No Data

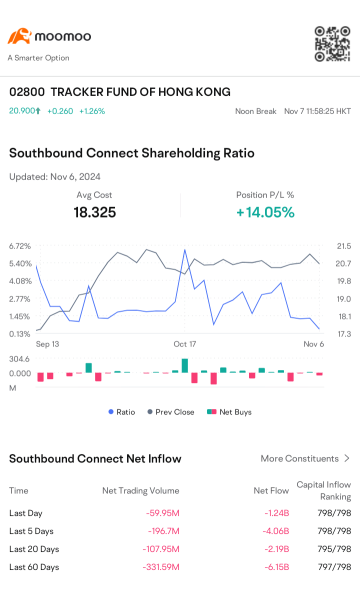

02800 TRACKER FUND OF HONG KONG

- 19.940

- +0.160+0.81%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Capital movement | Northbound funds aggressively bought TRACKER FUND OF HONG KONG exceeding 5 billion HKD, while Xiaomi Group and China Construction Bank Corporation faced Sell.

Track the latest dynamics of southbound capital.

Xiaomi speeds towards one trillion.

The stock price has reached a new high.

Northbound capital trends | Northbound capital net buying totaled 9.269 billion HKD as domestic investors once again favored Hong Kong stock ETFs, with investments in TRACKER FUND OF HONG KONG (02800) exceeding 5 billion HKD.

On January 3rd, in the Hong Kong stock market, northbound capital had a net purchase of 9.269 billion Hong Kong dollars, of which the SH->HK Connect had a net purchase of 5.638 billion Hong Kong dollars, and the SZ->HK Connect had a net purchase of 3.631 billion Hong Kong dollars.

Hong Kong stock market morning report on January 3: GTJA's merger application with HAITONG SEC will be discussed next week. Institutions expect that Hong Kong stock IPO fundraising could reach 160 billion Hong Kong dollars in 2025.

① PwC predicts that Hong Kong stock IPO fundraising could reach 160 billion Hong Kong dollars in 2025. ② GTJA's merger application with HAITONG SEC will be discussed next week. ③ Alibaba's buyback plan still has a remaining quota of 20.7 billion US dollars. ④ Last November, Hong Kong's retail sales volume decreased by 8.3% year-on-year.

Northbound capital trends | Northbound capital net buying totaled 6.511 billion, domestic investors aggressively sought to acquire dividend Assets and WeChat mini-store Concept, while selling TRACKER FUND OF HONG KONG (02800) over 1.4 billion.

On January 2, in the Hong Kong stock market, the net purchase by Northbound funds was 6.511 billion HKD, of which 6.625 billion HKD was net bought through SH->HK Connect, while 0.115 billion HKD was net sold through SZ->HK Connect.

On the first trading day of the New Year, Bank stocks opened high and then fell back. Many Institutions: the opening performance may be better than in previous years, but the trend of declining net interest margin remains unchanged.

① The crediting ratio between each quarter is expected to recover to a ratio of 4:3:2:1. ② It is expected that policy trends will continue, gradually boosting demand in the Real Estate sector. ③ This year, the decline in net interest margin for Banks is narrower compared to 2024, with a calculated interest margin of 1.34% under neutral assumptions.

MIB : yes I saw it...technical?

MIB : correction...so fast