HK Stock MarketDetailed Quotes

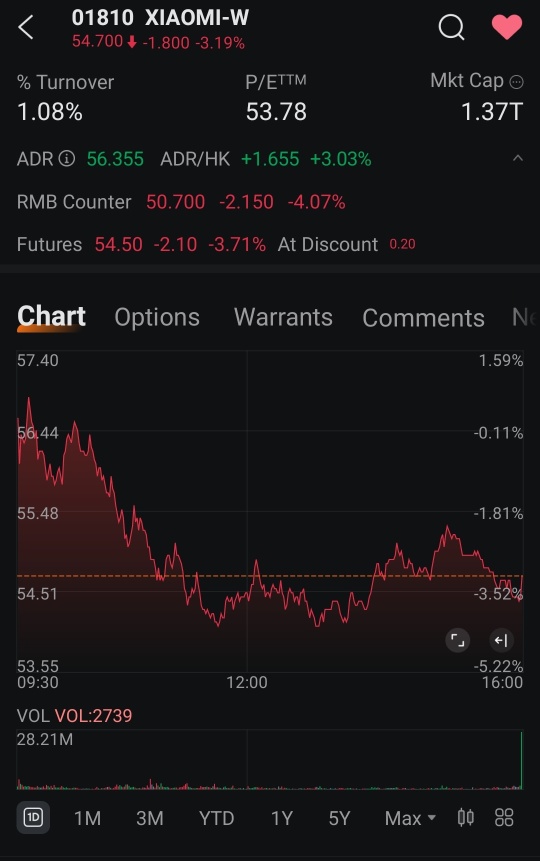

01810 XIAOMI-W

- 54.700

- -1.800-3.19%

Market Closed Mar 21 16:08 CST

1.37TMarket Cap53.79P/E (TTM)

56.850High54.050Low271.39MVolume56.600Open56.500Pre Close14.94BTurnover1.08%Turnover Ratio53.79P/E (Static)25.11BShares59.45052wk High6.74P/B1.37TFloat Cap14.70052wk Low--Dividend TTM25.11BShs Float59.450Historical High--Dividend LFY4.96%Amplitude8.280Historical Low55.032Avg Price200Lot Size--Div YieldTTM--Div Yield LFY

XIAOMI-W Stock Forum

$XIAOMI-W (01810.HK)$ Buy the dip buy the dip

1

1

$XIAOMI-W (01810.HK)$ Buy the dip buy the dip

1

$XIAOMI-W (01810.HK)$ patiently waiting at lower point

1

1

1

$XIAOMI-W (01810.HK)$ based on the inflow and outflows ans the number of options; it looks like it nay drop below or around 50 before recovers.

1

$XIAOMI-W (01810.HK)$

Based on the 3-month Xiaomi (01810) chart:

Bullish Factors:

1. Strong Uptrend: The stock has

nearly doubled from around 31.45 HKD in January to a high of 59.45 HKD in March, reflecting a 104.88% gain at its peak.

2. Higher Highs & Higher Lows: The price action indicates a clear uptrend, with consistent gains and controlled pullbacks.

3. RSI Levels (Momentum): RSI values are above 60, suggesting strong momentum, though not yet in overbought terr...

Based on the 3-month Xiaomi (01810) chart:

Bullish Factors:

1. Strong Uptrend: The stock has

nearly doubled from around 31.45 HKD in January to a high of 59.45 HKD in March, reflecting a 104.88% gain at its peak.

2. Higher Highs & Higher Lows: The price action indicates a clear uptrend, with consistent gains and controlled pullbacks.

3. RSI Levels (Momentum): RSI values are above 60, suggesting strong momentum, though not yet in overbought terr...

15

5

No comment yet

Market Insights

HK Dividend Stocks HK Dividend Stocks

Dividend stocks are stocks of companies in the HK stock market that regularly distribute dividends to shareholders, generally representing stable businesses. Information is provided by Futu and is a non-exhaustive list of all thematic stocks for reference purposes only.

This section presents the top 5 stocks in HK dividend stocks, ranked from highest to lowest based on real-time market data. Dividend stocks are stocks of companies in the HK stock market that regularly distribute dividends to shareholders, generally representing stable businesses. Information is provided by Futu and is a non-exhaustive list of all thematic stocks for reference purposes only.

This section presents the top 5 stocks in HK dividend stocks, ranked from highest to lowest based on real-time market data.

Netvista91 : Maybe Bear. Look at graph, candle so high. One day, must down for correction. Mark my word

MT888888 : next week back to 58 and above....a very healthy retracement. Just look at the daily chart...

104254860 MT888888 : The key figures from April 2 discuss the matter of influence, and it is currently difficult to see a return to the peak. Perhaps after April 2, it will return to 50.

Moriarty mcG OP 104254860 : April 2nd?

Moriarty mcG OP : options analysis for Xiaomi (01810), with a focus on put options and implied volatility.

Key Observations:

1. Stock Price Decline (-3.19%)

Xiaomi's stock is currently trading at HKD 54.7, down 1.8 HKD for the day. This suggests some short-term selling pressure.

2. Put Option Implied Volatility (IV) Analysis:

IV is highest for near-term expirations (March 28, 2025) and decreases as expiration extends to June 27, 2025, and March 30, 2026.

This means the market expects higher short-term uncertainty but lower long-term volatility.

3. Volatility Smile:

The Call option IV chart shows a strong skew, with deep OTM (Out of the Money) calls having extremely high IV (above 1300%).

This suggests traders may be speculating on major upside movements or that liquidity is low, leading to exaggerated IV.

Interpretation & Strategy:

Short-term traders: The high near-term IV in puts suggests the market is pricing in risk—perhaps due to Xiaomi’s earnings report on March 18. If you believe the stock will rebound, selling high IV puts could be profitable.

Long-term investors: The IV drop in 2026 expiration suggests confidence in Xiaomi’s long-term stability. If you're bullish, longer-dated call options might offer good value.

Stock Movement: The current pullback (-3.19%) might be a buying opportunity if you expect positive earnings. However, the high IV in options suggests some uncertainty.

View more comments...