No Data

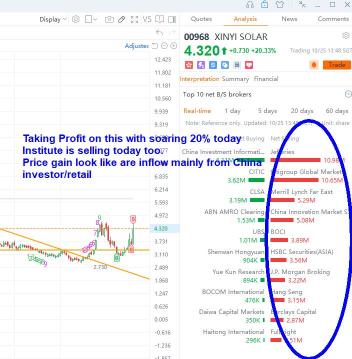

00968 XINYI SOLAR

- 3.220

- 0.0000.00%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

[Brokerage Focus] Zhongtai International reduces the Target Price for XINYI SOLAR (00968) by 16.36%, indicating that the adjustment of the production line will undoubtedly affect short-term revenue.

Kingwoo Finance News | Zhongtai International released a Research Report stating that as of the end of November, XINYI SOLAR (00968) has cumulatively cold-repaired nine Photovoltaic Glass production lines, with a total daily capacity of 7,000 tons (2,000 tons in the first half of the year and 5,000 tons in the second half). Among them, the two cold-repaired 1,000-ton production lines from the first half of the year have completed the project but have not yet been reignited and put into production, while the other cold-repair projects are still in progress. In terms of new capacity, the company has completed the construction of six Photovoltaic Glass production lines this year, of which (1) two 1,200-ton lines in Malaysia have been ignited and put into production in June and August respectively; (2) two 1,000-ton lines in Wuhu, Anhui.

Zhongtai International: Maintains XINYI SOLAR (00968) "Neutral" rating, Target Price lowered to HKD 3.22.

The company plans to ignite and put into production four 1,000-ton and one 900-ton production lines that are undergoing cold repairs this year, as well as the newly constructed Wuhu production line, based on market and company's own circumstances, at the right time in the future.

Pacific Securities: A reversal in the photovoltaic Industry is imminent. Pay attention to three directions.

The Research Reports from The Pacific Securities indicate that with continuous breakthroughs in new markets and new technologies, a new cycle of price parity in solar storage is accelerating its onset, and a reversal in the photovoltaic Industry is imminent, suggesting attention to three directions.

[Brokerage Focus] Guoyuan International points out that the bottom cycle of the Photovoltaic Glass Industry is clear and is Bullish on the demand recovery in Q2 2025, after which the industry will start a new cycle.

Jingwu Financial News | Guoyuan International released a Research Report stating that on October 30, 2024, the Ministry of Industry and Information Technology issued the "Implementation Measures for Capacity Replacement in the Cement Glass Industry (2024 Edition)", removing the previous version's provision that photovoltaic glass production lines do not require a capacity replacement plan, and increasing encouragement for photovoltaic rolled glass projects to be constructed through capacity replacement, which is expected to help alleviate the supply pressure of photovoltaic glass to some extent. According to the latest policy from the Ministry of Industry and Information Technology, the construction of photovoltaic glass production lines can proceed through capacity replacement or a risk warning mechanism. Since the hearing process began in 2022, three batches of projects have been approved, and the overall production rate of the approved projects is relatively low.

Hong Kong stocks move | The decline in solar stocks expands in the afternoon as the industry further strengthens self-discipline. Goldman Sachs states it is monitoring the follow-up implementation of production cuts.

In the afternoon, the decline of photovoltaic stocks expanded. As of the time of writing, xinyi solar (00968) decreased by 4.39%, priced at 3.27 Hong Kong dollars; xinte energy (01799) dropped by 2.47%, priced at 7.9 Hong Kong dollars; flat glass (06865) fell by 1.71%, priced at 12.68 Hong Kong dollars.

Hong Kong Shares Fall 0.8%, Markets Weigh China Inflation Data -- Market Talk

Comments

Photovoltaic solar energy stocks rose against the market, xinte energy (01799) rose by 3.07%. Institutions pointed out that with the significant increase in industry access thresholds, the sector is expected to bottom out.

COWmustMoo : if u have money