No Data

02331 LI NING

- 18.020

- -0.900-4.76%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Hong Kong stock Concept tracking | Consumer demand for Outfits in 2025 will improve quarter by quarter. Institutions are Bullish on leading companies benefiting from the boost in domestic demand (including concept stocks).

The domestic demand for Outfits in 2025 will show a trend of seasonal improvement quarter by quarter.

Li Ning Schedules Board Meeting to Approve Annual Results and Dividend

DATE OF BOARD MEETING

The country is urging you to lose weight! A trillion-yuan market is booming!

Being overweight is also a business.

The Dining, Alcoholic Beverages, and Sporting Goods sectors have all shown strong performance. The report from the China Consumer Association shows that over 60% of consumers believe the consumption environment is getting better.

Jinwu Financial News | The Consumer Sectors, including Dining, Alcoholic Beverages, and Sporting Goods, are showing strong performance. In the Dining Sector, JIUMAOJIU (09922) rose by 6.01%, XIABUXIABU (00520) increased by 4.65%, SHANGHAI XNG (03666) grew by 4.17%, HAIDILAO (06862) rose by 2.95%, and HAILUNSI (09869) increased by 2.42%. In the Alcoholic Beverages Sector, BUD APAC (01876) rose by 6.37%, CHINA RES BEER (00291) increased by 5.07%, TSINGTAO BREW (00168) grew by 4.99%, and DYNASTY WINES (00828) rose by 3.

The sportswear Sector faced slight pressure with 361 DEGREES (01361) dropping by 3.49%. Morgan Stanley expects that industry discounts will begin to improve starting in the second quarter.

Jingwu Financial News | The sportswear Sector is slightly under pressure, with 361 DEGREES (01361) down 3.49%, TOPSPORTS (06110) down 2.34%, CHINA DONGXIANG (03818) down 2.30%, ANTA SPORTS (02020) down 2.14%, YUE YUEN IND (00551) down 1.76%, HONMAGOLF (06858) down 1.49%, LI NING (02331) down 1.24%, and XTEP INT'L (01368) down 1.09%. Morgan Stanley published a research report indicating that the demand for sportswear in China has shown mild improvement since the beginning of the year, and industry discounts are expected to decline from the second...

Comments

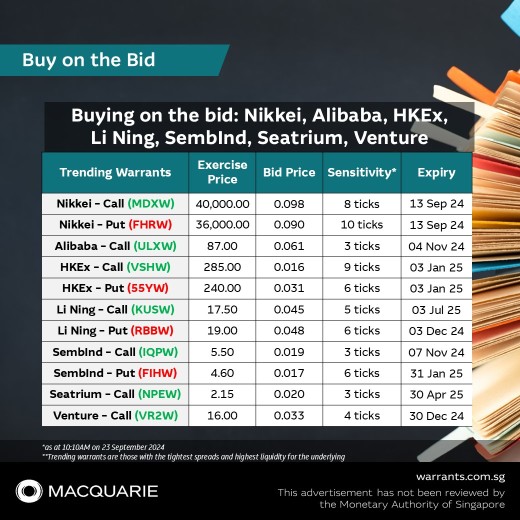

📌 Nikkie Call, MDXW

$NKY 40000MBeCW241213 (MDXW.SG)$

📌 Nikkie Put, FHRW

$NKY 36000MBePW241213 (FHRW.SG)$

📌 HKEx Call, VSHW

$HKEx MB eCW250103 (VSHW.SG)$

📌 HKEx Put, 55YW

$HKEx MB ePW250103 (55YW.SG)$

📌 Li Ning Call, KUSW

$LiNing MBeCW250703 (KUSW.SG)$

📌 Li Ning Put, RBBW

$LiNing MBePW241203 (RBBW.SG)$

📌 SembInd Call, IQPW

$SembInd MBeCW241107 (IQPW.SG)$

���������...

📌 S&P Call, XP5W

$S&P 5800MBeCW241220 (XP5W.SG)$

📌 S&P Put, 5B5W

$S&P 5350MBePW241220 (5B5W.SG)$

📌 Nikkei Call, MDXW

$NKY 40000MBeCW241213 (MDXW.SG)$

📌 Nikkei Put, FHRW

$NKY 36000MBePW241213 (FHRW.SG)$

📌 China Life Call, OHKW

$CLIFE MBeCW250703 (OHKW.SG)$

📌 Li Ning Call, KUSW

$LiNing MBeCW250703 (KUSW.SG)$

📌 Keppel Call, UYEW

$KeppelMBeCW250328 (UYEW.SG)$

���������...

📌 NASDAQ Call, IHJW

$NASDAQ 22000MBeCW241220 (IHJW.SG)$

📌 NASDAQ Put, UUZW

$NASDAQ 18500MBePW241220 (UUZW.SG)$

📌 Nikkei Call, MDXW

$NKY 40000MBeCW241213 (MDXW.SG)$

📌 Nikkei Put, FHRW

$NKY 36000MBePW241213 (FHRW.SG)$

📌 Baidu Call, ULNW

$Baidu MB eCW250204 (ULNW.SG)$

📌 Baidu Put, LCGW

$Baidu MB ePW250402 (LCGW.SG)$

📌 JD .com Call, RYOW

$JD MB eCW250103 (RYOW.SG)$

���������...

0DTE are typically more prevalent in the U.S. stock market, mainly because they are weekly options. Conversely, in the Hong Kong stock market, monthly options are more common. By conventional standards, options that expire within a week are deemed "zero days to expiration" options.

...