No Data

00998 CITIC BANK

- 5.480

- +0.010+0.18%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

[Brokerage Focus] Morgan Stanley states that the CSRC encourages state-owned Insurance to invest 30% of new premiums in A-shares, expecting domestic Silver to become a major investment choice.

Jinwu Financial News | Morgan Stanley has released a report stating that the China Securities Regulatory Commission encourages large state-owned insurance companies to invest 30% of new premiums in A-shares, believing that the attractive dividend yield and stable payout ratio of Bank Of China will likely become a main investment choice for state-owned insurance companies. More rational and long-term policies, along with the support of the credit cycle, should support the sustainable development of the financial market and the ideal performance of bank stocks. The bank believes that several factors will continue to drive the performance of China Mainland Banking stocks, including a potentially more constructive view of banks' Operation Indicators in the market; expanded fiscal policy support, which buffers the tail risks of bank credit quality; in the credit cycle.

China CITIC Bank Corporation (00998.HK): Received a notice from Shanghai Stock Exchange to resume review.

On January 23, Gelonghui reported that China CITIC Bank Corporation (00998.HK) announced its proposal to issue A-shares and Listed in Hong Kong shares through a rights issue, extend the validity period of the shareholder meeting resolution for the preferential allotment of shares to original Shareholders, and related matters including receiving a notice of suspension from the Exchange for review. The bank will publish an announcement on October 31, 2024, stating that due to the provisions of Article 60, Item (2) of the Shanghai Stock Exchange's Rules for the Review of Stock Issuance and Listing, it is required to replace PricewaterhouseCoopers Zhong Tian LLP, which was the accountant in the application for preferential allotment of shares to original A-share Shareholders, according to the regulations of the Shanghai Securities Exchange.

Express News | China CITIC Bank - Uncertainty Whether or When Approval by SSE and Consent of Csrc to Registration Will Be Obtained

Express News | China CITIC Bank - SSE Has Agreed to Resume Review of Bank's Refinancing Business.

Hong Kong stocks are moving unusually | China Mainland Banking stocks are rising across the board as listed Banks have been intensively distributing dividends recently. Institutions indicate that the Sector still has upward valuation potential.

China Mainland Banking stocks are all on the rise. As of the time of publication, Postal Savings Bank Of China (01658) is up 3.08%, priced at 4.68 Hong Kong dollars; Industrial And Commercial Bank Of China (01398) is up 2.21%, priced at 5.09 Hong Kong dollars; China CITIC Bank Corporation (00998) is up 2.23%, priced at 5.49 Hong Kong dollars.

Optimism for China CITIC Bank (HKG:998) Has Grown This Past Week, Despite One-year Decline in Earnings

Comments

$MEITUAN-W (03690.HK)$

$BIDU-SW (09888.HK)$

$BABA-W (09988.HK)$

$CHINA VANKE (02202.HK)$

$CITIC SEC (06030.HK)$

$CITIC BANK (00998.HK)$

$ZHONGLIANG HLDG (02772.HK)$

$BYD COMPANY (01211.HK)$

$HTSC (06886.HK)$

$SHK PPT (00016.HK)$

$ICBC (01398.HK)$

$HSBC HOLDINGS (00005.HK)$

$PING AN (02318.HK)$

$JD-SW (09618.HK)$

$ANTA SPORTS (02020.HK)$

Click here for Top Trending Posts

China property stocks surge to highest levels in a year as stimulus rally continues

Mini handle or pullback, this type of pattern provide me safe entry point.

$Apple (AAPL.US)$ $Bank of America (BAC.US)$ $American Express (AXP.US)$ $Coca-Cola (KO.US)$ $CHERVON (02285.HK)$ $The Kraft Heinz (KHC.US)$ $Moody's (MCO.US)$ $DaVita (DVA.US)$ $CITIC BANK (00998.HK)$

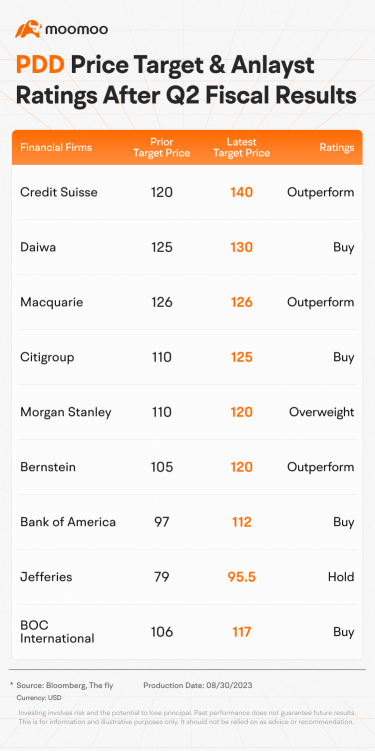

According to the earnings report, $PDD Holdings (PDD.US)$'s Q2 revenue was RMB 52.281 billion, a YoY increase of 66%, while operating profit was RMB 12.719 billion, a YoY increase of 46%. Adjusted net income was RMB 15.269 billion, a YoY increase of 42%. These figures exceeded...

每天都在學習中 : Look, Ali, Dad.$BABA-W (09988.HK)$ Available for as low as $90