No Data

02331 LI NING

- 15.580

- -0.160-1.02%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

[Brokerage Focus] Guosen maintains a "Buy" rating for LI NING (02331), bullish on the company's product competitiveness, expecting the footwear category to drive growth.

Jinwu Finance | Guosen Securities released a research report indicating that on January 15, 2025, the Shanghai United Property Exchange officially announced that LI NING (02331) (China) Sporting Goods Co., Ltd. has been selected as a partner for the sports outfits cooperation project for the China sports delegation for the 2025-2028 period; the LI NING brand will become the official sports outfits partner of the Chinese Olympic Committee and the China sports delegation from 2025 to 2028. Recently, ANTA, TEBE, and 361 DEGREES have sequentially disclosed their revenue for the fourth quarter and the entire year of 2024, with the fourth-quarter revenue growth generally accelerating compared to the third quarter. The bank noted that LI NING's fourth-quarter performance is rising quarter-on-quarter.

The LI NING brand has become the official Sports Outfits partner for the China Olympic Committee and the China Sports Delegation from 2025 to 2028.

On January 15, 2025, the Shanghai United Property Exchange officially announced that LI NING has been selected as a partner for the sports outfit cooperation project of the China Sports Delegation for 2025-2028.

Zhito's exclusive supply | Xiaohongshu's A-share Concept stocks have surged, and are the Hong Kong Stocks symbols being brewed?

A large number of "TikTok refugees" are flocking to Xiaohongshu, leading to a significant increase in A-shares related to Xiaohongshu Concept, where stocks such as Hangzhou Onechance Tech Corp. and Foshan Yowant Technology have continuously hit the daily limit up. In contrast, related stocks in the Hong Kong market are performing relatively flat due to a lack of Volume.

Li Ning Likely to Continue Facing Soft Sales -- Market Talk

Li Ning Target Price Lowered to HK$20.30 From HK$20.90 by Nomura>2331.HK

[Brokerage Focus] Goldman Sachs cuts LI NING (02331) Target Price by 14.4% but expects its future growth to be modest.

Jinwu Financial News | Goldman Sachs has released a research report analyzing and predicting the development prospects of LI NING (02331). The firm maintains its Net income forecast for fiscal year 2024 and the second half of the year, while lowering its forecasts for fiscal years 2025-2026 by 7%-11%. This is mainly due to slower sales growth, increased brand investment, and a reduction in some operational leverage. Although retail sales for 2024 are expected to achieve low to mid-single-digit growth driven by online business, the offline sales are also expected to turn positive from negative, yet discount pressures persist. Goldman Sachs believes that LI NING Company is likely to achieve its set goals in 2024.

Comments

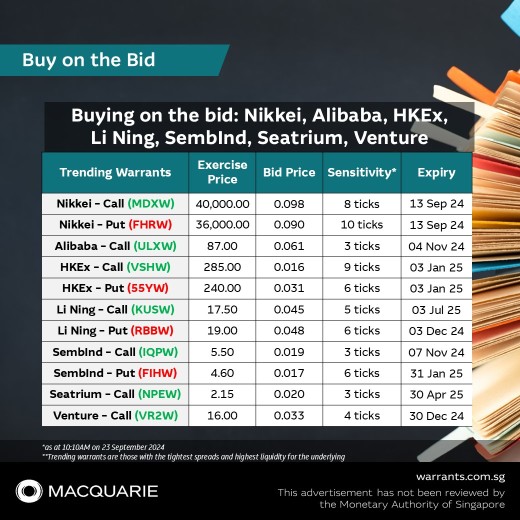

📌 Nikkie Call, MDXW

$NKY 40000MBeCW241213 (MDXW.SG)$

📌 Nikkie Put, FHRW

$NKY 36000MBePW241213 (FHRW.SG)$

📌 HKEx Call, VSHW

$HKEx MB eCW250103 (VSHW.SG)$

📌 HKEx Put, 55YW

$HKEx MB ePW250103 (55YW.SG)$

📌 Li Ning Call, KUSW

$LiNing MBeCW250703 (KUSW.SG)$

📌 Li Ning Put, RBBW

$LiNing MBePW241203 (RBBW.SG)$

📌 SembInd Call, IQPW

$SembInd MBeCW241107 (IQPW.SG)$

���������...

📌 S&P Call, XP5W

$S&P 5800MBeCW241220 (XP5W.SG)$

📌 S&P Put, 5B5W

$S&P 5350MBePW241220 (5B5W.SG)$

📌 Nikkei Call, MDXW

$NKY 40000MBeCW241213 (MDXW.SG)$

📌 Nikkei Put, FHRW

$NKY 36000MBePW241213 (FHRW.SG)$

📌 China Life Call, OHKW

$CLIFE MBeCW250703 (OHKW.SG)$

📌 Li Ning Call, KUSW

$LiNing MBeCW250703 (KUSW.SG)$

📌 Keppel Call, UYEW

$KeppelMBeCW250328 (UYEW.SG)$

���������...

📌 NASDAQ Call, IHJW

$NASDAQ 22000MBeCW241220 (IHJW.SG)$

📌 NASDAQ Put, UUZW

$NASDAQ 18500MBePW241220 (UUZW.SG)$

📌 Nikkei Call, MDXW

$NKY 40000MBeCW241213 (MDXW.SG)$

📌 Nikkei Put, FHRW

$NKY 36000MBePW241213 (FHRW.SG)$

📌 Baidu Call, ULNW

$Baidu MB eCW250204 (ULNW.SG)$

📌 Baidu Put, LCGW

$Baidu MB ePW250402 (LCGW.SG)$

📌 JD .com Call, RYOW

$JD MB eCW250103 (RYOW.SG)$

���������...

0DTE are typically more prevalent in the U.S. stock market, mainly because they are weekly options. Conversely, in the Hong Kong stock market, monthly options are more common. By conventional standards, options that expire within a week are deemed "zero days to expiration" options.

...