No Data

01088 CHINA SHENHUA

- 32.500

- 0.0000.00%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

No Data

Trade Overview

Capital Trend

No Data

News

Shanxi Securities: Coal supply continued to rise in October, expecting domestic coal prices to remain at a certain high level in the winter.

Coal production safety in the production areas tends to be normalized, with an increase in coal supply, while Shanxi has resumed production recently, with the supply in October increasing month-on-month but slightly decreasing compared to the previous month.

A-share subscription | Cologne New Materials (920098.BJ) opens for subscription and has established cooperative relationships with top companies in the coal or coal machinery industry such as China Shenhua Energy.

On November 26, Kelon New Materials (920098.BJ) started its subscription.

JPMorgan Expands Energy-Transition Efforts to Add Coal Deals

Shanxi Securities: The coal long-term contract mechanism is progressing steadily, and the degree of marketization has increased somewhat.

Due to the continuation of the current medium to long-term contract benchmark price, and the market price of coal for electricity is still relatively high compared to the long-term contract price, the 2025 plan is beneficial to coal leading enterprises that have performed high-quality performance in the past.

gtja: The long-term fund allocation with a high dividend logic remains unchanged. The fundamentals of coal for 25 years still have relatively high certainty.

In 2025, without considering policy stimuli, the certainty of the fundamentals of coal may still remain at the forefront of all industries.

Citic sec: The long-term agreement policy in 2025 may have a positive impact on coal companies with a higher proportion of long-term agreements.

The overall change in the 2025 long-term coal contract framework is not significant, with the signing ratio requirements being adjusted downwards each year.

Comments

Cars: $LI AUTO-W (02015.HK)$ $GEELY AUTO (00175.HK)$ $BYD COMPANY (01211.HK)$

Conventional Electricity: $CHINA RES POWER (00836.HK)$ $HUANENG POWER (00902.HK)$ $CKI HOLDINGS (01038.HK)$

Shipping: $COSCO SHIP HOLD (01919.HK)$ $OOIL (00316.HK)$

Coal: $CHINA SHENHUA (01088.HK)$ $YANKUANG ENERGY (01171.HK)$ $YANCOAL AUS (03668.HK)$

Home Appliances: $MIDEA GROUP (00300.HK)$ $HAIER SMARTHOME (06690.HK)$ $HISENSE HA (00921.HK)$

Investment: $CITIC SEC (06030.HK)$ $CHINA CINDA (01359.HK)$

���������...

There was HKD351.6 million, HKD326.1 million and HKD160.6 million Southbound Trading net outflow from $MEITUAN-W (03690.HK)$ , $CHINA SHENHUA (01088.HK)$ and $CHINA MOBILE (00941.HK)$ .

For $SH->HK Connect (GangGuTong.HK)$ , $TENCENT (00700.HK)$ was the most active stock with ...

Southbound trading has been crucial in stabilizing Hong Kong’s stock market amid geopolitical risks.

BOCI expects strong demand from Mainland investors for Hong Kong stocks to continue due to attractive valuations and high dividend yields.

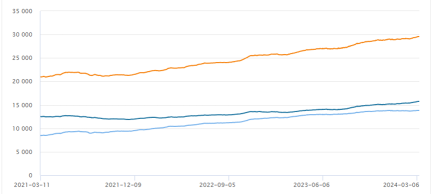

The volume of southbound trading is projected to grow from RMB289.4 billion in 2023 to RMB600 billion f...

Analysis

Price Target

No Data

No Data