No Data

01772 GANFENGLITHIUM

- 21.650

- -0.950-4.20%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Express News | Ganfeng Says Goulamina Project's Annual Production Amounts to 506,000 Tonnes of Lithium Concentrate in 1St Phase, 1 Mln Tonnes in 2Nd Phase

Express News | Ganfeng Lithium Announces Official Commissioning of 1St Phase of Goulamina Spodumene Project in Africa

GANFENGLITHIUM (002460.SZ): The high specific energy battery developed by the company in Solid State Battery technology achieves an energy density of 420Wh/kg.

On December 13, Glonghui reported that GANFENGLITHIUM (002460.SZ) stated on its investor interaction platform that the high energy density battery developed in the Solid State Battery field achieves an energy density of 420Wh/kg and a cycle life of over 700 times, and has also developed a sample with an energy density of 500Wh/kg, which can withstand stringent safety tests such as a 200°C thermal box and puncture.

GANFENGLITHIUM (002460.SZ): The third generation Solid State Battery will consider using a sulfide route.

On December 13, Gelonghui reported that GANFENGLITHIUM (002460.SZ) stated on the investor interaction platform that the company's current first-generation and second-generation solid-liquid hybrid batteries adopt the oxide route, and the third generation Solid State Battery will consider using the sulfide route.

Hong Kong stocks fluctuation | The decline of Nonferrous Metals stocks has expanded as the rising dollar pressures the Nonferrous Metals Industry, entering a high volatility phase.

The decline in non-ferrous stocks has widened. As of this report, LINGBAO GOLD (03330) is down 5.42% at 2.79 HKD; GANFENGLITHIUM (01776) is down 4.42% at 21.6 HKD; CMOC Group Limited (03993) is down 4.26% at 5.62 HKD.

Lithium stocks are under pressure, GANFENGLITHIUM (01772) fell by 4.65%, and Institutions indicate that lithium prices may be difficult to maintain recent highs.

Jingu Financial News | Lithium stocks are under pressure, as of the time of publication, GANFENGLITHIUM (01772) is down 4.65% and Tianqi Lithium Corporation (09696) is down 3.21%. In terms of news, Daiwa Capital Markets stated in a research report to clients that the Global lithium supply is expected to grow by 12-28% from 2025 to 2026 due to increased production in key regions such as Argentina, Australia, and Africa. However, the team warned that due to oversupply, lithium prices may still face pressure. Currently, China's LCE (lithium carbonate

Comments

Fueled by aggressive economic stimulus package, an amazing run-up occurred in China equities ahead of PRC National Day. The streak continued when the market reopened after a one-week break.

On October 8th, 4,976 stocks opened up by 9% or more; only 5 stocks opened down. All in all, benchmark index CSI300 posted a 32% gain in SIX trading DAYs.

The amount of time taken for the US market to rebound 3...

If you are a patient investor and like the idea of being invested in Australia's biggest lithium company who continues...

For resource stocks, $CHALCO (02600.HK)$ declined 3.6%, while $GANFENGLITHIUM (01772.HK)$ and $TIANQI LITHIUM (09696.HK)$ crumple...

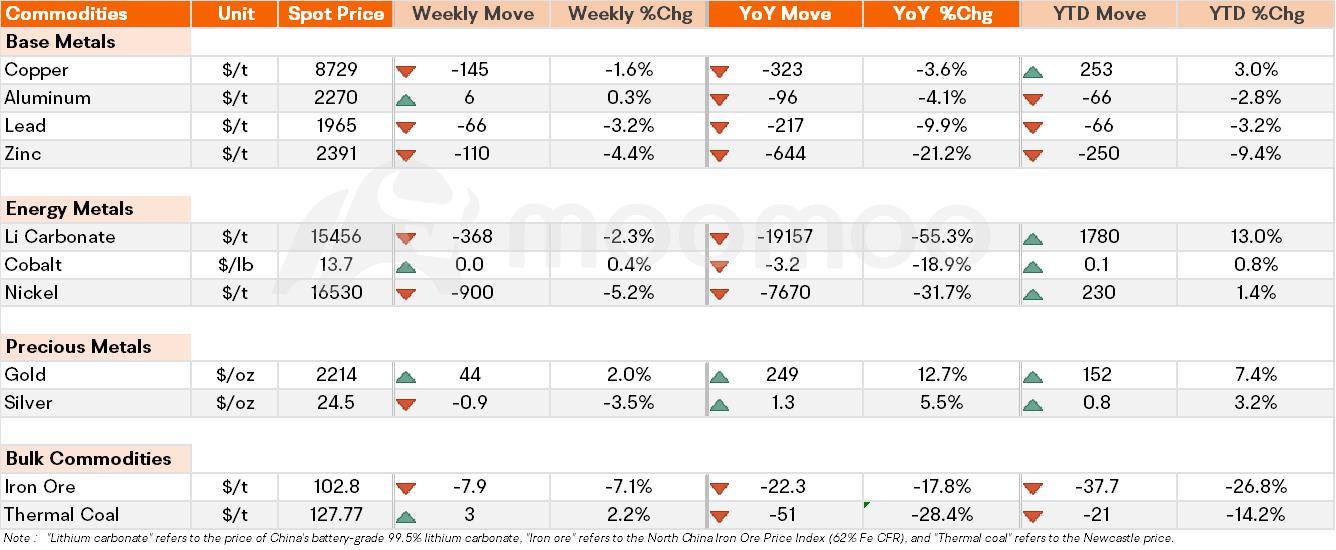

Spot Price Snapshot

Key Price Moves

Gold: On Thursday, the price of gold reached an all-time high and experienced its strongest month in more than three years due to high demand for safe-haven assets and expectati...

No Data