No Data

01378 CHINAHONGQIAO

- 11.600

- +0.020+0.17%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Aluminum prices soar! Japanese buyers are paying record premiums as global supply risks intensify.

Some Aluminum buyers in Japan have agreed to pay a significantly higher premium to a Global producer this quarter, marking the fourth consecutive quarter of rising Aluminum prices.

Hong Kong stocks are moving differently | Nonferrous Metals stocks are collectively rising, positive policy signals boost expectations, industrial Nonferrous Metals Consumer is expected to improve.

Nonferrous Metals stocks rose collectively. As of the time of publication, Aluminum Corporation Of China (02600) increased by 3.39% to 4.88 HKD; CMOC Group Limited (03993) rose by 3.13% to 5.94 HKD; Zijin Mining Group (02899) grew by 2.84% to 15.92 HKD; CHINAHONGQIAO (01378) climbed by 2.64% to 12.42 HKD.

Hong Kong stocks movement | chinahongqiao (01378) closed up nearly 6%, the profit recovery point for electrolytic aluminum is approaching, institutions suggest paying attention to companies with net buy exposure of aluminum oxide.

chinahongqiao (01378) closed up nearly 6%, as of the time of writing, up 5.76%, priced at 12.48 Hong Kong dollars, with a trading volume of 0.402 billion Hong Kong dollars.

China securities co.,ltd.: Electrolytic aluminum profit recovery turning point is approaching, focusing on companies with net buy exposure to alumina.

The inflection point of aluminum oxide prices is turning downwards, with excellent supply and demand for electrolytic aluminum, which can fully benefit from the profit recovery brought by the decline in aluminum oxide prices, focusing on companies with a net buy exposure to aluminum oxide.

Aluminum stocks have collectively risen, with rusal (00486) up 3.53%. Institutions indicate that the peak impact of the real estate industry on aluminum demand has passed.

Jinwu Finance News | Aluminum stocks have risen collectively, with Rusal (00486) up 3.53%, aluminum corporation of china (02600) up 2.38%, and chinahongqiao (01378) up 1.76%. Guosen's research reports indicate that aluminum alloy materials have balanced performance, and their large-scale application has been relatively late, with new application areas constantly being explored, leading to a demand potential that was once underestimated. The bank believes that the peak impact of the real estate industry on aluminum demand has passed, and it will trend toward stability in the future; the substitution of aluminum for copper, steel, and wood is still on the rise, and there is significant potential for per capita aluminum consumption in developing countries, meaning there is still substantial growth space for aluminum demand.

Huafu Securities: Tight supply at the ore end, downstream demand for electrolytic aluminum is resilient. Prices of alumina and electrolytic aluminum resonate.

With the peak season and expectations of the Federal Reserve's interest rate cuts and a soft landing strengthening, an increase in aluminum prices can be anticipated.

Comments

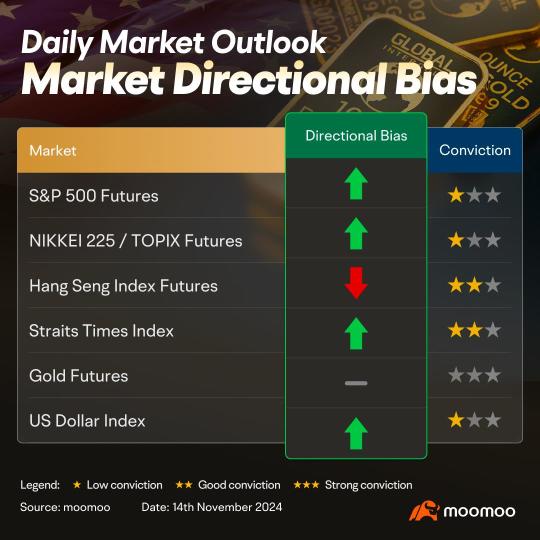

$E-mini S&P 500 Futures(MAR5) (ESmain.US)$ (4 Hour Chart) -[NEUTRAL]We maintain neutral with a slight bullish bias as price is currently hovering around 5955 resistance level. A 4 hour candlestick closing above 5955 resistance level would open push towards 6035 resistance level. Technical indicators are mixed for now, with price holding above 21-EMA.

Alternatively: A 4 hour candlestick closing below 5880 support level...

Coterra Energy Inc (CTRA US) $Coterra Energy (CTRA.US)$

Daily Chart -[BULLISH ↗ **]CTRA US pushed higher after shaping a bullish breakout. As long as price is holding above 25.20 support, a further push higher towards 26.95 resistance is expected. Technical indicators are advocating for a bullish scenario as well with bullish momentum building and MA golden cross is seen.

Alternatively: A daily candlestick closing below 25.20...

$E-mini S&P 500 Futures(MAR5) (ESmain.US)$ (4 Hour Chart) -[BULLISH↗ *]We continue to stay bullish as price is holding above 6000 support level. We expect the price to push towards 6050 resistance level. Technical indicators are leaning towards a bullish scenario.

Alternatively: A 4 hour candlestick closing below 6000 support level would open next drop towards 5940 support level.

$USD (USDindex.FX)$(4 Hour Ch...

Policymakers plan to increase gold inventory facilities and accelerate the development of related businesses, such as trading, insurance and logistics, according to Chan. The city’s government will also expand gold-related derivatives trading to satisfy mortgage and hedging needs.

$CHOW TAI FOOK JEWE (CJEWY.US)$ $CHOW TAI FOOK (01929.HK)$ $CHOW SANG SANG (00116.HK)$ $ZIJIN MINING (02899.HK)$ $MMG (01208.HK)$ $CHINAHONGQIAO (01378.HK)$ $CHINA TOWER (00788.HK)$ $Golden Minerals (AUMN.US)$ $DB GOLD DOUBLE LONG EXCH TRADED NOTES (DGP.US)$

No Data

103677010 : notes