No Data

03033 CSOP Hang Seng TECH Index ETF

- 4.282

- +0.016+0.38%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

A-shares and Hong Kong stocks are up, with the gem rising more than 1%, led by photovoltaics, chips, and non-ferrous metals.

PV concept stocks in A-shares rose at the beginning of the market, Suzhou Good-Ark Electronics hit the limit up, Sungrow Power Supply, Deli Technology rose more than 6%, Ginlong Technologies, Suzhou Maxwell Technologies, and Orise Technology quickly followed the upward trend.

Hong Kong stocks morning report on November 19: Hong Kong Exchanges and Clearing is preparing various optimization measures for mutual market access. Goldman Sachs predicts a 15% increase in the MSCI China Index by 2025.

① The Hong Kong Stock Exchange stated that it is preparing multiple optimization measures for mutual connectivity. ② S.F. Holding plans to issue 0.17 billion H shares through an IPO in Hong Kong. ③ Goldman Sachs expects the MSCI Chinese Index to rise by 15% by 2025. ④ Xiaomi's revenue in the third quarter increased by approximately 30% year-on-year.

Xiaomi conference call: autos Q4 revenue growth rate is expected to continue to rise, planning to open 120 500-square-meter large stores this year.

Xiaomi stated that the growth in total revenue for the Xiaomi Group this quarter is largely due to the stable growth of the auto business, and if necessary, it will further invest in expansion, planning to open 120 oversized Xiaomi Home stores by the end of the year, each covering an area of 400-500 square meters.

60% of the 'rebound fruit' has been eroded, who is currently increasing their holdings in Hong Kong stocks in the opposite direction?

Since October 8th, the once "unrivaled globally" Hong Kong stock market has retraced nearly 60% of the gains from the rebound trend from September 24, 2024 to October 7, 2024.

gtja: How will the Hong Kong stock market perform after the usa election?

After Trump takes office as president of the usa in 2025, China-US trade may continue to negotiate. Unlike 2018, the Hong Kong stock market has currently priced in, and compared horizontally, the valuation level of the Hong Kong stock is at a low point.

Last week, overseas funds accelerated inflow into Hong Kong stocks. Institutions stated that a "policy window" may be approaching in the near future.

①How much does external liquidity affect the Hong Kong stock market? ②What are the current hold positions strategies for Hong Kong stocks?

Comments

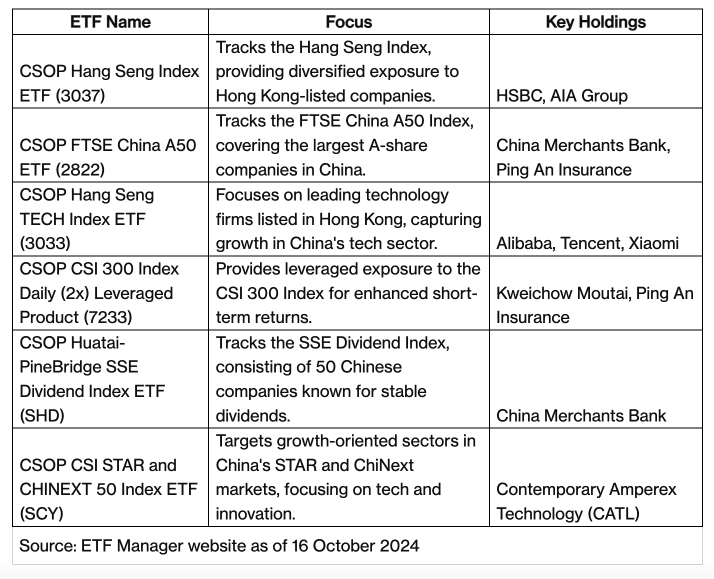

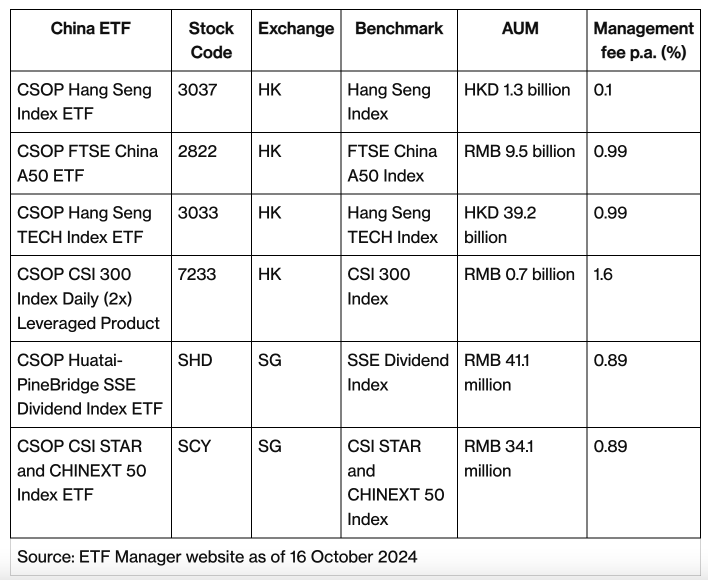

China’s market recently saw a significant bounce, driven by a new wave of government stimulus aimed at revitalising the economy.

Investor optimism surged following the government’s commitment to economic growth through measures like liquidity injections and targeted support to the real estate sector.

If you’re looking to gain exposure to this economic recovery, I’ll share some popular exchange-traded funds (ETFs) that provide ...

There was HKD665.2 million and HKD192.3 million Southbound Trading net outflow from $MEITUAN-W (03690.HK)$ and $TENCENT (00700.HK)$ .

For $SH->HK Connect (GangGuTong.HK)$ , $BABA-W (09988.HK)$was the most active stock with highest net inflow of HKD470 million...

There was HKD1.7 billion and HKD1.1 billion Southbound Trading net outflow from $TRACKER FUND OF HONG KONG (02800.HK)$ and $CSOP Hang Seng TECH Index ETF (03033.HK)$ .

For $SZ->HK Connect (LIST1922.HK)$ , $TENCENT (00700.HK)$ was the most active stock with highest net inflow of HKD815.7 million,...

Top five shares with highest short selling amount:

$TRACKER FUND OF HONG KONG (02800.HK)$ 's short selling ratio is 37%, with a turnover of $2.6 billion

$Hang Seng H-Share Index ETF (02828.HK)$ 's short selling ratio is 38.3%, with a turnover of $872.5 million...