No Data

01799 XINTE ENERGY

- 7.110

- -0.060-0.84%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Sinolink: A turning point in Photovoltaic Glass inventory has emerged, pay attention to the downstream component factory restocking demand after the Spring Festival.

The inventory turning point in the Photovoltaic Glass Industry has been observed, expecting a price turning point, and focusing on the demand for downstream component manufacturers to restock after the Spring Festival.

Photovoltaic Power stocks rose overall, FLAT GLASS (06865) increased by 3.83%, and Institutions expect a turning point in Photovoltaic Glass prices is likely.

Financial news | Photovoltaic Power shares rose overall, with FLAT GLASS (06865) up 3.83%, GCL TECH (03800) up 2.83%, XINYI SOLAR (00968) up 2.71%, GCL NEWENERGY (00451) up 1.04%, and XINTE ENERGY (01799) up 0.42%. According to Sinolink, since 2024, the total cold repair of Photovoltaic Glass production lines has reached 0.0275 million tons per day, accounting for over 20% of the existing production capacity. Additionally, considering the maintenance actions of some in-production capacity, the actual reduction in the Industry is even greater, and the Industry inventory peaked in early November.

Hong Kong stocks movement | XINTE ENERGY (01799) fell over 4% and terminated its Main Board IPO on the Shanghai Stock Exchange due to severe losses in the polysilicon Industry.

XINTE ENERGY (01799) fell over 4%, as of the time of writing, it has dropped by 3.87%, reported at 7.2 Hong Kong dollars, with a trading volume of 12.7894 million Hong Kong dollars.

TrendForce Consulting: It is expected that the global photovoltaic new installed capacity will reach 596GW in 2025, an increase of 6.0% year-on-year.

According to TrendForce's data, Global photovoltaic installed capacity has rapidly increased from 113 GW in 2019 to 462 GW in 2023, with an average annual compound growth rate of 42.3%.

Hong Kong stock movement | XINTE ENERGY (01799) fell more than 6% in the morning, the company has terminated its A-share issuance and listing application and withdrawn the application materials.

XINTE ENERGY (01799) fell over 6% in the morning session, and as of this report, it has decreased by 4.5%, trading at 7.43 HKD, with a transaction volume of 15.3421 million HKD.

Breaking the "involutionary" competition! The two major photovoltaic leaders announce "production reduction and control of output."

Tongwei Co.,Ltd's subsidiary Yongxiang Co. and Daqo Energy have a total production capacity of over 1.2 million tons. Analysts expect that this production cut will reach at least 0.8 million tons, leading to a significant decline in silicon material output from December to January. Despite the production cut being initiated, the current Industry still faces considerable inventory pressure.

Comments

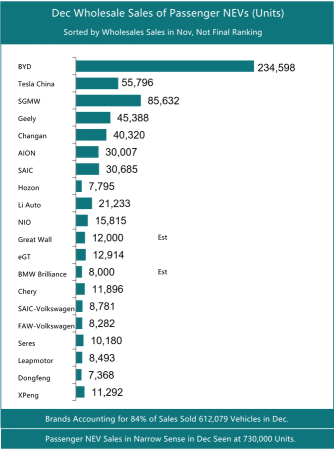

$Chongqing Changan Automobile (000625.SZ)$ $SAIC Motor Corporation (600104.SH)$ $Li Auto (LI.US)$ $LI AUTO-W (02015.HK)$ $NIO Inc. USD OV (NIO.SG)$ $NIO-SW (09866.HK)$ $GWMOTOR (02333.HK)$ $BAYER MOTOREN WERK (BMWYY.US)$ $VOLKSWAGEN A G (VWAGY.US)$ $LEAPMOTOR (09863.HK)$ $DONGFENG GROUP (00489.HK)$ $Dongfeng Automobile (600006.SH)$ $XPeng (XPEV.US)$ $XPENG-W (09868.HK)$ $XINTE ENERGY (01799.HK)$ $BYD COMPANY (01211.HK)$ $BYD Company Limited (002594.SZ)$

No Data