No Data

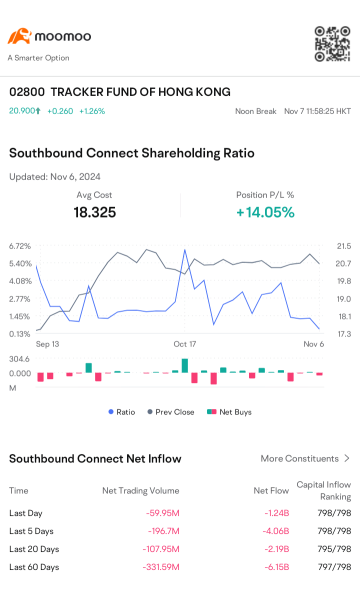

02800 TRACKER FUND OF HONG KONG

- 20.080

- -0.460-2.24%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

The interest rates of the same industry certificates of deposit are rapidly declining, and under "moderately loose" conditions, there is hope to drop to 1.30%.

1. After the improvement in MMF transmission efficiency, the CD interest rate and the 7-day OMO rate will integrate within the next year. 2. Due to the faster decline of long-term bonds, the spread between the 10Y government bond and the 1Y CD has been compressing, and is currently at 13BP.

Northbound trading direction | Northbound net purchases of 14.306 billion, domestic funds are re-adding positions in Hong Kong stock ETFs, aggressively buying Alibaba (09988) exceeding 1.7 billion.

On December 13th in the Hong Kong stock market, the northbound capital had a net purchase of 14.306 billion HKD, of which the SH->HK Connect had a net purchase of 9.36 billion HKD, and the SZ->HK Connect had a net purchase of 4.946 billion HKD.

A year-on-year increase of 32%! Global electric vehicle sales have set historical highs for three consecutive months, with China accounting for 70% of the market.

The performance of the China market is impressive, with sales in November growing by 50% year-on-year to reach 1.27 million vehicles, accounting for about 70% of Global total sales. Overall Auto sales in China for November increased by 16.6% compared to the previous year, marking the highest growth rate since January this year. BYD is expected to exceed the annual Global sales target and surpass Ford and Honda.

Announcement Highlights | Air China Limited has completed the issuance of over 0.85 billion A-shares to AVIC Group; CHINA RES LAND's sales in November increased by nearly 7% year-on-year.

In the first 11 months, SINO-OCEAN GP's cumulative contracted sales amounted to approximately 30.6 billion yuan, with 3.73 billion yuan in contract sales for November; CHINA RES LAND's total contract sales amount for November was approximately 25.8 billion yuan, representing a year-on-year increase of 6.9%.

Northbound capital movement | Northbound capital net Sell of 2.928 billion, increasing positions in Alibaba (09988) by over 1 billion and selling TRACKER FUND OF HONG KONG (02800) for over 4.1 billion Hong Kong dollars.

On December 12, in the Hong Kong stock market, the northbound capital had a net sell of 2.928 billion HKD, with a net buy of 0.172 billion HKD in SH->HK Connect and a net sell of 3.1 billion HKD in SZ->HK Connect.

Who might be the supplier for the Xiaomi YU7?

Xiaomi Autos is once again making waves in the automotive circle! The first SUV model, YU7, has been officially announced, and is expected to be launched in mid-2025. Xiaomi is ambitious and has raised its annual sales target to 120,000 units after completing a delivery volume of 100,000 units ahead of schedule. In a Research Report released on the 12th, UBS Group predicts that with the addition of the new model YU7 and the enhancement of production capacity, total sales of Xiaomi Autos in 2025 are expected to double to 260,000 units. The supply chain for the YU7 is gradually coming to light. UBS Group believes that companies such as Topband, FUYAO GLASS, Minth, Huayang, NEXTEER, and Keboda Technology are likely to become partners of Xiaomi, providing components for the YU7.

MIB : yes I saw it...technical?

MIB : correction...so fast