No Data

00998 CITIC BANK

- 4.970

- 0.0000.00%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

No Data

Trade Overview

Capital Trend

No Data

News

china citic bank corporation(00998) will distribute a mid-term dividend of 1.97434 Hong Kong dollars per 10 shares on January 15, 2025.

China Citic Bank Corporation (00998) announced that it will distribute dividends on January 15, 2025, for the period ending June 30, 2024...

CITIC BANK: ANNOUNCEMENT ADJUSTMENT TO THE DISTRIBUTION RATIO UNDER THE 2024 INTERIM PROFIT DISTRIBUTION PLAN

The no-card deposit and withdrawal business continues to tighten, with about 20 banks officially announcing adjustments to the business, leading to diffusion among small and medium banks since November.

① Since November, about 20 banks have announced restrictions on cardless deposit and withdrawal services. Throughout the year, at least 50 various banks, including state-owned banks, joint-stock banks, and small to medium-sized banks have successively announced tightened cardless services. ② From the announcements released by each bank, their reasons for adjusting cardless services are basically consistent—risk control.

A lifetime ban on business paper reveals a fraud case, China Citic Bank Corporation employee claimed to be able to process a 60 million loan to deceive a huge "benefits fee", and finally was sentenced to 12 years in prison.

① The violations related to Tao Jun resulted in the China CITIC Bank Corporation Taiyuan Branch and several individuals being fined simultaneously, but only he was banned for life in this batch of fines. ② Information from the judgment document website indicates that Tao Jun claimed he could help people obtain large loans and defraud them of substantial "kickbacks"; due to his involvement in a fraud case, he was sentenced to 12 years in the first instance.

China mainland banking stock price surged, harbin bank (06138) rose by 4.41%. Institutions view the bank's allocation value favorably against the backdrop of a comprehensive policy implementation.

Golden Eagle Financial News | China mainland banking stocks strengthened, as of the time of writing, Harbin Bank (06138) rose 4.41%, ZYBank (01216) rose 1.67%, Bank of Tianjin (01578) rose 1.2%, Minsheng Bank (01988) rose 1%, China Citic Bank Corporation (00998) followed suit. On the news front, Citic Sec stated that the core operating elements of the banking industry are running steadily, with the fundamental variables of the sector entering a stable period against the backdrop of the previous comprehensive policy implementation. Overall, the changes in investor funding and macro policy expectations in the next phase have become marginal variables affecting the trend of banks, and we tend to point towards

China Citic Bank Corporation has listed a high number of individual non-performing loan projects. The retail assets risk is still in the release stage, and the bank's non-performing asset disposal is accelerating.

China Citic Bank Corporation has recently listed a large number of non-performing loan projects, involving multiple branches in Peking, Shenzhen, and others, mostly personal consumption and non-performing loans for operations. The current retail asset risks of banks are still in the releasing stage, with remaining pressure on improving asset quality indicators, requiring larger efforts in non-performing loan write-offs, disposal measures, and more.

Comments

$MEITUAN-W (03690.HK)$

$BIDU-SW (09888.HK)$

$BABA-W (09988.HK)$

$CHINA VANKE (02202.HK)$

$CITIC SEC (06030.HK)$

$CITIC BANK (00998.HK)$

$ZHONGLIANG HLDG (02772.HK)$

$BYD COMPANY (01211.HK)$

$HTSC (06886.HK)$

$SHK PPT (00016.HK)$

$ICBC (01398.HK)$

$HSBC HOLDINGS (00005.HK)$

$PING AN (02318.HK)$

$JD-SW (09618.HK)$

$ANTA SPORTS (02020.HK)$

Click here for Top Trending Posts

China property stocks surge to highest levels in a year as stimulus rally continues

Mini handle or pullback, this type of pattern provide me safe entry point.

$Apple (AAPL.US)$ $Bank of America (BAC.US)$ $American Express (AXP.US)$ $Coca-Cola (KO.US)$ $CHERVON (02285.HK)$ $The Kraft Heinz (KHC.US)$ $Moody's (MCO.US)$ $DaVita (DVA.US)$ $CITIC BANK (00998.HK)$

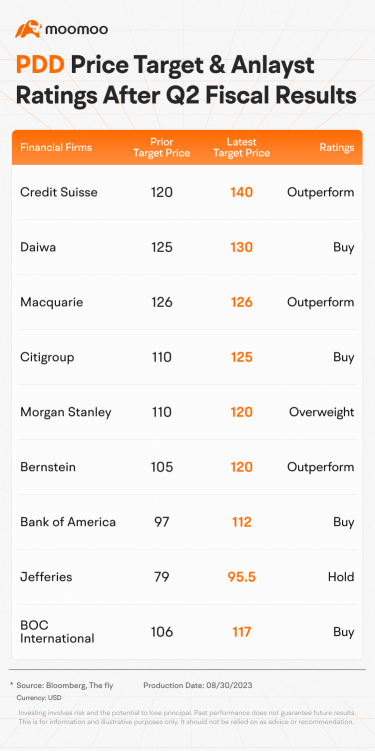

According to the earnings report, $PDD Holdings (PDD.US)$'s Q2 revenue was RMB 52.281 billion, a YoY increase of 66%, while operating profit was RMB 12.719 billion, a YoY increase of 46%. Adjusted net income was RMB 15.269 billion, a YoY increase of 42%. These figures exceeded...

Analysis

Price Target

No Data

No Data

每天都在學習中 : Bullish on Alibaba.$BABA-W (09988.HK)$ Buy around $90 on dips.