No Data

01055 CHINA SOUTH AIR

- 3.700

- +0.080+2.21%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

[Brokerage Focus] Citic sec expects that the 2025 Spring Festival travel season will be a touchstone for the aviation cycle.

Jingu financial news | Citic Securities stated that looking ahead to 2025, positive factors such as domestic line revenue management returning to normal, international hub construction, and aviation fuel cost reduction continue to accumulate. Unlike before, the traditional 'late-cycle' aviation cycle is expected to be brought forward. Reflecting on history, the firm believes that the biggest difference in this current upward cycle is that the industry has experienced five consecutive years of low aircraft introductions, with the introduction growth rate from 2020 to 2023 lower by 8.3 percentage points compared to 2010-2018 CAGR. From the perspectives of airlines, aircraft manufacturers, and operational leasing, the firm determines that the market has not fully reflected strong supply constraints. Comparison with 2014-15

[Brokerage Focus] jpmorgan: The decline in fuel costs alleviates the cost pressure on airlines in Hong Kong and mainland China.

King W Financial News | JPMorgan analyzed the development prospects of aviation companies in Hong Kong/China Mainland in its research report on the 28th. JPMorgan believes that the decrease in rbob gasoline costs will alleviate the main cost pressure of airlines, supporting the improvement in profit margins. The tight market supply is expected to improve revenue management, and airlines can optimize pricing strategies to deal with strong demand. In addition, the surge in goods hoarding and cross-border e-commerce business due to specific policies is expected to further boost demand, especially in the aviation cargo sector. China's expansion of the visa-free entry program is also a strategic move that will boost passenger traffic. Domestic airfare prices

Hong Kong stocks concept tracking | Hong Kong Civil Aviation Department invests 4.3 billion in Zhuhai Airport, institutions bullish on the long-term investment logic of the future aviation industry (with concept stocks)

On the 26th, the Airport Authority of Hong Kong signed a cooperation agreement on equity of Zhuhai Airport with Zhuhai Transport Holdings Group in Zhuhai.

[Brokerage Focus] UBS Group believes that domestic airlines will show the highest resilience in the future 2-3 years during the macroeconomic rebound.

Jingu News | The UBS Group research report pointed out that recently, the stock prices of China's aviation industry have been rising, mainly driven by improved investor sentiment. In particular, domestic investors have been significantly boosted by the decline in domestic airfare prices compared to the same period last year and the favorable outlook for aviation fuel prices in 2025. Additionally, Canada's lifting of restrictions on the number of direct flights from China and the news of China Southern Airlines planning to sell 10 B787-8 aircraft have further strengthened market confidence. The bank believes that in the next 2-3 years, if the fleet growth rate slows down, airlines may exhibit the highest elasticity during the macroeconomic rebound.

Sinolink Securities: Transportation sector policy expectations are positive, suggesting layout in aviation and logistics as the main themes for 2025.

Currently, the transportation sector has shown good fundamentals, recommended two investment mainlines for the transportation sector under the boost of domestic demand confidence in policies.

Hong Kong stock concept tracking | The passenger transportation volume on international routes in October has recovered to 96% of 2019 levels, with airline stock prices undergoing a major cyclical recovery (including concept stocks).

In October, the passenger transportation volume on international routes in our country recovered to 96% of that in 2019.

Comments

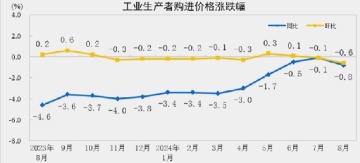

Month-on-Month Analysis:

PPI dropped by 0.7%, widening the decline by 0.5 percentage points compared to the previous month.

The prices of producer goods fell by 1.0%, with a 0.7 percentage point increase i...

$TENCENT (00700.HK)$ incremented 0.3% to $359.2 after China approved 75 imported online games, including Rainbow Six Siege agented by TENCENT.

As for other tech stocks, $BABA-W (09988.HK)$ closed the half-day flat ...

DBS: China Southern Airlines – Buy Target Price HK$4.50; RMB6.30 - Alpha Edge Investing

$CHINA SOUTH AIR (01055.HK)$ $China Southern Airlines (600029.SH)$

DBS: Optimism in the air for European and Asian airlines – Global Aviation – Airlines - Alpha Edge Investing

$Delta Air Lines (DAL.US)$ $CATHAY PAC AIR (00293.HK)$ $China Southern Airlines (600029.SH)$ $CHINA SOUTH AIR (01055.HK)$

Shifting Trends in Singles' Day E-Commerce Singles' Day, popularized by Alibaba more than a decade ago, has undergone changes in China's e-commerce landscape, with consumers turning to live video streaming platforms that provide a more engaging experience. During this year's Double 11 festival period, platforms su...

Analysis

Price Target

No Data

No Data

Dragon Fish : Bad news.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)