No Data

01088 CHINA SHENHUA

- 32.050

- -1.150-3.46%

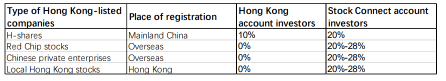

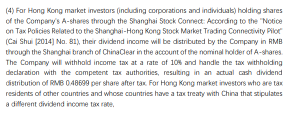

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

China Shenhua Energy Appoints New Executive Director

China Shenhua Energy (01088.HK) appointed Zhang Changyan as a member of the Global Strategy and Investment Committee, as well as a member and chairman of the Safety, Health, Eco-friendly Concept, and ESG Working Committee.

On December 20th, Gelonghui announced that China Shenhua Energy (01088.HK) has resolved to appoint Zhang Changyan as a member of the Global Strategy and Investment Committee, and as a member and chairman of the Safety, Health, Eco-friendly Concept, and ESG Working Committee. The term for the aforementioned committee member and chairman shall begin from the date of the Board of Directors' approval until the expiration of the sixth Board of Directors' term. Lv Zhiyuan will no longer serve as a member and chairman of the Board of Directors' Safety, Health, Eco-friendly Concept, and ESG Working Committee.

Coal Industrial Concept stocks are generally declining, China Coal Energy (01898) fell by 5.64%. Institutions indicate that at the current time, the high inventory of Thermal Coal still puts pressure on coal prices.

Jinwu Financial News | Coal Industrial Concept(coal Industry) sees widespread decline, SOUTHGOBI (01878) down 8.5%, HIDILI INDUSTRY (01393) down 7.58%, CHINA QINFA (00866) down 5.93%, China Coal Energy (01898) down 5.64%, China Shenhua Energy (01088) down 3.77%, MONGOL MINING (00975) down 3.66%, SHOUGANG RES (00639) down 3.15%, YANKUANG ENERGY (01171) down 2.91%, YANCOAL AUS (03668) down 2.67%. Sealand indicated that, at this moment, with high inventory of Thermal Coal, coal prices remain.

Hong Kong stocks are showing unusual movements | Coal Industrial Concept (coal Industry) stocks are dropping significantly due to high inventory and continued pressure from import levels, while the long-term advantages of their dividend attributes remain.

The Coal Industrial Concept (coal Industry) stocks are among the biggest decliners. As of the time of this report, SOUTHGOBI (01878) has fallen by 9.09%, trading at 3.1 HKD; CHINA QINFA (00866) is down by 5.93%, trading at 1.27 HKD; and China Coal Energy (01898) has declined by 5.11%, trading at 9.09 HKD.

Shanxi: Coal supply continues to recover in November, manufacturing investment maintains high growth.

From January to November 2024, the cumulative production of raw coal reached 4.322 billion tons, an increase of 1.20% year-on-year, with the growth rate declining compared to the same period in 2023. In November alone, the production of raw coal was 0.428 billion tons, an increase of 1.80% year-on-year, with the growth rate decreasing compared to the same month last year.

Ping An Securities Energy and Chemical 2025 strategy: Energy price reduction cycle, waiting for bottom reversal.

Traditional Energy is still in a price decline cycle, with supply expected to increase steadily by 2025. Demand recovery still requires waiting, and the overall fundamentals are relatively weak. The price center may continue to move downward, but the year-on-year decline is expected to narrow.

Comments

Cars: $LI AUTO-W (02015.HK)$ $GEELY AUTO (00175.HK)$ $BYD COMPANY (01211.HK)$

Conventional Electricity: $CHINA RES POWER (00836.HK)$ $HUANENG POWER (00902.HK)$ $CKI HOLDINGS (01038.HK)$

Shipping: $COSCO SHIP HOLD (01919.HK)$ $OOIL (00316.HK)$

Coal: $CHINA SHENHUA (01088.HK)$ $YANKUANG ENERGY (01171.HK)$ $YANCOAL AUS (03668.HK)$

Home Appliances: $MIDEA GROUP (00300.HK)$ $HAIER SMARTHOME (06690.HK)$ $HISENSE HA (00921.HK)$

Investment: $CITIC SEC (06030.HK)$ $CHINA CINDA (01359.HK)$

���������...

There was HKD351.6 million, HKD326.1 million and HKD160.6 million Southbound Trading net outflow from $MEITUAN-W (03690.HK)$ , $CHINA SHENHUA (01088.HK)$ and $CHINA MOBILE (00941.HK)$ .

For $SH->HK Connect (GangGuTong.HK)$ , $TENCENT (00700.HK)$ was the most active stock with ...

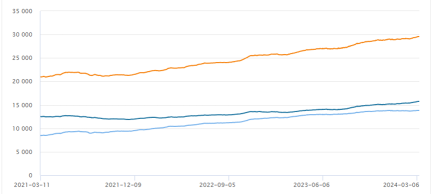

Southbound trading has been crucial in stabilizing Hong Kong’s stock market amid geopolitical risks.

BOCI expects strong demand from Mainland investors for Hong Kong stocks to continue due to attractive valuations and high dividend yields.

The volume of southbound trading is projected to grow from RMB289.4 billion in 2023 to RMB600 billion f...