No Data

00998 CITIC BANK

- 5.040

- +0.070+1.41%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

China Citic Bank Corporation has listed a high number of individual non-performing loan projects. The retail assets risk is still in the release stage, and the bank's non-performing asset disposal is accelerating.

China Citic Bank Corporation has recently listed a large number of non-performing loan projects, involving multiple branches in Peking, Shenzhen, and others, mostly personal consumption and non-performing loans for operations. The current retail asset risks of banks are still in the releasing stage, with remaining pressure on improving asset quality indicators, requiring larger efforts in non-performing loan write-offs, disposal measures, and more.

China Citic Bank Corporation (00998.HK): When implementing the mid-term dividends for A-share common stock in 2024, the conversion of "Citic Convertible Bonds" will be suspended.

Gelonghui reported on November 27th that china citic bank corporation (00998.HK) announced that due to the implementation of the 2024 A-share common stock mid-term dividends, the status of relevant securities for china citic bank corporation is as follows: From the last trading day before the announcement of the implementation of the 2024 A-share common stock mid-term dividends (December 3, 2024) to the date of equity registration for these dividends, the china citic convertible bond (113021) will suspend its conversion; on the first trading day after the equity registration date, the china citic convertible bond will resume conversion.

In November, the MLF volume continued to shrink. Previously, the 500 billion buy-back reverse repurchase has released medium-term liquidity ahead of schedule. The industry expects the reserve requirement ratio cut to be implemented faster.

①The funding operation mode of shortening and lengthening funds continues. On the one hand, the central bank continues to reduce the MLF operations volume, reduce the existing stock to mitigate its impact on the liquidity market. On the other hand, short-term funds continue to be net injected to hedge against cross-month fund pressure, strengthening the guiding position of reverse repurchase agreements on market interest rates. ②Local government bonds are centrally supplied, and the MLF is likely to see a quicker implementation under the reduced volume environment.

China CITIC Bank Updates on Interim Dividend

China CITIC Bank Corporation will distribute a mid-term dividend of 1.847 yuan for every 10 shares on January 15, 2025.

China Citic Bank Corporation (00998) announced that it will distribute a mid-term dividend of RMB 1.847 per 10 shares for the six months ending on June 30, 2024 on January 15, 2025.

Rare! This rural commercial bank is offering a 5-year fixed deposit interest rate of 1.5%, which is lower than the 1.55% level of state-owned banks. It is referred to as a "case" in the industry.

①Recently, Wuxiang Rural Commercial Bank adjusted the deposit execution interest rates, lowering the execution interest rates for personal fixed-term deposits of two years, three years, and five years to 1.5%, with the five-year execution interest rate being lowered below the lowest level of the state-owned banks' published rates. ②The phenomenon of the aforementioned rural commercial bank reducing rates beyond the mid- to long-term levels of state-owned banks is still considered an isolated case.

Comments

$MEITUAN-W (03690.HK)$

$BIDU-SW (09888.HK)$

$BABA-W (09988.HK)$

$CHINA VANKE (02202.HK)$

$CITIC SEC (06030.HK)$

$CITIC BANK (00998.HK)$

$ZHONGLIANG HLDG (02772.HK)$

$BYD COMPANY (01211.HK)$

$HTSC (06886.HK)$

$SHK PPT (00016.HK)$

$ICBC (01398.HK)$

$HSBC HOLDINGS (00005.HK)$

$PING AN (02318.HK)$

$JD-SW (09618.HK)$

$ANTA SPORTS (02020.HK)$

Click here for Top Trending Posts

China property stocks surge to highest levels in a year as stimulus rally continues

Mini handle or pullback, this type of pattern provide me safe entry point.

$Apple (AAPL.US)$ $Bank of America (BAC.US)$ $American Express (AXP.US)$ $Coca-Cola (KO.US)$ $CHERVON (02285.HK)$ $The Kraft Heinz (KHC.US)$ $Moody's (MCO.US)$ $DaVita (DVA.US)$ $CITIC BANK (00998.HK)$

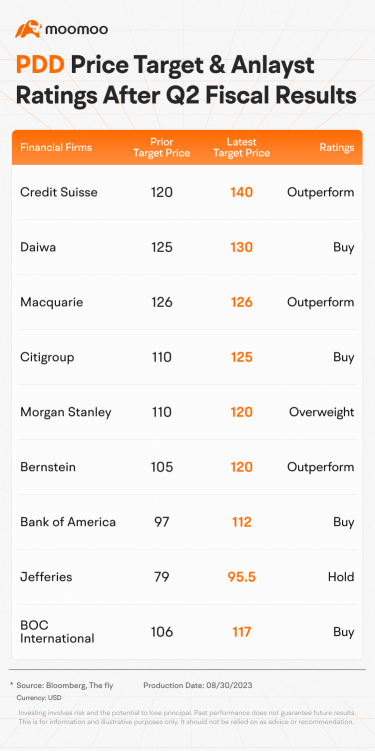

According to the earnings report, $PDD Holdings (PDD.US)$'s Q2 revenue was RMB 52.281 billion, a YoY increase of 66%, while operating profit was RMB 12.719 billion, a YoY increase of 46%. Adjusted net income was RMB 15.269 billion, a YoY increase of 42%. These figures exceeded...

Analysis

Price Target

No Data

No Data

每天都在學習中 : Bullish on Alibaba.$BABA-W (09988.HK)$ Buy around $90 on dips.