No Data

02602 ONEWO

- 21.700

- +0.650+3.09%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

CICC: Maintaining the "Outperform Industry" rating for Wanwu Cloud (02602) with a Target Price of 30.58 HKD.

China International Capital Corporation is Bullish on the long-term multi-track, comprehensive competitive strength based on residence, commercial enterprises, Technology, urban and other scenarios.

【Brokerage Focus】Guolian gives Wanwu Cloud (02602) an initial "Buy" rating, indicating that revenue from basic Property Service for residential and commercial enterprises continues to grow at a high speed.

Jinwu Financial News | Guolian's research report indicates that Wanwu Cloud (02602) has maintained rapid growth in revenue from its Residence and commercial property services. From 2019 to 2023, the CAGR of revenue from residential properties and commercial properties was 23.7% and 34.1% respectively. In the first half of 2024, the saturated revenue of residential and commercial projects under management was 26.207 and 14.311 billion yuan respectively, representing year-on-year increases of 14.2% and 25.8%. The contracted project saturated revenue was 31.85 and 17.508 billion yuan respectively, showing year-on-year increases of 8.8% and 14.8%. The strategy for Diecheng is steadily advancing.

Most property management stocks are performing well. KAISA PROSPER (02168) rose by 12.26%. Institutions indicate that property management will be long-term beneficiaries in the existing market.

Jin Wu Finance | Most property management stocks are performing well, KAISA PROSPER (02168) rose by 12.26%, S-ENJOY SERVICE (01755) rose by 5.15%, CHINA RES MIXC (01209) rose by 4.07%, CG SERVICES (06098) rose by 3.28%, Wan Wu Yun (02602) rose by 3.09%, A-LIVING (03319) rose by 3.02%. Recently, the Research Reports from China Merchants International pointed out that, looking back at 2024, the main real estate stocks that outperformed the Industry are mainly "dilemma reversal" symbol and "performance bottoming and rebounding" symbol, while the property stocks are mainly those with "outstanding expansion capabilities" and "parent company.

Combining weight and weight, Wanwuyun (02602.HK)'s proposed fund is loaded into holding assets

On December 11, at the Wanwu Cloud. Insight Conference, Wanwu Cloud and Gaohe Capital announced the establishment of a Global Strategy partnership, planning to jointly create a Community Fund, incorporating substantial Assets. Under the "Dicheng + Community" model, Wanwu Cloud aims to become the leading player in community commerce. This also sends a strong signal of Wanwu Cloud's transformation from traditional Property Service to Asset Service, and the implementation of the Dicheng + Community ecosystem is expected to accelerate. Wanwu Cloud's Deputy General Manager Ye Fei stated that Dicheng + Community is customer-centric, focusing on the needs of residents, leveraging the Dicheng foundation and Wanwu Cloud's Operation capabilities to link Assets, Brands, and Consumers, thus accelerating life consumption in Dicheng.

Onewo Inc. Announces Key Meeting for Shareholders

Assets, low carbon, AI, Wanwu Cloud (02602.HK) decoding future Operation | Directly hitting the Insight Conference.

On December 11th, Wanwu Cloud held the Insight Conference in Shenzhen. With a series of official announcements regarding products and Business actions, the Operational keywords for Wanwu Cloud's next three years have also emerged. At the conference, Wanwu Cloud's Director Zhu Baoquan reviewed the marketization process over the past 10 years. Since the marketization started in September 2014 with the launch of Smart Service, finding Firstservice (abbreviated as FSV) as the company's Global benchmark for learning, Wanwu Cloud has horizontally integrated spatial extensions and vertically shaped Technology capabilities. Currently, Wanwu Cloud has formed a diverse range of brands and services within the space and has relied on Technology capabilities represented by "Ling Stone".

Comments

one of the rocket to fly by next week

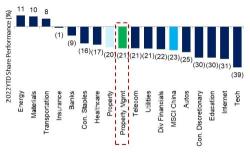

2023 outlook will be righter because of soothing property,Covid beta,(after 2-years roller-coaster ride).

Here are a few reasons:

1.most have changed in a good way for long term,For example ,rapid move into independence, non-resi, decline of excessive profitability);

even the headwinds (less new-home GFA, slower VAS) are useful to distinguish consolidators;

2.intact biz nature: asset-light wi...