No Data

01799 XINTE ENERGY

- 8.150

- -0.400-4.68%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Hong Kong stocks movement | Solar stocks fell in early trading as the usa increased tariffs on solar products. Institutions suggest that this may put pressure on the profits of various companies in the short term.

Photovoltaic stocks fell in the morning session. As of the time of publication, irico newenergy (00438) fell by 5.4% to HKD 2.98; flat glass (06865) fell by 3.62% to HKD 13.3; xinte energy (01799) fell by 2.57% to HKD 8.33.

Citic Securities: The construction of a new electrical utilities system promotes the sustainable development of the power grid. It is expected that the investment growth rate of the power grid in 2025 will maintain double-digit growth.

In 2025, electrical utilities construction will continue to focus on the long-term requirements of "dual carbon" transformation and the construction of new power systems, continuing the trend of balancing the main grid and the distribution side of electrical utilities.

Both supply and demand are expected to decrease. The industry predicts that the price of photovoltaic glass will mainly stabilize in the short term. | Industry Observation

①The photovoltaic glass continues the previous downturn trend, with major manufacturers taking price increase actions, but the upward support is insufficient, and short-term price stability is expected to be the main focus; ②Leading companies indicate that the top two leading positions are still stable, including looking into the future, the change in market structure will not be significant.

Hong Kong stocks are moving differently | The photovoltaic stocks are generally rising, and the industry's "self-discipline" symposium is convened again, with the industry chain supply and demand relationship expected to accelerate improvement.

Photovoltaic stocks generally rose, as of the time of publication, flat glass (06865) increased by 6.42%, closing at 13.6 Hong Kong dollars; gcl tech (03800) rose by 5%, closing at 1.47 Hong Kong dollars; xinyi solar (00968) rose by 4.86%, closing at 3.45 Hong Kong dollars.

Hong Kong stock concept tracking | Signals of supply-side reform in the silicon material sector are frequent, and industry self-discipline in production limits is beneficial for short-term inventory depletion and price recovery (includes concept stocks).

In the new standard, the energy consumption of newly built silicon material production capacity has decreased from the previous 17 degrees per kilogram to 53 degrees per kilogram, with only the top 4 leading companies in the industry possibly meeting this standard.

China Securities Co., Ltd. Power Equipment New Energy Fund 25-year investment strategy: grasp three types of assets, energy storage dominates the whole year.

china securities co.,ltd. is most bullish on energy storage in the new energy fund sector of the power equipment sector.

Comments

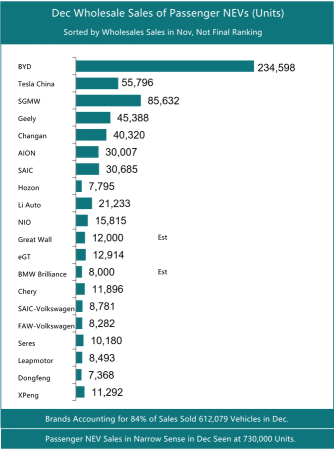

$Chongqing Changan Automobile (000625.SZ)$ $SAIC Motor Corporation (600104.SH)$ $Li Auto (LI.US)$ $LI AUTO-W (02015.HK)$ $NIO Inc. USD OV (NIO.SG)$ $NIO-SW (09866.HK)$ $GWMOTOR (02333.HK)$ $BAYER MOTOREN WERK (BMWYY.US)$ $VOLKSWAGEN A G (VWAGY.US)$ $LEAPMOTOR (09863.HK)$ $DONGFENG GROUP (00489.HK)$ $Dongfeng Automobile (600006.SH)$ $XPeng (XPEV.US)$ $XPENG-W (09868.HK)$ $XINTE ENERGY (01799.HK)$ $BYD COMPANY (01211.HK)$ $BYD Company Limited (002594.SZ)$

No Data