No Data

01799 XINTE ENERGY

- 5.790

- -0.150-2.53%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Germany increases fiscal spending to promote Energy transition, and China’s solar storage sector welcomes new investment opportunities abroad.

Recently, the German Federal Parliament passed a spending bill worth 500 billion euros with more than two-thirds of the votes. The bill proposes that 100 billion euros be injected into the existing climate and transformation Fund to support the Energy transition and climate protection. The Soochow securities electric new team pointed out that as Germany increases financial support for Energy transition development, the installed capacity of photovoltaic and energy storage is expected to accelerate growth at a turning point, and the demand for Power Inverter exports is expected to benefit.

XINTE ENERGY (01799.HK) plans to hold a Board of Directors meeting on March 31 to approve the annual performance.

Gelonghui, March 20 - XINTE ENERGY (01799.HK) announced that the Board of Directors meeting will be held on March 31, 2025 (Monday) to review and approve the annual performance and its release for the financial year ending December 31, 2024, and to consider the payment of the final dividend (if any).

XINTE ENERGY: NOTICE OF BOARD MEETING

Cailian Press Venture Capital: In February, the financing in the Carbon Neutrality sector reached 1.835 billion yuan, an increase of 13.98% month-on-month. New Stoneware completed 1 billion yuan in Series C+ financing.

According to data from the financial news agency Venture Capital Tong, in February, there were a total of 52 private equity investment events in the Carbon Neutrality sector, a decrease of 24.64% compared to last month's 69 events; The total disclosed financing amount was approximately 1.835 billion yuan, an increase of 13.98% compared to last month's 1.61 billion yuan.

XINTE ENERGY (01799.HK): Kong Ying resigned as Executive Director.

Glory Financial reported on March 16 that XINTE ENERGY (01799.HK) announced that Kong Ying has resigned from his positions as executive director, member of the Board of Directors' nomination committee, and deputy general manager for personal career development reasons, effective from March 14, 2025.

Express News | Xinte Energy Says Kong Ying Resigned as an Executive Director Due to Personal Career Development, Effect From 14 March

Comments

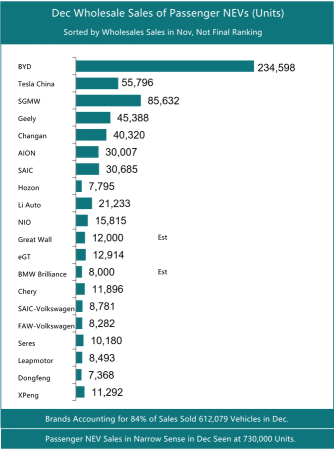

$Chongqing Changan Automobile (000625.SZ)$ $SAIC Motor Corporation (600104.SH)$ $Li Auto (LI.US)$ $LI AUTO-W (02015.HK)$ $NIO Inc. USD OV (NIO.SG)$ $NIO-SW (09866.HK)$ $GWMOTOR (02333.HK)$ $BAYER MOTOREN WERK (BMWYY.US)$ $VOLKSWAGEN A G (VWAGY.US)$ $LEAPMOTOR (09863.HK)$ $DONGFENG GROUP (00489.HK)$ $Dongfeng Automobile (600006.SH)$ $XPeng (XPEV.US)$ $XPENG-W (09868.HK)$ $XINTE ENERGY (01799.HK)$ $BYD COMPANY (01211.HK)$ $BYD Company Limited (002594.SZ)$