No Data

01772 GANFENGLITHIUM

- 24.500

- +0.700+2.94%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Citic Sec: Overseas lithium mines expand production cuts, industry mergers and acquisitions accelerate.

The acceleration of industry mergers and acquisitions is an important sign in the mining industry's downward cycle, indicating that the industry is becoming optimistic about the future lithium prices and that the market generally recognizes that current lithium prices are at the bottom range, with limited expected further downward space.

Solid state batteries accelerate the reshaping of the lithium battery industry chain, eVTOL manufacturers call for breakthroughs in materials end | Focus on.

1. The contact mode between the solid state battery electrolyte and the active material has changed from solid-liquid contact to solid-solid contact, leading to a series of changes, including the attention to dry process technology and the corresponding equipment manufacturers are also iterating; 2. Solid-state batteries still face challenges in terms of cost and mass production; 3. The application end of eVTOL in the emerging industry xinxingchanye has attracted attention, with ehang believing that the current battery material end is still the bottleneck.

The Battery Film Special Committee advocates: resist "involutionary" vicious competition. Listed companies respond: prices will definitely return to rational levels in the future.

① The Battery Film Specialized Committee of the China Plastics Processing Industry Association advocates that the battery separator industry should not engage in price wars or market share disputes; ② Shenzhen Senior Technology Material stated that currently many small manufacturers are selling at a loss, and prices will definitely return to a more rational state in the future.

Express News | JPMorgan Chase & Co's Long Position in H-Shares of Ganfeng Lithium Increases to 9.79% on Nov 20 From 9.10% - HKEX

ganfenglithium (002460.SZ): The developed 320Wh/kg and 400Wh/kg high energy density battery is actively being connected with downstream customers for applications in related fields.

Ganfeng Lithium (002460.SZ) stated at the investor relations event on November 26th that the low-altitude economy currently shows enormous potential for development, covering multiple areas such as general aviation, drone logistics, and also demanding high requirements for batteries. The company's research and development of 320Wh/kg and 400Wh/kg high specific energy batteries are actively being integrated into relevant applications with downstream customers.

HK stock anomaly | Lithium prices may continue to fluctuate next year. Ganfeng Lithium (01772) fell more than 6%, tianqi lithium corporation (09696) fell nearly 4%.

Lithium stocks dropped in the afternoon. As of the time of writing, ganfenglithium (01772) fell by 5.95%, trading at 23.7 Hong Kong dollars; tianqi lithium corporation (09696) fell by 3.96%, trading at 26.7 Hong Kong dollars.

Comments

Fueled by aggressive economic stimulus package, an amazing run-up occurred in China equities ahead of PRC National Day. The streak continued when the market reopened after a one-week break.

On October 8th, 4,976 stocks opened up by 9% or more; only 5 stocks opened down. All in all, benchmark index CSI300 posted a 32% gain in SIX trading DAYs.

The amount of time taken for the US market to rebound 3...

If you are a patient investor and like the idea of being invested in Australia's biggest lithium company who continues...

For resource stocks, $CHALCO (02600.HK)$ declined 3.6%, while $GANFENGLITHIUM (01772.HK)$ and $TIANQI LITHIUM (09696.HK)$ crumple...

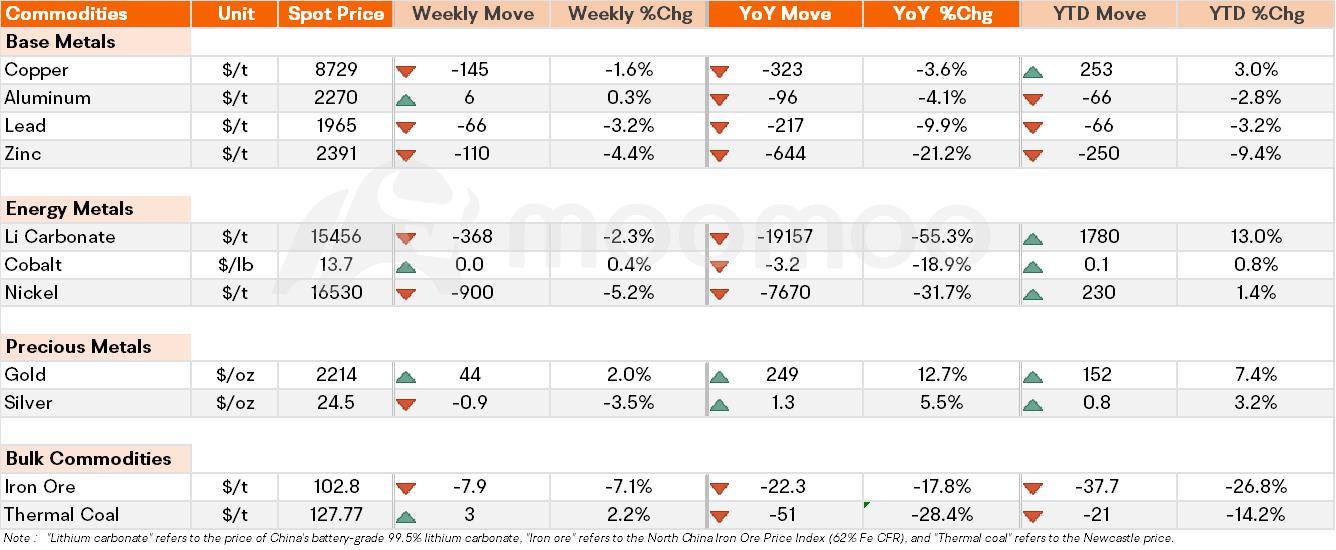

Spot Price Snapshot

Key Price Moves

Gold: On Thursday, the price of gold reached an all-time high and experienced its strongest month in more than three years due to high demand for safe-haven assets and expectati...

Analysis

Price Target

No Data

No Data