No Data

02331 LI NING

- 14.820

- -0.740-4.76%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Hong Kong stocks movement | LI NING (02331) surged over 3% in the late session as the sports brand accelerates its overseas expansion efforts, partnering with Sequoia to explore overseas Business.

LI NING (02331) surged over 3% in the closing session, up 3.04% as of the time of writing, priced at 16.28 Hong Kong dollars, with a transaction volume of 0.292 billion Hong Kong dollars.

Zhizhong Hong Kong Stock Short Selling Statistics | January 6th

Hong Kong Stock short selling Statistics | January 6.

Express News | BlackRock's Long Position in Li Ning Increases to 5.06% on Dec 25 From 4.55% - HKEX

LI NING (02331.HK) issued 0.2174 million shares due to the exercise of stock options.

Gelonghui, December 30: LI NING (02331.HK) announced that on December 30, 2024, 0.2174 million new shares will be issued according to the share option plan adopted by the company on May 30, 2014.

Outfit brands return to offline to attract customers, still viewing outdoor sports as the key to traffic | Year-end review.

① This year, outfit brands are focusing on the establishment of offline channels, with some accelerating the opening of offline stores; ② Online is facing a traffic bottleneck, with low stock price competition, high return rates, and declining quality leading to a poor online ecosystem; ③ Outdoor sports are still regarded as a high-traffic area, with professionals believing that competition will intensify.

GF SEC: The WeChat Mini Store is testing a gift function, which is expected to bring new growth to the textile and apparel Industry.

The WeChat ecosystem has been continuously improving in recent years. Bullish on WeChat Mini Stores, which are expected to break through by giving gifts, achieving rapid growth in the e-commerce Business. Online revenue has already become one of the important income sources in the Clothing and Home Textiles Industry.

Comments

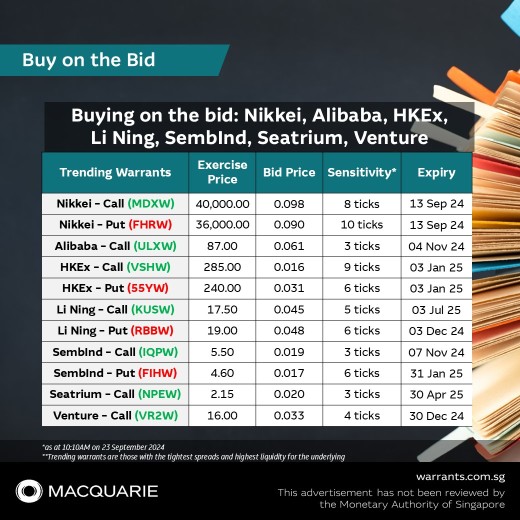

📌 Nikkie Call, MDXW

$NKY 40000MBeCW241213 (MDXW.SG)$

📌 Nikkie Put, FHRW

$NKY 36000MBePW241213 (FHRW.SG)$

📌 HKEx Call, VSHW

$HKEx MB eCW250103 (VSHW.SG)$

📌 HKEx Put, 55YW

$HKEx MB ePW250103 (55YW.SG)$

📌 Li Ning Call, KUSW

$LiNing MBeCW250703 (KUSW.SG)$

📌 Li Ning Put, RBBW

$LiNing MBePW241203 (RBBW.SG)$

📌 SembInd Call, IQPW

$SembInd MBeCW241107 (IQPW.SG)$

���������...

📌 S&P Call, XP5W

$S&P 5800MBeCW241220 (XP5W.SG)$

📌 S&P Put, 5B5W

$S&P 5350MBePW241220 (5B5W.SG)$

📌 Nikkei Call, MDXW

$NKY 40000MBeCW241213 (MDXW.SG)$

📌 Nikkei Put, FHRW

$NKY 36000MBePW241213 (FHRW.SG)$

📌 China Life Call, OHKW

$CLIFE MBeCW250703 (OHKW.SG)$

📌 Li Ning Call, KUSW

$LiNing MBeCW250703 (KUSW.SG)$

📌 Keppel Call, UYEW

$KeppelMBeCW250328 (UYEW.SG)$

���������...

📌 NASDAQ Call, IHJW

$NASDAQ 22000MBeCW241220 (IHJW.SG)$

📌 NASDAQ Put, UUZW

$NASDAQ 18500MBePW241220 (UUZW.SG)$

📌 Nikkei Call, MDXW

$NKY 40000MBeCW241213 (MDXW.SG)$

📌 Nikkei Put, FHRW

$NKY 36000MBePW241213 (FHRW.SG)$

📌 Baidu Call, ULNW

$Baidu MB eCW250204 (ULNW.SG)$

📌 Baidu Put, LCGW

$Baidu MB ePW250402 (LCGW.SG)$

📌 JD .com Call, RYOW

$JD MB eCW250103 (RYOW.SG)$

���������...

0DTE are typically more prevalent in the U.S. stock market, mainly because they are weekly options. Conversely, in the Hong Kong stock market, monthly options are more common. By conventional standards, options that expire within a week are deemed "zero days to expiration" options.

...