No Data

00998 CITIC BANK

- 6.110

- -0.020-0.33%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Research Reports Gold Digging | SWHY: Maintain "Buy" rating on China CITIC Bank Corporation, with stable interest margin and increased dividends in 2024.

SWHY research indicates that China CITIC Bank Corporation (601998.SH) will have stable interest margins, stable revenue, accelerated profit growth, and increased dividends in 2024, gradually demonstrating high-quality high-dividend attributes. Looking ahead to 2025, it is believed that China CITIC Bank will achieve better horizontal performance than peers and stronger vertical performance than itself, based on more solid asset quality and nearly complete business structure jiegoutiaozheng. A "Buy" rating is maintained. Based on prudent considerations, the profit growth forecast for 2025-2026 has been revised down, credit costs have been increased, and a new forecast for 2027 has been added, expecting the net income growth rate attributable to parent company to be respectively for 2025-2027.

China CITIC Bank 2024 Profit Up 2%, Revenue Rises 4%

China CITIC Bank Co., Ltd. 2024 Annual Report

Summary of the 2024 Annual Report of China CITIC Bank Co., Ltd.

China CITIC Bank Corporation (00998) has reappointed KPMG Huazhen and KPMG Hong Kong.

China CITIC Bank Corporation (00998) issued a notice, China CITIC Bank Corporation (hereinafter referred to as "the bank") in 2025...

China CITIC Bank Announces 2024 Annual Results and Dividend Proposal

Comments

$MEITUAN-W (03690.HK)$

$BIDU-SW (09888.HK)$

$BABA-W (09988.HK)$

$CHINA VANKE (02202.HK)$

$CITIC SEC (06030.HK)$

$CITIC BANK (00998.HK)$

$ZHONGLIANG HLDG (02772.HK)$

$BYD COMPANY (01211.HK)$

$HTSC (06886.HK)$

$SHK PPT (00016.HK)$

$ICBC (01398.HK)$

$HSBC HOLDINGS (00005.HK)$

$PING AN (02318.HK)$

$JD-SW (09618.HK)$

$ANTA SPORTS (02020.HK)$

Click here for Top Trending Posts

China property stocks surge to highest levels in a year as stimulus rally continues

Mini handle or pullback, this type of pattern provide me safe entry point.

$Apple (AAPL.US)$ $Bank of America (BAC.US)$ $American Express (AXP.US)$ $Coca-Cola (KO.US)$ $CHERVON (02285.HK)$ $The Kraft Heinz (KHC.US)$ $Moody's (MCO.US)$ $DaVita (DVA.US)$ $CITIC BANK (00998.HK)$

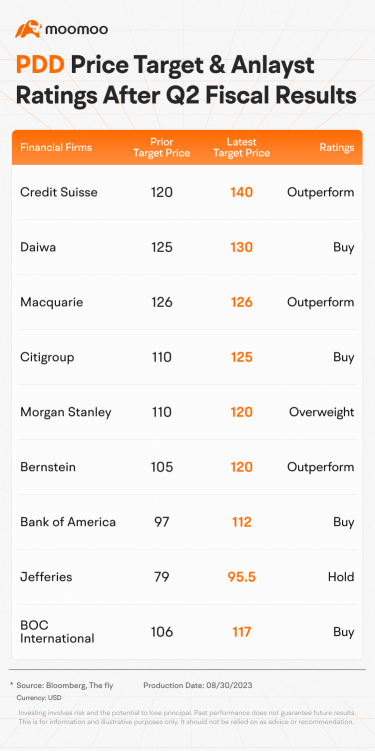

According to the earnings report, $PDD Holdings (PDD.US)$'s Q2 revenue was RMB 52.281 billion, a YoY increase of 66%, while operating profit was RMB 12.719 billion, a YoY increase of 46%. Adjusted net income was RMB 15.269 billion, a YoY increase of 42%. These figures exceeded...

每天都在學習中 : Look, Ali, Dad.$BABA-W (09988.HK)$ Available for as low as $90