No Data

01336 NCI

- 27.900

- -0.100-0.36%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

NCI and Harmonic Join Forces to Make Captioning Easier Than Ever

Minsheng Securities' forecast for the first quarter report in the Insurance Industry: Life insurance profits are expected to diverge while property insurance is likely to achieve stable growth.

The current valuation of the Insurance Sector remains relatively low. The recent rebound in long-term interest rates is expected to alleviate the bond allocation pressure on insurance companies, while the continuous Inflow of funds into the Hong Kong stock market is also likely to continue boosting the valuation performance of Listed in Hong Kong insurance.

Insurance capital is about to "operate" Gold! Four major insurance capital giants have been approved to become members of the Shanghai Gold Exchange.

Insurance funds broaden the channels for risk avoidance.

Hong Kong stocks closed (03.20) | The Hang Seng Index fell by 2.23%, while some Autos stocks rose against the trend. Technology, Mainland Insurance Companies, and others faced significant pressure.

The Federal Reserve keeps interest rates unchanged, with expectations of two rate cuts this year. The three major Hong Kong stock indices collectively fell today, with the Hang Seng Index and the Chinese Enterprises Index dropping over 2%, and the Hang Seng Tech Index plummeting more than 3%.

Hong Kong stocks movement | Mainland Insurance Companies dropped across the board, government bond Futures expanded their afternoon gains. Institutions claim that the subsequent performance of insurance companies on the liability side may show significant

Mainland Insurance Companies fell across the board. As of the time of writing, New China Life Insurance (01336) dropped by 6.91%, trading at 28.95 HKD; China Pacific Insurance (02601) decreased by 5.51%, trading at 24.85 HKD; China Life Insurance (02628) fell by 5.42%, trading at 16.06 HKD; The People's Insurance (01339) declined by 4.85%, trading at 4.32 HKD.

March 20 Insurance Daily丨Insurance funds have "lifted the ban" on 5 Banks this year, the good start sees the reappearance of the "short to medium duration products" phenomenon, and eight insurance intermediaries are queuing for an IPO.

This year, insurance funds have "lifted the ban" on 5 banks. Besides the dividend yield, what other considerations exist? Since the beginning of this year, 5 banks have been targeted by insurance funds. Experts say that due to the premium status of bank AH Stocks, the dividend yield of state-owned large banks' H Shares is higher than that of the corresponding A Shares, and a higher dividend yield means more substantial returns. For insurance funds pursuing stable Cash / Money Market cash flow, this undoubtedly has enormous appeal. Moreover, from a long-term investment perspective, stable and considerable dividend income can provide insurance companies with continuous Inflow, better matching the compensation needs of the insurance Business and the fund utilization plans. (Daily Economic News)

Comments

...

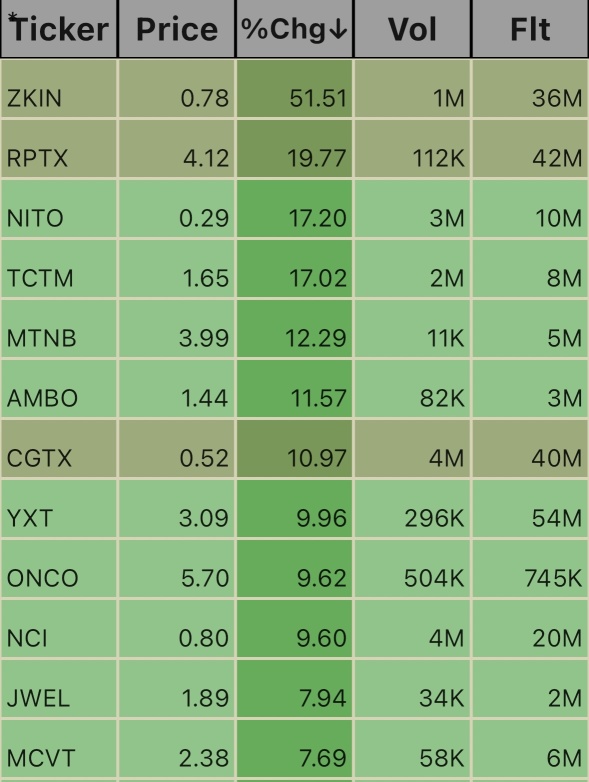

📊⚡️📊

Unlock the Full List

72576952 : no more yout table on the stock Why???

Stock_Drift OP 72576952 : Come again?

72576952 : For long time ago tou have posted som picture which many stock on the table. wchich colors and volume