No Data

02367 GIANT BIOGENE

- 48.000

- -0.600-1.23%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Giant Biogene Holding Co., Ltd. (HKG:2367) Insiders Have Significant Skin in the Game With 58% Ownership

[Brokerage Focus] Sinolink maintains a "Buy" rating on Giant Biologics (02367), indicating expected developments in its medical aesthetics next year.

Jinwu Finance | Sinolink research pointed out that Giant Bio (02367) recently announced on its official website that its bone repair materials have been approved as class III medical instruments, meeting the expectations outlined in the previous prospectus for obtaining certification in Q4 2024. 1) Indications: Filling and repairing defects in the maxillofacial bone and alveolar bone; 2) Advantages: Can quickly take shape without collapsing to provide support, and also has an efficient repair function that guides bone regeneration; 3) Components: Inorganic component is hydroxyapatite granules, organic component is macromolecular polysaccharides. The firm stated that the cosmetics line continues to improve the multi-product matrix, with expectations for the medical beauty sector to take shape next year. Considering the bright online performance during Singles' Day Sales, the company's profit forecast has been raised, and it is expected.

Hong Kong stocks Concept tracking | The recovery of beauty Consumer purchasing cycles returns to normal in 2024, with a rise of new domestic beauty and personal care brands (including Concept stocks).

The output value of the Cosmetic industry in Guangzhou has exceeded 100 billion yuan.

GF SEC: Maintain the "Buy" rating for Juzi Biotechnology (02367) with a fair value of 55.72 HKD.

GF SEC expects that Juxi Bio's net income for the years 2024-2026 will be 2.12, 2.658, and 3.174 billion yuan.

One Giant Biogene Holding Insider Has Reduced Their Stake

Pharmaceutical stocks receive new funding attention, with Giant Biotechnology soaring over 8%.

① What is the reason for Yiming Angke's rise? ② How do institutions view this round of national medical insurance negotiations?

Comments

Giant Biogene Holding Co., Ltd. (HKG:2367) Stock Has Shown Weakness Lately But Financials Look Strong: Should Prospective Shareholders Make The Leap?

Giant Biogene Holding Co., Ltd. (HKG:2367) Stock Has Shown Weakness Lately But Financials Look Strong: Should Prospective Shareholders Make The Leap?There was HKD343.4 million Southbound Trading net outflow from $TENCENT (00700.HK)$ .

For $SZ->HK Connect (LIST1922.HK)$ , $XIAOMI-W (01810.HK)$was the most active stock with highest net inflow of HKD148.1 million, while $TENCENT (00700.HK)$ was the mo...

1. Hang Seng Index fell 2.57% in the first two weeks (2023/05/22 to 2023/06/02), with all 12 Hang Seng industries falling. Among them, the Hang Seng healthcare sector fell 1.51%, outperforming the Hang Seng Index by 1.06 percentage points, ranking third among the 12 Hang Seng industries

2. On May 22, the results of the f...

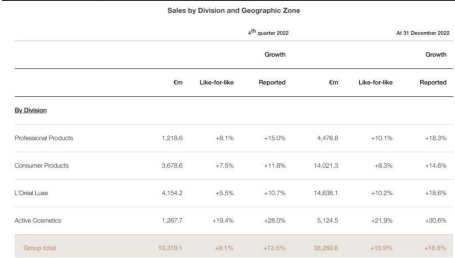

$L'OREAL (LRLCF.US)$ $Estee Lauder (EL.US)$ $Shiseido (ADR) (SSDOY.US)$

①China's overall performance is poor, with only L'Oreal's positive growth, behind the reflection of organizational efficiency and brand matrix perfection differences.

②Effective skincare continues to overgrow, perfume demand explodes, and wash care upgrade is ready to take ...

How to grasp the investment opportunities in the consumer sector in 2023?

[Food & Beauty]Infection peak has passed. Consumer recovery ahead

Infections...