No Data

02367 GIANT BIOGENE

- 48.900

- -0.300-0.61%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

【Brokerage Focus】Bank of America: The rise and reshuffling of local cosmetic brands in China, with the stability of international brand prices being key.

Jingu Financial News | Bank of America Securities recently held a meeting, inviting leading online cosmetic distributors to share insights. The november 11 shopping festival-related in 2024 started about 10 days earlier than 2023, divided into three waves of promotions, with the first wave in October being the most effective, but the marginal utility of the subsequent two waves gradually weakened. According to Syntun's data, the retail sales of cosmetics during the november 11 shopping festival-related reached 96 billion yuan, a year-on-year growth of 22.5% (2023 had a low base, -4.0%). Proya Cosmetics (603605) performed well and became the top Tmall beauty brand.

[Brokerage Focus] CICC Securities: Several heavyweight domestically produced innovative drugs included in medical insurance, fund revenue and expenditure expected to improve.

Jingu Financial News | CMB International released a research report, stating that the MSCI Chinese medical index has cumulatively fallen by 17.6% since the beginning of the year, underperforming the MSCI China index by 30.1%. Benefiting from overseas interest rate cuts and domestic macroeconomic improvements, the medical industry, as a high elasticity sector, is expected to outperform the market. The new version of the medical insurance catalogue has been announced, with multiple heavyweight domestic innovative drugs included. The bank expects the price reduction of renewed varieties to be moderate, reflecting the strong support of the medical insurance fund for innovative drugs. In September and October this year, the balance of basic medical insurance (centralized fund) has significantly improved. As the policy focus shifts to stimulating the economy, the bank believes that the financial status of the medical insurance fund is

Zhaoyuan International: Health insurance continues to support innovation, and the fund's revenue and expenditure are expected to improve.

The updated policies for medical devices are expected to be implemented quickly, promoting the recovery of profits for domestic medical device companies.

[Brokerage Focus] huaan maintains a "buy" rating on Juzhi Bio (02367), pointing out that the advantages of diversified products and channels will drive its performance growth.

Jingu Financial News | Huaan Securities issued a research report, stating that Juzi Biotech (02367) announced on November 12 that the core brands Kefumei/Kelijin achieved year-on-year growth of 80+% / 150+% in GMV across all online channels during the November 11 shopping festival-related period; The group standard of "Fermented Ginseng Powder" led by Juzi Biotech was officially released, becoming the first group standard in this field. The report pointed out that the company's sales revenue growth in the first half of 24H1 mainly came from the sales growth of professional skincare products sector, with the core brands Kefumei and Kelijin contributing 97.1% of the sales revenue proportion. Kefumei of 24H1 achieved a revenue of 2.071 billion yuan,

Hong Kong stock fluctuation | Genscript Biotech (02367) rose nearly 4% during the session. The performance of KeFuMei and KeLiJin during the november 11 shopping festival-related may support the company in achieving its annual profit target.

Jushi Group (02367) rose nearly 4% during trading hours. As of the press time, it increased by 3.88% to HK$50.9, with a transaction value of 73.9355 million Hong Kong dollars.

Sinolink: In 2025, competition in beauty, medical aesthetics, and gold jewelry may continue to be intense. The popularity of trendy products is expected to continue with the resonance of supply and demand sentiment.

Beauty, medical beauty, gold jewelry and other optional consumer sectors are experiencing weakening prosperity, intensifying internal circulation, with emotional consumption leading the market, and the trendy market continuing to expand.

Comments

Giant Biogene Holding Co., Ltd. (HKG:2367) Stock Has Shown Weakness Lately But Financials Look Strong: Should Prospective Shareholders Make The Leap?

Giant Biogene Holding Co., Ltd. (HKG:2367) Stock Has Shown Weakness Lately But Financials Look Strong: Should Prospective Shareholders Make The Leap?There was HKD343.4 million Southbound Trading net outflow from $TENCENT (00700.HK)$ .

For $SZ->HK Connect (LIST1922.HK)$ , $XIAOMI-W (01810.HK)$was the most active stock with highest net inflow of HKD148.1 million, while $TENCENT (00700.HK)$ was the mo...

1. Hang Seng Index fell 2.57% in the first two weeks (2023/05/22 to 2023/06/02), with all 12 Hang Seng industries falling. Among them, the Hang Seng healthcare sector fell 1.51%, outperforming the Hang Seng Index by 1.06 percentage points, ranking third among the 12 Hang Seng industries

2. On May 22, the results of the f...

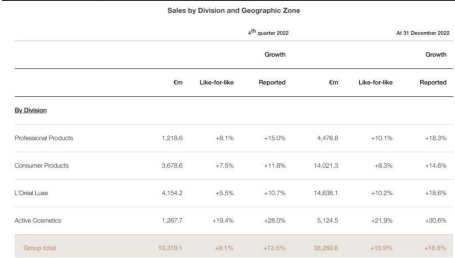

$L'OREAL (LRLCF.US)$ $Estee Lauder (EL.US)$ $Shiseido (ADR) (SSDOY.US)$

①China's overall performance is poor, with only L'Oreal's positive growth, behind the reflection of organizational efficiency and brand matrix perfection differences.

②Effective skincare continues to overgrow, perfume demand explodes, and wash care upgrade is ready to take ...

How to grasp the investment opportunities in the consumer sector in 2023?

[Food & Beauty]Infection peak has passed. Consumer recovery ahead

Infections...