No Data

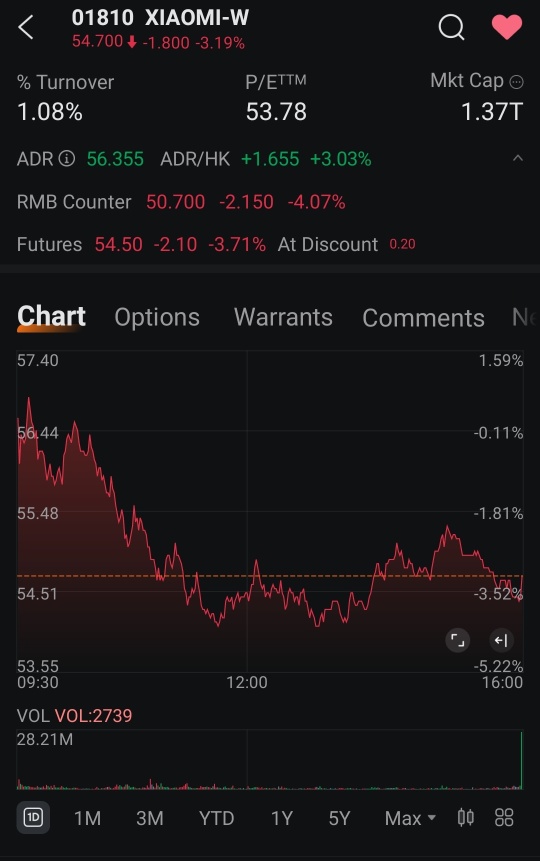

01810 XIAOMI-W

- 54.700

- -1.800-3.19%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

China Stocks: Seeking Alpha Analysts Vs. Wall Street

Trending Stocks Today: KINTOR PHARMA-B Soars 45.61%

Trending Industry Today: BYD COMPANY Leads Losses In Electric Vehicles Stocks

[Brokerage Focus] Guozheng International: The pullback in Hong Kong stocks provides a buying opportunity, with companies like Smol waiting to unleash their potential, maintaining a “Buy” rating.

Jinwu Financial News | Guozheng International released a Research Report pointing out that the Hong Kong stock market has recently undergone adjustments. After rising for 4 consecutive days, on March 20, the Hong Kong stocks significantly corrected, with the tech Sector leading the decline. The Hang Seng Index opened slightly lower at 17 points to 24,753 points before plummeting, dropping to a low of 24,186 points in the afternoon, and ultimately closing at 24,219 points, down 551 points or 2.23%. The Main Board's trading volume reached 294.9 billion Hong Kong dollars, an increase of 8.5% compared to the previous day. In terms of Hong Kong Stock Connect trading, after a large net Inflow on March 19, there was a net Outflow on the 20th, amounting to 0.408 billion.

Trending Industry Today: BYD COMPANY Leads Losses In Automobile Stocks

CICC: Maintains XIAOMI-W "Outperform Industry" rating and raises Target Price to 70 Hong Kong dollars.

CICC released a Research Report stating that it maintains XIAOMI-W (01810) an "outperforming the Industry" rating, with the Target Price raised by 14.9% to 70 HKD. Xiaomi Group's revenue in the fourth quarter of last year grew by 48.8% year-on-year to 19.01 billion HKD, exceeding the bank's expectations by 1.8%. Adjusted net profit increased by 69.4% year-on-year to 8.32 billion RMB, including losses from the Autos business of 0.7 billion RMB, which surpassed the bank's expectations by 24.6%. CICC pointed out that due to increased investments in innovative businesses such as electric vehicles and AI in the short term, the forecast for this year's adjusted net profit has been lowered by 5.3% to 38.44 billion RMB.

Netvista91 : Maybe Bear. Look at graph, candle so high. One day, must down for correction. Mark my word

MT888888 : next week back to 58 and above....a very healthy retracement. Just look at the daily chart...

104254860 MT888888 : The key figures from April 2 discuss the matter of influence, and it is currently difficult to see a return to the peak. Perhaps after April 2, it will return to 50.

Moriarty mcG OP 104254860 : April 2nd?

Moriarty mcG OP : options analysis for Xiaomi (01810), with a focus on put options and implied volatility.

Key Observations:

1. Stock Price Decline (-3.19%)

Xiaomi's stock is currently trading at HKD 54.7, down 1.8 HKD for the day. This suggests some short-term selling pressure.

2. Put Option Implied Volatility (IV) Analysis:

IV is highest for near-term expirations (March 28, 2025) and decreases as expiration extends to June 27, 2025, and March 30, 2026.

This means the market expects higher short-term uncertainty but lower long-term volatility.

3. Volatility Smile:

The Call option IV chart shows a strong skew, with deep OTM (Out of the Money) calls having extremely high IV (above 1300%).

This suggests traders may be speculating on major upside movements or that liquidity is low, leading to exaggerated IV.

Interpretation & Strategy:

Short-term traders: The high near-term IV in puts suggests the market is pricing in risk—perhaps due to Xiaomi’s earnings report on March 18. If you believe the stock will rebound, selling high IV puts could be profitable.

Long-term investors: The IV drop in 2026 expiration suggests confidence in Xiaomi’s long-term stability. If you're bullish, longer-dated call options might offer good value.

Stock Movement: The current pullback (-3.19%) might be a buying opportunity if you expect positive earnings. However, the high IV in options suggests some uncertainty.

View more comments...