No Data

02800 TRACKER FUND OF HONG KONG

- 19.760

- +0.490+2.54%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Goldman Sachs, Morgan Stanley Cut to Hold at HSBC

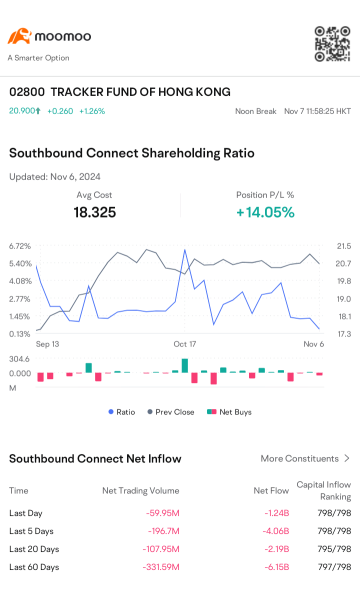

On November 26, southbound funds had a net buy of over 6.8 billion HKD: increasing holdings in alibaba and tracker fund of hong kong while there was an outflow from xiaopeng autos.

① The southbound capital traded approximately 46.2 billion Hong Kong dollars that day; which stocks are experiencing continued inflow? ② The inflow into alibaba exceeded 0.7 billion Hong Kong dollars; how did the stock price perform?

Tariff risks raise concerns! The three major indices in the Hong Kong stock market show mixed performance, with cryptos concept stocks leading the decline.

What is the reason for the rise of jiangsu lopal tech.? Is there any improvement in short selling in the Hong Kong stock market?

Constant shocks! Tariffs and other geopolitical risks are repeatedly escalating, Hong Kong shipping stocks are responding weakly first.

①How much impact does the continuous impact of geopolitical risks such as tariffs have on the shipping sector? ②Hong Kong-listed shipping stocks first responded weaker, which individual stocks showed unusual movements?

China has taken the lead! Wall Street strategists: the next "Trump trade" may be outside of the USA.

①When looking to the future, Jay Pelosky, the founder and global strategist of the New York investment consulting firm TPW Advisory, has insights that differ from many mainstream market views; ②He believes that Trump's victory might ultimately serve as an important catalyst - driving the usa market to end its long-standing excellent performance.

In November, the MLF volume continued to shrink. Previously, the 500 billion buy-back reverse repurchase has released medium-term liquidity ahead of schedule. The industry expects the reserve requirement ratio cut to be implemented faster.

①The funding operation mode of shortening and lengthening funds continues. On the one hand, the central bank continues to reduce the MLF operations volume, reduce the existing stock to mitigate its impact on the liquidity market. On the other hand, short-term funds continue to be net injected to hedge against cross-month fund pressure, strengthening the guiding position of reverse repurchase agreements on market interest rates. ②Local government bonds are centrally supplied, and the MLF is likely to see a quicker implementation under the reduced volume environment.