No Data

03115 iShares Core Hang Seng Index ETF

- 71.660

- -0.660-0.91%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Deutsche Bank strongly promotes Xiaomi: After the Autos Business succeeds in going from zero to one, there will be exponential growth!

Deutsche Bank believes that new products, market segmentation, stores, and production capacity will bring exponential growth to Xiaomi's Autos Business. It is expected that by 2027, the gross margin of Xiaomi's electric vehicle business will reach 25%, contributing 45.5% and 42% to overall gross profit and pretax profit respectively, with sales reaching 1 million units, making it the largest business segment of the group. Deutsche Bank has given Xiaomi a "Buy" rating for the first time and raised its Target Price to HKD 43.

The interest rates of the same industry certificates of deposit are rapidly declining, and under "moderately loose" conditions, there is hope to drop to 1.30%.

1. After the improvement in MMF transmission efficiency, the CD interest rate and the 7-day OMO rate will integrate within the next year. 2. Due to the faster decline of long-term bonds, the spread between the 10Y government bond and the 1Y CD has been compressing, and is currently at 13BP.

A year-on-year increase of 32%! Global electric vehicle sales have set historical highs for three consecutive months, with China accounting for 70% of the market.

The performance of the China market is impressive, with sales in November growing by 50% year-on-year to reach 1.27 million vehicles, accounting for about 70% of Global total sales. Overall Auto sales in China for November increased by 16.6% compared to the previous year, marking the highest growth rate since January this year. BYD is expected to exceed the annual Global sales target and surpass Ford and Honda.

Who might be the supplier for the Xiaomi YU7?

Xiaomi Autos is once again making waves in the automotive circle! The first SUV model, YU7, has been officially announced, and is expected to be launched in mid-2025. Xiaomi is ambitious and has raised its annual sales target to 120,000 units after completing a delivery volume of 100,000 units ahead of schedule. In a Research Report released on the 12th, UBS Group predicts that with the addition of the new model YU7 and the enhancement of production capacity, total sales of Xiaomi Autos in 2025 are expected to double to 260,000 units. The supply chain for the YU7 is gradually coming to light. UBS Group believes that companies such as Topband, FUYAO GLASS, Minth, Huayang, NEXTEER, and Keboda Technology are likely to become partners of Xiaomi, providing components for the YU7.

Honeywell Upgraded at HSBC on Possibility of Breakup

Lei Jun wants to dethrone the Model Y.

There is still a need to overcome the capacity challenges.

Comments

Let's see how the market react on Monday.

$Hang Seng Index (800000.HK)$ $iShares Core Hang Seng Index ETF (03115.HK)$ $KraneShares CSI China Internet ETF (KWEB.US)$ $Alibaba (BABA.US)$ $Futu Holdings Ltd (FUTU.US)$ $PDD Holdings (PDD.US)$ $JD.com (JD.US)$ $NIO Inc (NIO.US)$ $XPeng (XPEV.US)$

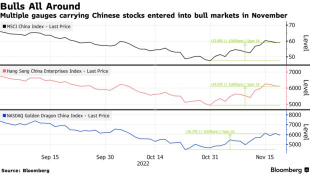

The latest rally may have legs, if China’s exit from Covid Zero continues and its economy further recovers, according to Laura Wang, chief China equity strategist at Mo...

FrankieSmilez :

beedeebee OP FrankieSmilez : too high level, no details plan of the allocation and when will they roll out.

FrankieSmilez beedeebee OP : On Saturday, Lan said Beijing was "accelerating the use of additional treasury bonds, and ultra-long-term special treasury bonds are also being issued for use".

"In the next three months, a total of 2.3 trillion yuan of special bond funds can be arranged for use in various places," he added.

On top of that, Beijing also plans to "issue special government bonds to support large state-owned commercial banks," Lan said, although he did not say how much.

beedeebee OP FrankieSmilez : yea, that's about it. Probably I don't see what you see.

FrankieSmilez beedeebee OP : They'll be another update on Monday Morning

View more comments...