No Data

02020 ANTA SPORTS

- 89.200

- +0.050+0.06%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Anta enters the second half at a new scale peak: why is it important to focus on the main brand?

Short-term profits may come under pressure.

Are Robust Financials Driving The Recent Rally In ANTA Sports Products Limited's (HKG:2020) Stock?

[Brokerage Focus] CICC: With the further strengthening of stable growth policies, the Consumer sector is expected to gradually welcome a trend market.

According to the report by China International Capital Corporation and based on Wind Statistics, since the beginning of the year, the Consumer and CSI Consumer 360 index have risen by 0.5% and 1.4%, respectively. In the context of significant attention in the Technology growth sector, their overall performance is relatively mild, slightly better than the overall market (CSI 300 Index declined slightly by 0.5% during the same period). The bank indicated that recently, with the policy dividends in the consumer sector and marginal improvements in China's economic growth expectations, attention to the Consumer Sector has increased, but market volatility remains high. Considering the current macro environment, the overall allocation for the Consumer Sector may still be in a left-leaning phase, and there may still be periodic structural opportunities in the short to medium term (3-6 months).

Analysts Offer Insights on Consumer Cyclical Companies: ANTA Sports Products (OtherANPDF), Geely Automobile Holdings (OtherGELYF) and Academy Sports and Outdoors (ASO)

Positive Outlook for ANTA Sports Products Driven by Strong Sales and Strategic Expansion

Research Reports Gold Mining|CICC: Raised Anta's Target Price to HKD 120.92, expecting to continue leading the industry this year.

CICC published a Research Report, maintaining ANTA SPORTS' "outperforming the Industry" rating, pointing out that the company's operation status was stable last year. The firm expects it to continue leading the peers in 2025, maintaining the earnings per share forecast for 2025 and 2026 at 4.81 and 5.41 yuan respectively, with the Target Price raised by 16% to 120.92 HKD, corresponding to a projected PE of about 24 and 21 times for the coming two years.

Comments

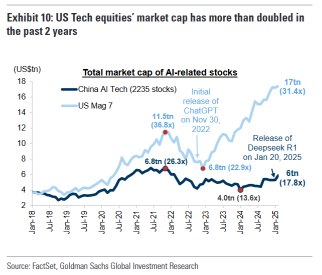

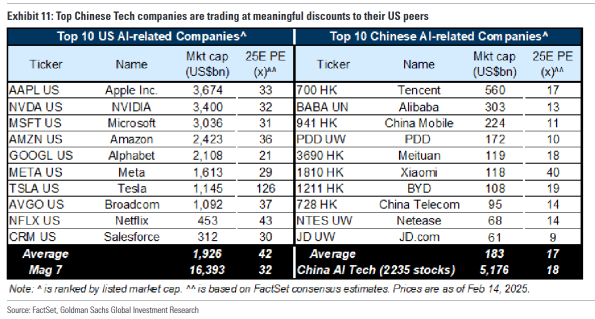

Wall Street banks have issued optimistic reports on Chinese tech stocks, signaling potential revaluation.

Goldman Sachs analyst Kinger Lau published a report titled “AI Changes the Ga...

McDonalds Corporation (MCD US) $McDonald's (MCD.US)$

Daily Chart -[BULLISH ↗ **]MCD US consolidating above 290.35 support. As long as price is holding above this level, we expect a bounce towards 317.20 resistance. Technical indicators are advocating for a bullish scenario as well.

Alternatively: A daily candlestick closing below 290.35 support level could open drop towards next support...

$MEITUAN-W (03690.HK)$

$BIDU-SW (09888.HK)$

$BABA-W (09988.HK)$

$CHINA VANKE (02202.HK)$

$CITIC SEC (06030.HK)$

$CITIC BANK (00998.HK)$

$ZHONGLIANG HLDG (02772.HK)$

$BYD COMPANY (01211.HK)$

$HTSC (06886.HK)$

$SHK PPT (00016.HK)$

$ICBC (01398.HK)$

$HSBC HOLDINGS (00005.HK)$

$PING AN (02318.HK)$

$JD-SW (09618.HK)$

$ANTA SPORTS (02020.HK)$

Click here for Top Trending Posts

Securities & Brokerage: $HTSC (06886.HK)$ $CMSC (06099.HK)$

Gaming Software: $NTES-S (09999.HK)$ $XD INC (02400.HK)$ $NETDRAGON (00777.HK)$

Digital Solutions: $TENCENT (00700.HK)$ $TRAVELSKY TECH (00696.HK)$ $CHINASOFT INT'L (00354.HK)$

Online Retailer: $BABA-W (09988.HK)$ $MEITUAN-W (03690.HK)$ $JD-SW (09618.HK)$

Insurer: $PING AN (02318.HK)$ $AIA (01299.HK)$ $CHINA LIFE (02628.HK)$

Telecommunication: $CHINA MOBILE (00941.HK)$ $CHINA TELECOM (00728.HK)$

���������...

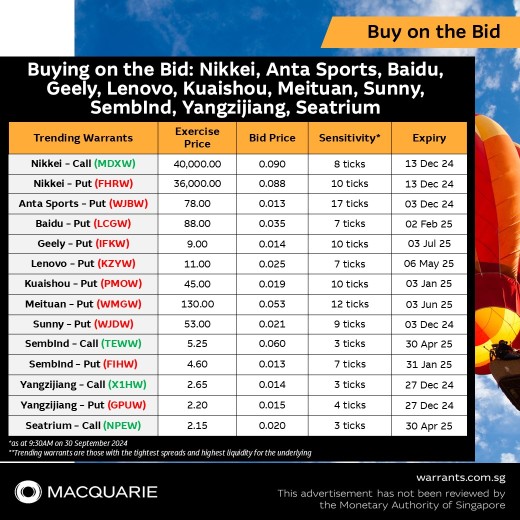

📌 Nikkei Call, MDXW

$NKY 40000MBeCW241213 (MDXW.SG)$

📌 Nikkei Put, FHRW

$NKY 36000MBePW241213 (FHRW.SG)$

📌 Anta Sports Put, WJBW

$ANTA MBePW241203 (WJBW.SG)$

📌 Baidu Put, LCGW

$Baidu MB ePW250402 (LCGW.SG)$

📌 Geely Put, IFKW

$Geely MB ePW250703 (IFKW.SG)$

📌 Lemovo Put, KZYW

$Lenovo MB ePW250506 (KZYW.SG)$

���������...

104088143 : Good

104456407 : moomoo

Nchiwla : amazing!

104554083 : good

73786850 : Wow!

View more comments...