No Data

01698 TME-SW

- 46.150

- -0.850-1.81%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

U.S. stocks close: The Nasdaq returns above 0.02 million points as Apple reaches a new high with a market cap of 3.9 trillion.

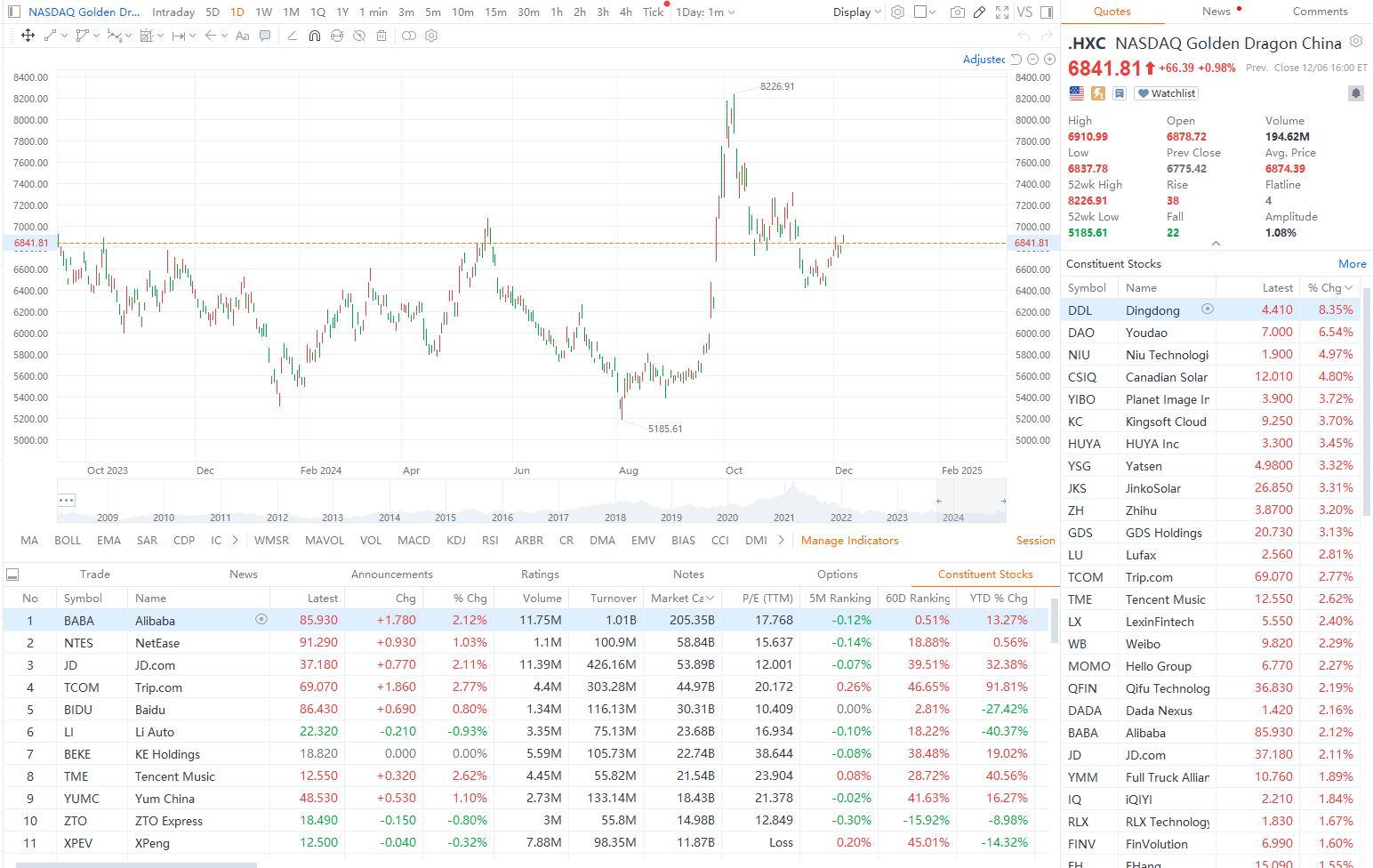

① Tesla rose by 7.36%, leading the "Seven Giants"; ② Nasdaq China Golden Dragon Index has risen for three consecutive days; ③ American Airlines announced that flights have resumed running; ④ OpenAI has discussed developing a humanoid Siasun Robot&Automation.

Hong Kong stock market news for December 24: The three major US Indexes closed higher. HKEX has a half-day trading session due to Christmas.

① Consumer confidence in the USA has declined for the first time in three months. ② The three major US stock indices collectively closed higher on Monday, with most China Concept Stocks showing strength. ③ Musk criticized the Federal Reserve, claiming there are absurdly many employees under Powell. ④ The NASDAQ 100 Index is rebalanced, with the weight of Tesla, Meta, and Broadcom decreasing. ⑤ HKEX will have a half-day Trade session on Christmas Eve.

Hong Kong stock market morning report on December 23: Biden signed a bill to prevent the USA government from "shutting down". The performance of China Concept Stocks shows divergence.

① Biden signed an emergency funding bill to prevent a "shutdown" of the USA government. ② The USA's November core PCE price index rose 2.8% year-on-year, which was lower than expected. ③ The three major stock indexes in the USA opened lower and closed higher last Friday, while China Concept Stocks showed mixed performance. ④ NYMEX Henry Hub Natural Gas Futures rose more than 14% last week. ⑤ Federal Reserve's Goolsbee stated that interest rates may decline within 12 to 18 months.

Zhao Silver International: Remains Bullish on Internet Plus-Related platform economy, prefers MEITUAN-W and others.

CMB International released a research report stating that the preference for sub-sectors of the Internet Industry is local life services → advertising → games = value-added services → e-commerce → cloud → live streaming. The top picks are MEITUAN-W (03690), TENCENT (00700), Tencent Music (TME.US), and Alibaba (BABA.US). The report indicates that leading platform Internet companies continue to maintain business resilience, benefiting from ongoing cost-cutting and efficiency improvements, healthy profit growth, and stable shareholder returns. The current industry valuation is at a low point, highly defensive, and potential profit upward factors next year come from macro policy stimulation, overseas expansion opportunities, and progress in AI business.

Trending Industry Today: Coinbase Leads Losses In Non-Fungible Tokens Stocks

Pu Yin International: Online music has become an important growth driver in the music market, with the platform's bargaining power gradually increasing.

The increase in penetration rates, subscription fee hikes, and expansion of content beyond music will drive the long-term growth of music streaming platforms in the future.

Comments

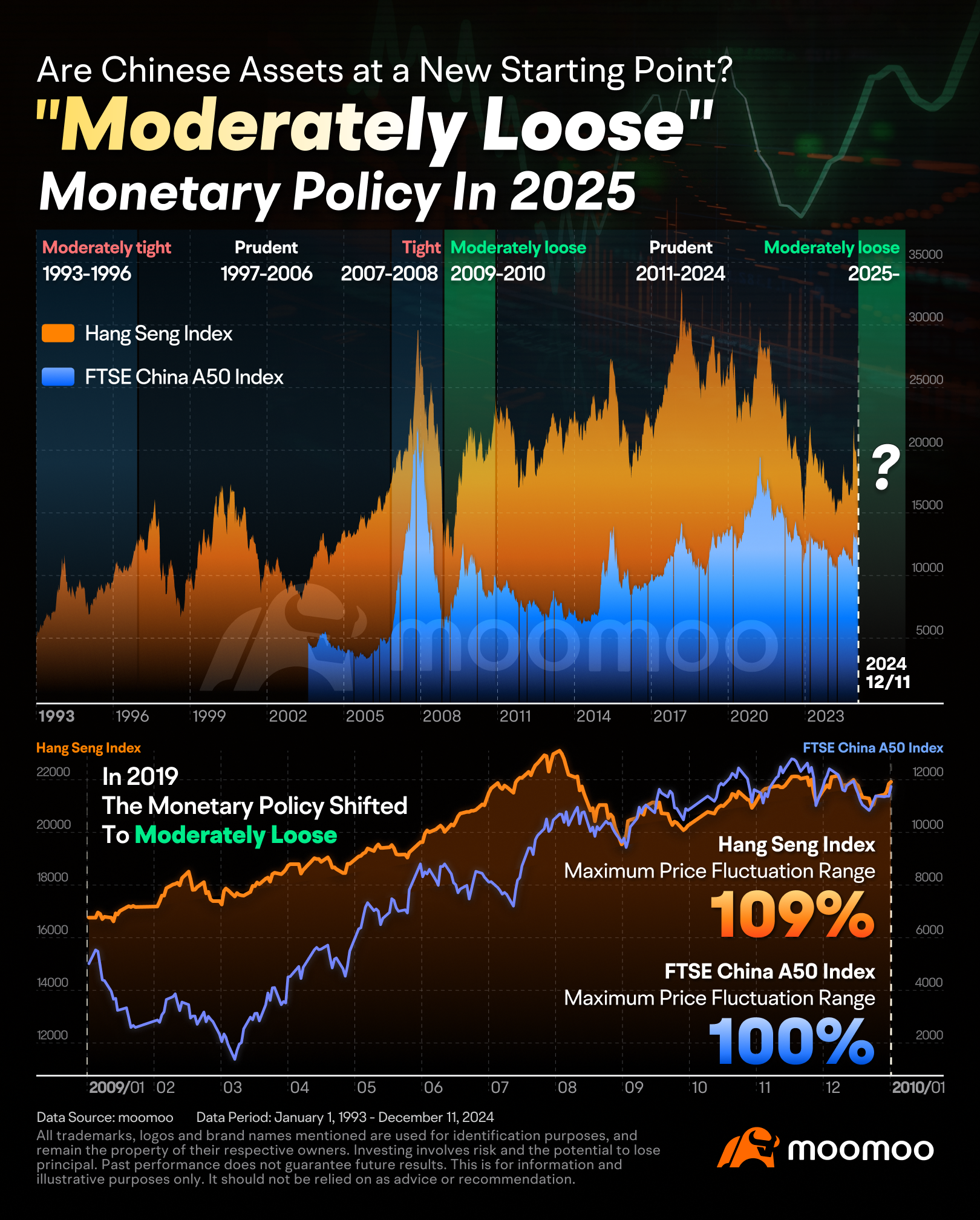

What does the Central Economic Work Conference discuss?

The conference typically comprises two main components: evaluating the...

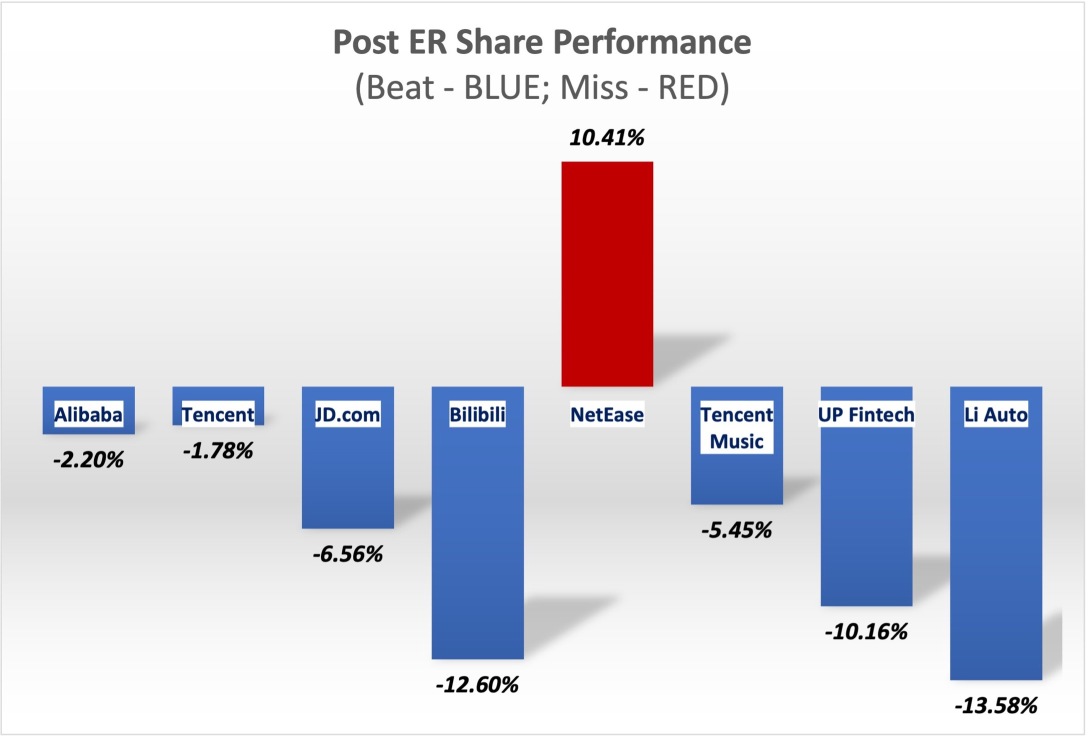

You could have made a lot of money with put options. 😂

$TENCENT (00700.HK)$ $Tencent (TCEHY.US)$ $BABA-W (09988.HK)$ $Alibaba (BABA.US)$ $JD.com (JD.US)$ $JD-SW (09618.HK)$ $BILIBILI-W (09626.HK)$ $Bilibili (BILI.US)$ $NTES-S (09999.HK)$ $NetEase (NTES.US)$ $Li Auto (LI.US)$ $LI AUTO-W (02015.HK)$ $Tencent Music (TME.US)$ $TME-SW (01698.HK)$ $UP Fintech (TIGR.US)$