No Data

01772 GANFENGLITHIUM

- 24.200

- -0.900-3.59%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Central China: Performance in the lithium battery industry will continue to improve in 2025, focus on four main lines.

Overall, it is expected that the sector's performance will be under pressure in 2024, and the sector's performance will recover and grow in 2025, but the differentiation will intensify.

HK Stock Market News | Lithium prices have been falling recently. tianqi lithium corporation (09696) fell by more than 5%, ganfenglithium (01772) is now down by more than 3%.

Lithium stocks fell in the afternoon. As of the time of publication, tianqi lithium corporation (09696) dropped by 5.11% to HK$26; ganfenglithium (01772) fell by 3.39% to HK$24.25.

China Securities Co.,Ltd.: Lithium production in December is expected to remain stable on a month-on-month basis, and lithium prices still have support.

The demand for industrial and commercial energy storage overseas is good, and the energy storage orders in December are still adequate, so the production in December is expected to remain stable month-on-month, with lithium prices still being supported.

[Brokerage Focus] Citigroup: contemporary amperex technology (300750) market share increases, and supply in china is expected to grow by about 5% year-on-year in 2025.

Kingnews | Citigroup recently released two research reports on Chinese auto manufacturers, analyzing the latest trends in the new energy vehicle (NEV) market and the development trends of the battery industry. The reports cover multiple dimensions such as battery installation volume, market share changes, lithium compound price fluctuations, providing investors with a comprehensive industry perspective. One of the reports pointed out that Contemporary Amperex Technology (CATL) saw a 1.1 percentage point monthly increase in market share in the battery market, mainly due to the sales growth of Tesla, Geely, and Chang'an. Meanwhile, BYD's market share

Hong Kong Stock Concept Tracking | Downstream demand boosts, the lithium battery sector's bottom is gradually becoming clear (with related stocks attached).

Capacity utilization rate is rebounding, the inflection point of the lithium iron phosphate industry may appear.

ganfenglithium (01772.HK) was subject to a shareholding reduction of 2.0139 million shares by jpmorgan.

On November 28, according to the latest equity disclosure information from the Hong Kong Stock Exchange, on November 22, 2024, ganfenglithium (01772.HK) was partially sold by JPMorgan Chase & Co. at an average price of HKD 24.641 per share, totaling approximately HKD 49.6234 million for 2.0139 million shares. After the shareholding reduction, JPMorgan Chase & Co.'s latest number of shares held is 35,305,533, and the shareholding ratio decreased from 9.24% to 8.74%.

Comments

Fueled by aggressive economic stimulus package, an amazing run-up occurred in China equities ahead of PRC National Day. The streak continued when the market reopened after a one-week break.

On October 8th, 4,976 stocks opened up by 9% or more; only 5 stocks opened down. All in all, benchmark index CSI300 posted a 32% gain in SIX trading DAYs.

The amount of time taken for the US market to rebound 3...

If you are a patient investor and like the idea of being invested in Australia's biggest lithium company who continues...

For resource stocks, $CHALCO (02600.HK)$ declined 3.6%, while $GANFENGLITHIUM (01772.HK)$ and $TIANQI LITHIUM (09696.HK)$ crumple...

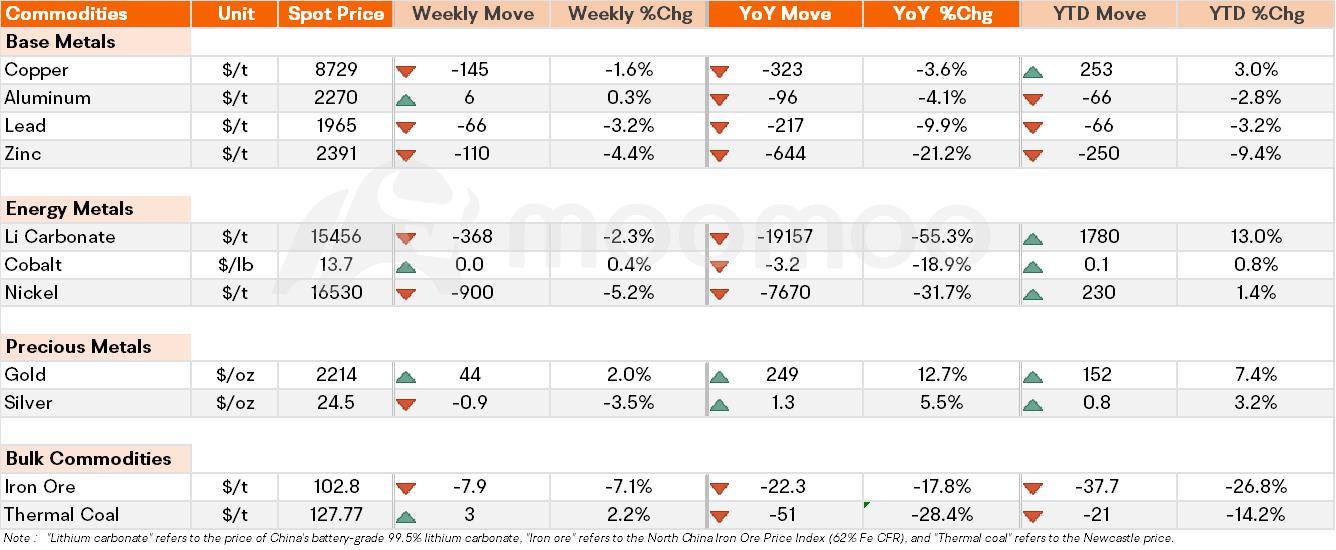

Spot Price Snapshot

Key Price Moves

Gold: On Thursday, the price of gold reached an all-time high and experienced its strongest month in more than three years due to high demand for safe-haven assets and expectati...