No Data

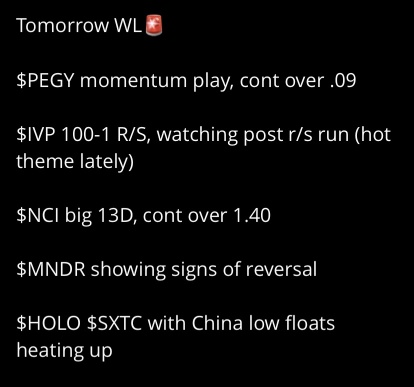

01336 NCI

- 25.850

- +0.550+2.17%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Investing over 2 billion again! Zhongbao Investment, along with New China Life Insurance and others, establishes a new Fund as integrated circuit investment transforms from a "marathon" into a "relay race."

① Shanghai has become one of the centers of the integrated circuit industry in China, with significant contributions from insurance capital; ② China Insurance Investment and others have established a Fund, investing over 2 billion to take shares in the Shanghai integrated circuit Fund; ③ The advanced manufacturing industry, which is highly capital and technology-intensive, requires "live water" from insurance financial capital.

Hong Kong stocks are showing unusual activity | Mainland Insurance Companies collectively declined as Institutions state that the third quarter performance exceeded expectations or has already been realized, and market concerns are focused on long-term in

Mainland Insurance Companies collectively declined. As of the time of writing, China Pacific Insurance (02601) fell by 3.98% to 25.35 Hong Kong dollars; New China Life Insurance (01336) decreased by 2.68% to 25.45 Hong Kong dollars; China Life Insurance (02628) dropped by 1.53% to 15.46 Hong Kong dollars; PICC P&C (02328) declined by 0.49% to 12.1 Hong Kong dollars.

HAITONG SEC (06837.HK) received a Shareholding increase of 3.326 million shares from New China Life Insurance.

On December 11, according to the latest equity disclosure data from the Hong Kong Stock Exchange, on December 5, 2024, HAITONG SEC (06837.HK) was increased by New China Life Insurance Company Ltd. by 3.326 million shares at an average price of HK$7.0956 per share, involving about HK$23.6 million. After the shareholding, New China Life Insurance Company Ltd.'s latest number of shares held is 206,326,000 shares, with the shareholding ratio rising from 5.95%.

New China Life Insurance Announces Key Secretary Change

New China Life Insurance (01336.HK) has nominated Mao Sixue and Zhuozhi as candidates for director.

Gelonghui reported on December 9 that new china life insurance (01336.HK) announced that at the 27th meeting of the 8th board of directors held on December 9, 2024, the proposals for "nominating Ms. Mao Sixue as a candidate for non-executive director of the 8th board of directors" and "nominating Mr. Zhuozhi as a candidate for independent non-executive director of the 8th board of directors" were reviewed and approved, agreeing to nominate Mao Sixue as a candidate for non-executive director and Zhuozhi as a candidate for independent non-executive director of the 8th board of directors. The above proposals must be reviewed by the company’s shareholder meeting. After approval by the shareholder meeting, Mao Sixue and Zhuozhi's

December 9 Insurance Daily | The country's first self-regulatory rules for the "insurance + futures" industry have been released, and the goals for the property and casualty insurance industry over the next five years are clear and specific!

The first domestic self-regulatory rules for the "insurance + futures" industry have been released. The China Futures Industry Association officially published the "Futures Company 'Insurance + Futures' Business Rules (Trial)" today. This rule is the first self-regulatory normative document in the field of "insurance + futures" business. From the content, the rule revolves around the main line of strong regulation, risk prevention, and promoting high-quality development, adhering to problem orientation and clarifying various prohibited behaviors in the futures company's "insurance + futures" business. The rule also specifies the self-regulatory inspection mechanism for the business and proposes specific handling measures for the violations of futures operating institutions. (Financial Frontline) Strong regulation, risk prevention, and promoting reform.

Comments

📊⚡️📊