No Data

01088 CHINA SHENHUA

- 34.700

- -0.400-1.14%

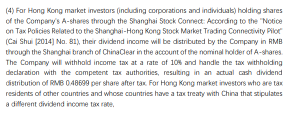

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Morgan Stanley: Maintains China Shenhua Energy 'Shareholding' rating, with the Target Price raised to 38 HKD.

Morgan Stanley has released a research report stating an 8.3% increase in the Target Price for China Shenhua Energy (01088) Listed in Hong Kong, from 35.1 HKD to 38 HKD, maintaining a "Shareholding" rating. Morgan Stanley has raised its forecast for China Shenhua's net profit in 2024 by 6.8%, mainly benefiting from aligning coal prices with the Qinhuangdao (QHD) coal spot price, which is set to rise to 732 RMB per ton, higher than the previous 710 RMB. It is expected that the average Qinhuangdao coal prices for 2025 and 2026 will be 710 and 680 RMB per ton, respectively, higher than the previous estimates of 680 and 660 RMB.

Morgan Stanley maintains a "Shareholding" rating for China Shenhua Energy (01088), with the Target Price raised to 38 Hong Kong dollars.

Morgan Stanley has raised its forecast for China Shenhua Energy's net profit in 2024 by 6.8%.

Coal prices have mostly retraced, with nan nan res (01229) falling by 4.76%. Institutions believe that next year's coal prices will have a bottom and will not fear marginal weakening of supply and demand.

Kingwu Financial News | Most of the coal prices have fallen back, with Nan Nan Res (01229) down 4.76%, Mongolia Energy (00276) down 3.03%, Yankuang Energy (01171) down 1.71%, SouthGobi (01878) down 1.56%, China Shenhua Energy (01088) down 0.88%. GTJA stated that looking ahead to 2025, 'stability' remains the key word for the coal industry, with coal prices having a bottom and marginal supply and demand slightly weakening. The bank determines that under the assumption of neutral policy expectations, the paper-based marginal supply and demand of coal will slightly weaken compared to 2024: the core incremental supply comes from Shanxi's production increase (approximately the same.

[Brokerage Focus] gtja: "Stability" will still be the keyword for the coal industry in 2025.

Jinwu Finance News | gtja stated that looking ahead to 2025, 'stability' remains the key word for the coal industry, with coal prices having a bottom and marginal supply and demand slightly weakening. The bank determines that under the assumption of neutral policy expectations, the paper-based marginal supply and demand of coal will slightly weaken compared to 2024: the core increase in supply comes from increased production in shanxi (an increase of approximately 70 million tons year-on-year), but the impact on actual sales is expected to be weaker than production data; on the demand side, the demand for thermal coal may still maintain a good growth of 2.5-3% amidst marginal weakening contributions from hydropower and new energy, while non-thermal coal, without considering policy impacts, may see continued decline in demand for steel and cement.

Hong Kong stock concept tracking | Coal prices continue to remain high, institutions are bullish on the coal sector's interest rate arbitrage trade (including concept stocks)

With the continuous implementation of repurchase, shareholding, refinancing, and other mmf tools such as SFISF, arbitrage trade is expected to continuously deepen the value of coal dividends.

Hong Kong stock unusual movement | Coal industrial concept strengthened during the trading session, institutions predict that the price of hot media will gradually recover by the end of the year, energy demand may remain high in the short term.

Coal stocks strengthened during the session. As of the time of this report, china coal energy (01898) rose 3.65%, reaching HK$9.65; china shenhua energy (01088) increased by 3.36%, reaching HK$33.8; southgobi (01878) went up 2.61%, reaching HK$3.93; china qinfa (00866) climbed 2.17%, reaching HK$1.41.

Comments

Cars: $LI AUTO-W (02015.HK)$ $GEELY AUTO (00175.HK)$ $BYD COMPANY (01211.HK)$

Conventional Electricity: $CHINA RES POWER (00836.HK)$ $HUANENG POWER (00902.HK)$ $CKI HOLDINGS (01038.HK)$

Shipping: $COSCO SHIP HOLD (01919.HK)$ $OOIL (00316.HK)$

Coal: $CHINA SHENHUA (01088.HK)$ $YANKUANG ENERGY (01171.HK)$ $YANCOAL AUS (03668.HK)$

Home Appliances: $MIDEA GROUP (00300.HK)$ $HAIER SMARTHOME (06690.HK)$ $HISENSE HA (00921.HK)$

Investment: $CITIC SEC (06030.HK)$ $CHINA CINDA (01359.HK)$

���������...

There was HKD351.6 million, HKD326.1 million and HKD160.6 million Southbound Trading net outflow from $MEITUAN-W (03690.HK)$ , $CHINA SHENHUA (01088.HK)$ and $CHINA MOBILE (00941.HK)$ .

For $SH->HK Connect (GangGuTong.HK)$ , $TENCENT (00700.HK)$ was the most active stock with ...

Southbound trading has been crucial in stabilizing Hong Kong’s stock market amid geopolitical risks.

BOCI expects strong demand from Mainland investors for Hong Kong stocks to continue due to attractive valuations and high dividend yields.

The volume of southbound trading is projected to grow from RMB289.4 billion in 2023 to RMB600 billion f...