong stock market, northbound capital had a net buying transaction of 13.896 billion HKD, of which the SH->HK Connect recorded a net buy of 8.479 billion HKD, and the SZ->HK Connect recorded a net buy of 5.416 billion HKD.

BYD Electronic (International) Reports 5.6% Increase in 2024 Profit; Shares Drop 10%

Hong Kong stock movement | BYD Electronics (00285) fell over 9%, with Institutions pointing out that its weak GPM in the second half of last year led to Net income being lower than expected.

BYD Electronics (00285) fell over 9%, as of the time of this report, it declined by 9.37%, trading at 42.55 Hong Kong dollars, with a transaction volume of 0.827 billion Hong Kong dollars.

Hong Kong stock morning news | Trump sends signals about tariff exemptions; Xiaomi plans to raise approximately 42.5 billion Hong Kong dollars through a placement.

① Trump has stated that he will announce additional tariffs on Autos, timber, and chips; there may be exemptions for tariffs on multiple countries. ② Trump again calls for the Federal Reserve to lower interest rates; Federal Reserve's Bostic stated that the inflation rate will not return to 2% before early 2027. ③ The three major U.S. stock indices collectively rose, while China Concept Stocks remained lukewarm. ④ The central bank's MLF operation was adjusted to multiple price level bidding, marking a net injection after eight months.

GTJA: Lithium battery demand has entered the transition between peak and off-peak seasons, and follow-up tracking shows demand exceeding expectations.

GTJA released a Research Report stating that lithium battery demand has entered the transition between peak and off-peak seasons, and will continue to track demand exceeding expectations.

Super Micro, BYD, MicroStrategy, Tesla, Lockheed, LUNR: Biggest Movers

Comments

why going down, anyone know?

Could be a potential bullish flag pattern here and if able to hold as a higher low around its HKD 48 regions, could breakout from its HKD 55+ main downtrend resistance until we see a further breakout.

Support: HKD 48.70 area

Resistance: HKD 50, HKD 54, HKD 56 areas

![BYD ELECTRONICS [Titan Weekend Chart Reviews]](https://sgsnsimg.moomoo.com/sns_client_feed/103290357/20250310/8279e7369b50aa6922d53c0b46f53167.jpg/thumb?area=104&is_public=true)

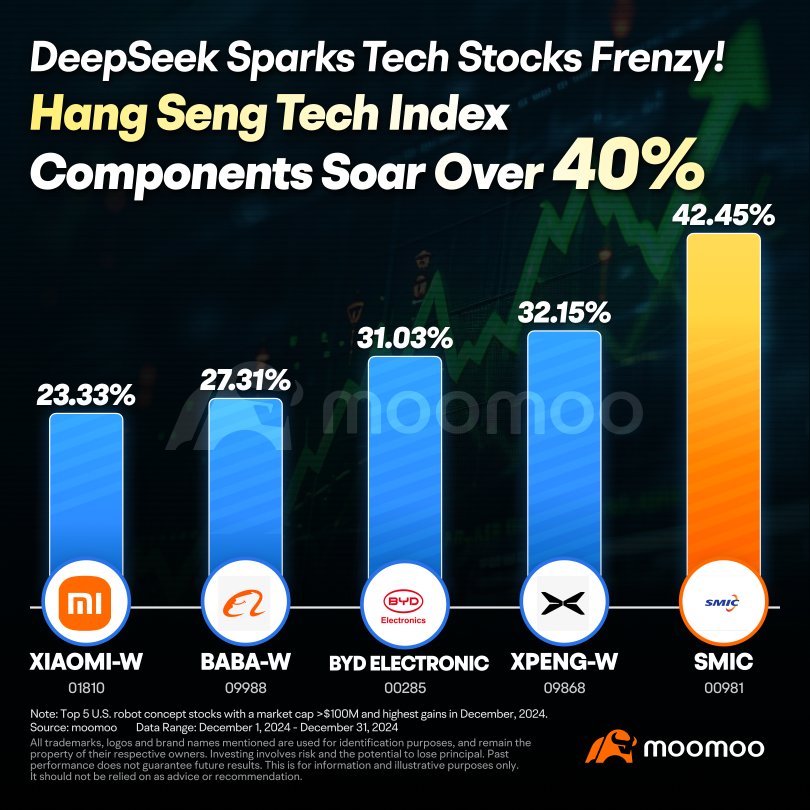

Among its components, $SMIC (00981.HK)$ gained 42...

ZimomoMEL : In the second half of last year, the gross margin and operating profit did not meet the Brokerage's expectations. In summary, when the market is going down, it will decline even if you are profitable; when it is going up, it will rise even if you are making losses. It all depends on the Brokerage's rhetoric.