No Data

02367 GIANT BIOGENE

- 49.450

- +3.100+6.69%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

[Brokerage Focus] Goldman Sachs indicates that local Cosmetic brands continue to grow, outperforming multinational companies.

Jinwu Financial News | Goldman Sachs' monthly tracking report on China's Cosmetic Industry shows the development trends of the cosmetic market in December 2024 as follows: On e-commerce platforms, the GMV of cosmetics on Tmall/Taobao decreased by 6% year-on-year, similar to the year-on-year decline of -7% in October and November; meanwhile, the GMV on Douyin increased by 29%, driving the total GMV of Tmall/Taobao and Douyin to grow by 8% year-on-year in December. For the whole year, the GMV of cosmetics on Tmall/Taobao decreased by 7% year-on-year, with sales dropping by 15% year-on-year, but the average selling price (ASP) increased by 9% year-on-year; along with Douyin's 27% year-on-year growth, the annual performance.

Giant Biogene Announces Change in Hong Kong Business Address

CMB International: With continued policy efforts, Bullish on the rebound of China Meheco Group's valuation.

Benefiting from overseas interest rate cuts and improvements in the domestic macro environment, the pharmaceutical sector, as a high-elasticity Industry, is expected to outperform the market in 2025.

[Brokerage Focus] CMB International stated that the pharmaceutical industry is expected to outperform the market in 2025, benefiting from overseas interest rate cuts and improvements in the domestic macro environment.

Jinwu Finance News | Zh Xia International released a Research Report stating that on January 3, the General Office of the State Council issued the "Opinions on Deepening the Reform of Pharmaceutical and Medical Instruments Regulation to Promote High-Quality Development of the Pharmaceutical Industry." The policy mentions deepening the reform of the entire process of pharmaceutical and medical instruments regulation, accelerating the establishment of a unified national market in the field of pharmaceutical and medical instruments, creating an innovative ecosystem with Global competitiveness, and promoting the transition of China from a major pharmaceutical country to a strong pharmaceutical country. The policy aims for significant improvements in the quality and efficiency of the review and approval of Innovative Drugs and medical instruments by 2027, establishing a regulatory system that aligns with pharmaceutical innovation and industrial development. By 2035, the pharmaceutical industry will have...

Major rating丨Morgan Stanley: The stock price of Junzi Biological is expected to rise about 70% to 80% in the next 15 days, with a Target Price of 65 Hong Kong dollars.

Morgan Stanley published a research report stating that if traded at an expected PE of 18 times for 2025, one can see the convincing risks and returns of Giant Bio, with the company's business still in a strong expansion cycle. The bank expects Giant Bio's earnings growth for the fiscal years 2024 and 2025 to be 37% and 23%, respectively, and the upcoming full-year results may be stronger than other companies covered by the bank. Morgan Stanley anticipates that within the next 15 days, the stock price of Giant Bio will see an increase of approximately 70% to 80%, setting its target price at 65 HKD and giving it a 'Shareholding' rating.

Giant Biogene Holding Co., Ltd. (HKG:2367) Insiders Have Significant Skin in the Game With 58% Ownership

Comments

Giant Biogene Holding Co., Ltd. (HKG:2367) Stock Has Shown Weakness Lately But Financials Look Strong: Should Prospective Shareholders Make The Leap?

Giant Biogene Holding Co., Ltd. (HKG:2367) Stock Has Shown Weakness Lately But Financials Look Strong: Should Prospective Shareholders Make The Leap?There was HKD343.4 million Southbound Trading net outflow from $TENCENT (00700.HK)$ .

For $SZ->HK Connect (LIST1922.HK)$ , $XIAOMI-W (01810.HK)$was the most active stock with highest net inflow of HKD148.1 million, while $TENCENT (00700.HK)$ was the mo...

1. Hang Seng Index fell 2.57% in the first two weeks (2023/05/22 to 2023/06/02), with all 12 Hang Seng industries falling. Among them, the Hang Seng healthcare sector fell 1.51%, outperforming the Hang Seng Index by 1.06 percentage points, ranking third among the 12 Hang Seng industries

2. On May 22, the results of the f...

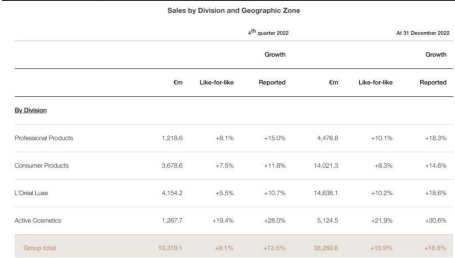

$L'OREAL (LRLCF.US)$ $Estee Lauder (EL.US)$ $Shiseido (ADR) (SSDOY.US)$

①China's overall performance is poor, with only L'Oreal's positive growth, behind the reflection of organizational efficiency and brand matrix perfection differences.

②Effective skincare continues to overgrow, perfume demand explodes, and wash care upgrade is ready to take ...

How to grasp the investment opportunities in the consumer sector in 2023?

[Food & Beauty]Infection peak has passed. Consumer recovery ahead

Infections...

No Data