No Data

00694 BEIJING AIRPORT

- 2.910

- -0.020-0.68%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Hong Kong stocks movement | Aviation/airlines Industry rises counter to market trend, Air China Limited (00753) rises over 5% during trading hours, expanded tourism Consumer spending is expected to stimulate an increase in demand for regional airlines.

The aviation/airlines industry rose against the market trend. As of the time of reporting, China Eastern Airlines (00670) increased by 3.46%, trading at 2.69 Hong Kong dollars; Air China Limited (00753) rose by 3.18%, trading at 5.52 Hong Kong dollars; China Southern Airlines (01055) was up by 2.33%, trading at 3.95 Hong Kong dollars; Capital Airlines (00694) increased by 0.69%, trading at 2.91 Hong Kong dollars.

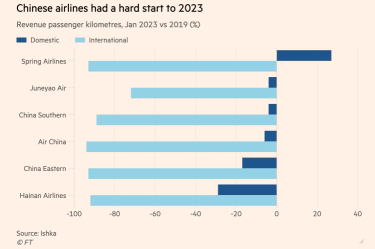

Airlines See Lower Customer Demand, Cut Back Financial Expectations

BEIJING AIRPORT (00694.HK) plans to hold a Board of Directors meeting on March 27 to approve the annual performance.

Gelonghui on March 10th丨BEIJING AIRPORT (00694.HK) announced that the Board of Directors will hold a meeting on March 27, 2025 (Thursday) to discuss the following matters: 1. Consider and approve the company's performance for the year ending December 31, 2024; 2. Consider and approve the company's profit distribution plan, declaration, recommendation or payment of dividends (if any); and 3. Other matters (if any).

BEIJING AIRPORT: ANNOUNCEMENTNOTICE OF BOARD MEETING

Hong Kong stocks fluctuated | The Aviation/airlines Industry continues its recent strong performance, the civil aviation sector is expected to benefit from the decline in international oil price levels, Institutions are Bullish on the stabilization and re

Aviation/airlines industry continues its recent strong performance. As of the time of writing, China Southern Airlines (01055) rose by 4.92%, trading at 3.84 HKD; Air China Limited (00753) increased by 3.16%, trading at 5.23 HKD; Capital Airlines (00694) climbed by 2.57%, trading at 2.79 HKD; China Eastern Airlines (00670) grew by 1.9%, trading at 2.68 HKD.

【Brokerage Focus】CITIC SEC pointed out that the demand for public business is accelerating recovery, expecting additional growth in long-haul routes.

Jinwu Financial News | CITIC SEC stated that after the Lantern Festival, the recovery of public business demand has accelerated, which may provide significant support for the recent positive changes in domestic ticket prices. Reviewing the historical recovery of short-term public business demand may be an important observation Indicator. After the Spring Festival transport in 2025, public business travel is expected to rebound, with passenger flow on the Beijing-Shanghai line recovering to 92.4% of the levels seen in the 10 days before the Spring Festival transport during the 10 days after the Lantern Festival (better than 88.7% in 2024), and ticket prices seeing a year-on-year positive change with improved pre-sale data. There are expectations for accelerated resumption of work and high prosperity in new productive forces leading to increased travel demand. The North American routes are a major factor limiting the improvement in wide-body aircraft utilization, and we estimate the situation on the U.S. routes

Comments

$TENCENT (00700.HK)$ │Overweight

$Kweichow Moutai (600519.SH)$ │Overweight

$BABA-W (09988.HK)$ │Overweight

$PETROCHINA (00857.HK)$ │Overweight

$PDD Holdings (PDD.US)$ │Overweight

$AIA (01299.HK)$ │Overweight

$MEITUAN-W (03690.HK)$ │Overweight

$BYD COMPANY (01211.HK)$ │Overweight

$NTES-S (09999.HK)$ │Overweight

$Midea Group Co., Ltd (000333.SZ)$ │Overweight

$HKEX (00388.HK)$ │Overweight

$BIDU-SW (09888.HK)$ │Overweigh...

On January 6, the CAAC claimed that it would increase the proportion of international aviation, cargo aviation, regional aviation, and general aviation in the civil aviation business, accelerate the construction of a new pattern of opening up civil aviation to the outside world and strive for an overall recovery to the pre-epidemic level of 75%.

Just past ...

It will go up to 5.00, We just wait for it🥲🥲

Medium & Long Term - Monopoly

markets. I believe people's will stay away from this stock.

markets. I believe people's will stay away from this stock.