No Data

00694 BEIJING AIRPORT

- 2.650

- -0.040-1.49%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Consumer potential has been validated by data! Hong Kong stock tourism concept stocks have been popular for several consecutive days, with meilan airport rising nearly 13%.

① Hong Kong stocks in the travel concept sector have been popular for several days; what bullish factors are driving the sector's trends? ② The potential for travel consumer spending has been validated; how do institutions view it?

Hong Kong stocks concept tracking | Hong Kong Civil Aviation Department invests 4.3 billion in Zhuhai Airport, institutions bullish on the long-term investment logic of the future aviation industry (with concept stocks)

On the 26th, the Airport Authority of Hong Kong signed a cooperation agreement on equity of Zhuhai Airport with Zhuhai Transport Holdings Group in Zhuhai.

beijing airport (00694.HK) revenue in the first three quarters increased by 27.34% year-on-year, and net loss significantly narrowed to 0.46 billion yuan.

Gelonghui October 31st | Beijing airport (00694.HK) announced that, according to China's corporate accounting standards, in January-September 2024, the company's revenue was RMB 4.109 billion, a year-on-year increase of 27.34%; net loss was RMB 0.46 billion, significantly narrower than the RMB 1.336 billion loss in the same period last year.

BEIJING AIRPORT: ANNOUNCEMENTINSIDE INFORMATION

Aviation stocks rose in early trading as Transport Canada revoked restrictions on Chinese mainland airlines. International aviation demand continues to recover.

The aviation/airlines industry rose in early trading, as of press time, Air China Limited (00753) rose by 3.17% to HK$4.23; China Southern Airlines (01055) rose by 4.04% to HK$3.35; Capital Airport (00694) rose by 1.06% to HK$2.87; China Eastern Airlines (00670) rose by 2.76% to HK$2.23.

Beijing airport (00694.HK) had 1.458 million shares reduced by Mitsubishi UFJ Financial Group.

According to the latest equity disclosure information from the Hong Kong Stock Exchange on October 25, 2024, Beijing Airport (00694.HK) was shareholding by Mitsubishi UFJ Financial Group, Inc. at an average price of HK$2.8429 per share on the exchange, reducing 1.458 million shares, involving approximately HK$4.145 million. After the shareholding, Mitsubishi UFJ Financial Group, Inc.'s latest number of shares held is 168,538,000 shares, with a shareholding ratio of 9.04.

Comments

$TENCENT (00700.HK)$ │Overweight

$Kweichow Moutai (600519.SH)$ │Overweight

$BABA-W (09988.HK)$ │Overweight

$PETROCHINA (00857.HK)$ │Overweight

$PDD Holdings (PDD.US)$ │Overweight

$AIA (01299.HK)$ │Overweight

$MEITUAN-W (03690.HK)$ │Overweight

$BYD COMPANY (01211.HK)$ │Overweight

$NTES-S (09999.HK)$ │Overweight

$Midea Group Co., Ltd (000333.SZ)$ │Overweight

$HKEX (00388.HK)$ │Overweight

$BIDU-SW (09888.HK)$ │Overweigh...

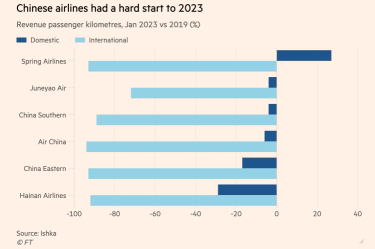

On January 6, the CAAC claimed that it would increase the proportion of international aviation, cargo aviation, regional aviation, and general aviation in the civil aviation business, accelerate the construction of a new pattern of opening up civil aviation to the outside world and strive for an overall recovery to the pre-epidemic level of 75%.

Just past ...

It will go up to 5.00, We just wait for it🥲🥲

Medium & Long Term - Monopoly

markets. I believe people's will stay away from this stock.

markets. I believe people's will stay away from this stock.