No Data

01798 DATANG RENEW

- 2.030

- 0.0000.00%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

No Data

Trade Overview

Capital Trend

No Data

News

DATANG RENEW (01798.HK): Zhu Mei resigns as Non-executive Director.

Gelonghui, December 10, announced that Mrs. Zhu Mei has proposed to resign from her position as a non-executive director of DATANG RENEW and a member of the Board of Directors' Compensation and Assessment Committee, effective from December 10, 2024.

China Datang Corp. Renewable Power Issues 1.3 Billion Yuan Debentures

Datang Renew (01798.HK) has completed the issuance of 1.3 billion yuan in ultra-short-term financing bonds.

On December 5th, GeLongHui reported that Datang Renew (01798.HK) announced that the company completed the issuance of the third batch of ultra-short-term financing bonds for the year 2024 on December 3, 2024. The total amount of this issuance is 1.3 billion yuan, with a maturity period of 79 days (maturity date is February 21, 2025). The face value is 100 yuan, the interest rate is 1.87%, and interest starts accruing from December 4, 2024. The proceeds from this issuance will be used for the repayment of existing interest-bearing debts, supplemental working capital, and other legal and compliant purposes.

Datang Renewable to Redeem 2 Billion Yuan of 3.52% Bonds in January

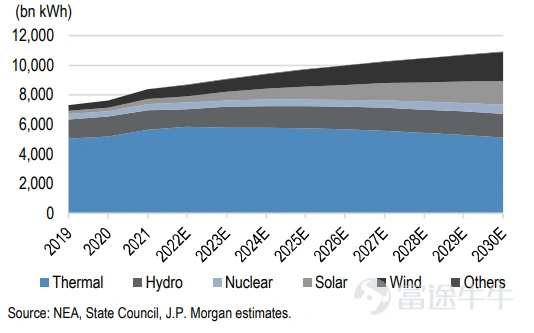

Citic Securities: The construction of a new electrical utilities system promotes the sustainable development of the power grid. It is expected that the investment growth rate of the power grid in 2025 will maintain double-digit growth.

In 2025, electrical utilities construction will continue to focus on the long-term requirements of "dual carbon" transformation and the construction of new power systems, continuing the trend of balancing the main grid and the distribution side of electrical utilities.

China Securities Co., Ltd. Power Equipment New Energy Fund 25-year investment strategy: grasp three types of assets, energy storage dominates the whole year.

china securities co.,ltd. is most bullish on energy storage in the new energy fund sector of the power equipment sector.

Comments

China Datang Corporation Renewable Power's (HKG:1798) Earnings Growth Rate Lags the 13% CAGR Delivered to Shareholders

China Datang Corporation Renewable Power's (HKG:1798) Earnings Growth Rate Lags the 13% CAGR Delivered to Shareholders

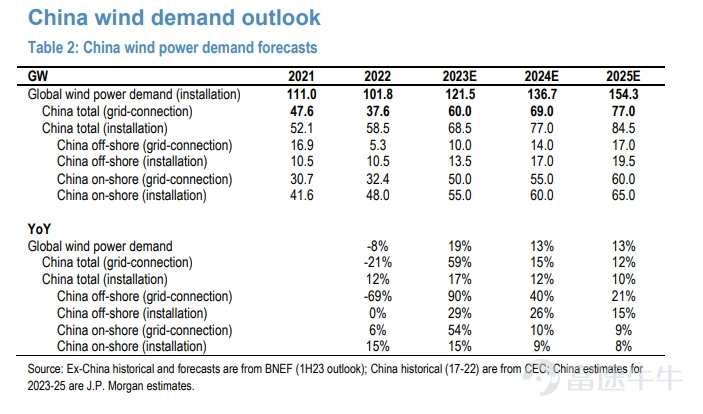

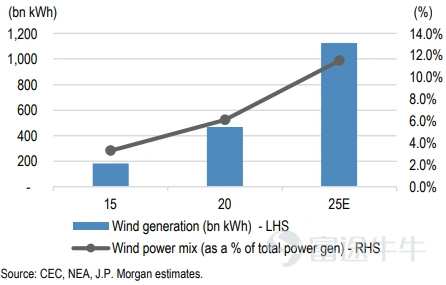

1. The demand for wind power continues to grow. Longyuan and Datang New Energy will achieve 20-25% profit growth in the first half of 2023, which is basically in line with market expectations.

2. Hydropower is less affected by the weather than expected. In the long run, the weak second quarter performance may provide an entry point for hydropower operators.

3. The construction of nuclear power units is accele...

1. Strong 1Q23 results driven by higher generation and lower financing costs.

During 1Q23, Datang Renewable (DTR, or the "Company") recorded total power generation of 8,736 GWh (+24.7% yoy), among which wind generation was 8,209 GWh (+22.7% yoy) and solar generation was 527 GWh (+68.6% yoy). The higher generation in 1Q23 was primarily due to better...