No Data

02669 CHINA OVS PPT

- 4.810

- -0.050-1.03%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

CHINA OVS PPT [02669] is currently reported at 4.77 Hong Kong dollars, a decrease of 5.17%.

As of 15:05, CHINA OVS PPT [02669] reported HKD 4.77, down HKD 0.26 or 5.17% from yesterday's closing price of HKD 5.03, with a transaction volume of 24.1627 million HKD. Today's highest price was HKD 4.98, and the lowest price was HKD 4.77. Based on yesterday's closing price, the 10-day average price is HKD 4.84, the 50-day average price is HKD 5.20, and the current PE is 11.17 times, with a 14-day strength index of 44.71.

[Brokerage Focus] Ping An Securities: As the Spring Festival holiday approaches, the real estate Industry is expected to enter a period of sluggish transactions in the short term.

Jinwoo Financial News | Ping An Securities has released its monthly report on the real estate Industry. With the approach of the Spring Festival holiday, it is expected that short-term transactions will enter a period of stagnation. In the mid-term view, the current high point of the property market in terms of volume and price has clearly receded. Coupled with the reduction of down payments and interest rates, the threshold for residents to purchase property has significantly improved. Although the existing inventory is high and expectations for housing prices and income still constrain the property market's performance, it is believed that the sharp decline in the market has passed. As more high-efficiency, high-quality products enter the market, some demand may flow back from the second-hand housing market to the new housing market, leading to a stabilization of high-quality products in the market first. The short-term focus should be on the performance from after the Spring Festival to March. On the indiv

"No price limit" has sparked intense competition: in Peking, the two plots have attracted over 400 rounds of bidding, totaling nearly 18.2 billion.

At the beginning of 2025, the Peking land auction market welcomed a strong start, with two plots sold for nearly 18.2 billion yuan at a High Stock Price. Due to the absence of price limits on these two plots, developers fiercely competed, with a total of over 400 bidding rounds for the two plots.

The Central Finger Research: In December, the SSE Conglomerates Index for property service prices in twenty cities slightly declined, with Wuhan experiencing the largest decrease.

In December 2024, the Property Service price SSE Conglomerates Index for twenty cities was 1075.37, a year-on-year decrease of 0.01% and a month-on-month decrease of 0.03%, with both year-on-year and month-on-month figures shifting from an increase to a decrease.

[Brokerage Focus] SWHY expects the Real Estate Industry to bottom out and maintains a 'Bullish' rating on Real Estate and property management.

Gold Eagle Financial News | SWHY stated that over the past three years, China's Real Estate sector has undergone deep adjustments, and the effects of relaxed policies during this period have been limited. The bank believes that the core issue lies not in insufficient demand, but in the weakening of residents' balance sheets. The statements in September to 'stop the decline and stabilize' and in December to 'stabilize the Real Estate and stock markets' clarified the policy approach to repairing residents' balance sheets, demonstrating stronger policy effectiveness than before. The policy has entered a more targeted trajectory, and it is expected that more proactive and substantial policies will be introduced subsequently, with the Industry likely to reach a bottom. Considering that mid-term demand has support but short-term supply has constraints, the bank forecasts that the total will still be skewed next year.

The research institute found that the disclosure rate of the ESG reports of listed Property Service companies reached 95.65% overall.

The Zhongzhi Research Institute has released the 2024 ESG evaluation research report for listed Property Service companies in China.

Comments

The sales volume of China's top 100 real estate companies fell 13% MoM in April. Chinese developers took the lead to decline. $KWG GROUP (01813.HK)$ and $AGILE GROUP (03383.HK)$ plummeted...

UOB KH report.

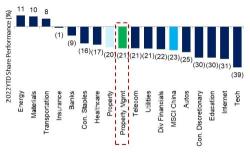

MSCI China now trades at an undemanding 12-month forward PE of 10.2x, or a 37.0% discount to Emerging Asia. This steep discount is unwarranted and they expect valuation to normalise in 2H23, backed by additional policy support. However, a significant rerating is only possible if credit growth accelerates; hence, their index target is at 74 points for now, implying 12.0x target PE. They prefer exposure to automobiles, co...

2023 outlook will be righter because of soothing property,Covid beta,(after 2-years roller-coaster ride).

Here are a few reasons:

1.most have changed in a good way for long term,For example ,rapid move into independence, non-resi, decline of excessive profitability);

even the headwinds (less new-home GFA, slower VAS) are useful to distinguish consolidators;

2.intact biz nature: asset-light wi...

103540795 : 18800soon.. 19000