No Data

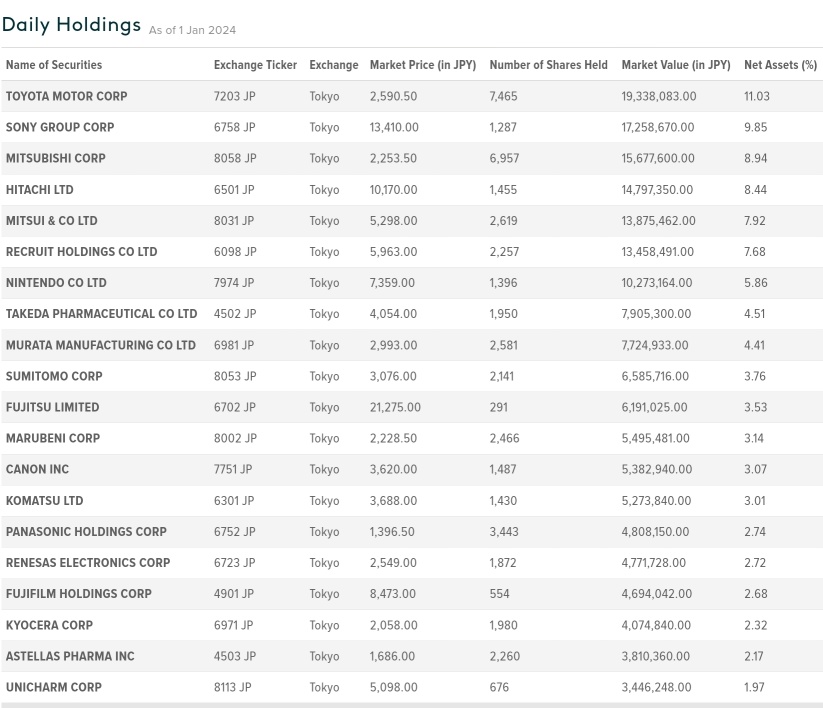

03150 Global X Japan Global Leaders ETF

- 63.060

- -0.140-0.22%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

As of the end of the year, a record high has been reached for the first time in 35 years.

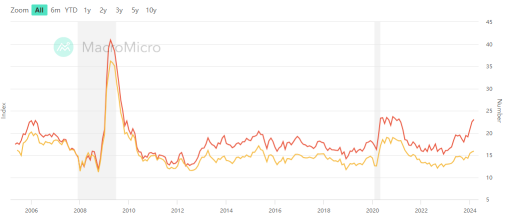

The Nikkei average fell for the first time in four trading days. It ended the trade at 39,894.54 yen, down 386.62 yen (volume estimated at 1.6 billion 20 million shares). Reflecting the high plateau of U.S. interest rates, there was a leading Buy in the financial Sector, including Banks and Insurance. The Nikkei average started strong at 40,325.78 yen. However, amid the decline in U.S. stocks at the end of the previous week and limited market participants at the year-end, profit-taking Sell and adjustments of positions became predominant, resulting in a turn to the downside. After that, it continued to fluctuate around 0.04 million yen. It is noted that the annual figure stands at 1989.

List of converted stocks (Part 3) [Parabolic Signal Converted Stocks List]

○List of stocks that have turned to Buy Market Code Stock Name Closing Price SAR Main Board <8217> Okuwa 899 862 <8253> Crescent 37353495 <8279> Yaoko 93738980 <8283> PALTAC 43984211 <8308> Resona HD 11491103 <8411> Mizuho 38933735 <8421> Shinchu Gold 216500200200

List of conversion stocks (Part 1) [Parabolic Signal Conversion Stocks]

○List of stocks undergoing Buy conversion in the market Code Stock Name Closing Price SAR Tokyo Main Board <1301> Kiyokyo 4115 3945 <1332> Nissui 900873 <1377> Sakata Seed 34703370 <1726> Br. HD 346330 <1802> Obayashi Corporation 21012025 <1808> Haseko Corporation 20491980 <1820> Nishimatsu Construction 52485066 <1887> Japan National.

Recovery to 0.04 million yen level due to expectations for the New Year market.

The Nikkei average rose significantly for the third consecutive day. It ended at 40,281.16 yen, up 713.10 yen (with an estimated Volume of 2.1 billion 30 million shares), recovering to the 0.04 million yen level for the first time in about five and a half months since July 19. The yen rate weakened to around 158 yen to the dollar in the previous day's Overseas market, leading to early buying focused on export stocks such as Automobiles, and the Nikkei average started to rise. Just before the midday close, it recovered to the 0.04 million yen level for the first time in about two weeks. Afterwards, Semiconductor-related stocks and other high-value stocks continued to rise.

There is a shift away from large vehicles in the USA, which benefits Asian manufacturers.

[EV] Due to the high prices of automobiles and rising interest rates, it has been reported that among Americans, more people believe that bigger is not always better when considering purchasing a vehicle. As costs rise, some automobile buyers seem to be considering sacrificing size and interior space to keep monthly payments lower. <7203> Toyota <6758> Sony Group Corp <6752> Panasonic HD <3

Defense spending is increasing, and Japan's total budget for 2025 will reach a record 115 trillion yen.

In the new budget proposal, the spending items with the largest increase include: a significant increase of over 10% in defense spending, reaching 8.5 trillion yen; and an approximately 7% increase in allocations to local governments. Due to record high tax revenues, the scale of newly issued government bonds will decrease by nearly one-fifth, down to 28.6 trillion yen.

Comments

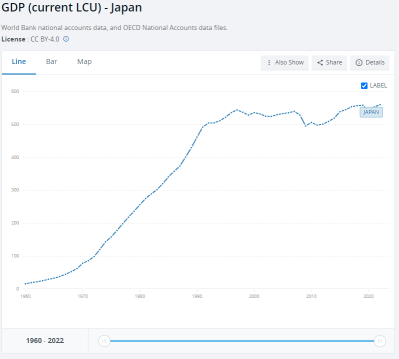

The Japanese stock market has experienced a significant narrative shift, with robust and enticing performance since 2023. The Nikkei Index has recorded its largest gains since 1989, consistently benefiting from growing corporate profits, enhanced capital efficiency, and supportive policy environments for market liquidity. As of today, the Nikkei 225 index closed up 0.5%, at 40,109.23 points, marking the fi...